The waterfall in crude oil prices has been relentless. Oil prices have declined by the largest amount over an 18 month period ever. Wow, that’s a heck of a decline. And due to its resourceful nature, it has plenty of folks worried about the global economy. But a supercharged late week rally has many hopeful that a crude oil bottom may be taking shape.

In my opinion, Crude Oil is the most important commodity around the globe. And from a macro view, the decline has been (is) a major concern.

In the chart below I take a look at Crude Oil on a monthly closing basis and pit it against its own volatility index (Fear Index). From the chart, it appears that a crude oil bottom is a possibility. Why?

Investors reached panic levels recently and looking at the chart, it is clear that Crude Oil has reversed at similar levels on its Fear index – see line (1) in the chart below.

The month isn’t over yet, but it appears that Crude Oil is trying to create a bullish reversal here in January. See the long candlestick “wick” at point (2) below.

It’s worth reminding ourselves that this is a monthly chart, so where it stands at the end of the month will be more important than where it is right now.

Another bullish pattern that may be taking shape is the falling wedge. This pattern would be triggered if Crude Oil can breakout above the descending resistance line (3), which is still a quite a bit higher than current prices. And that could be the difference between a crude oil bottom and “the” crude oil bottom.

Either way, there’s a tradable opportunity if Crude picks up steam.

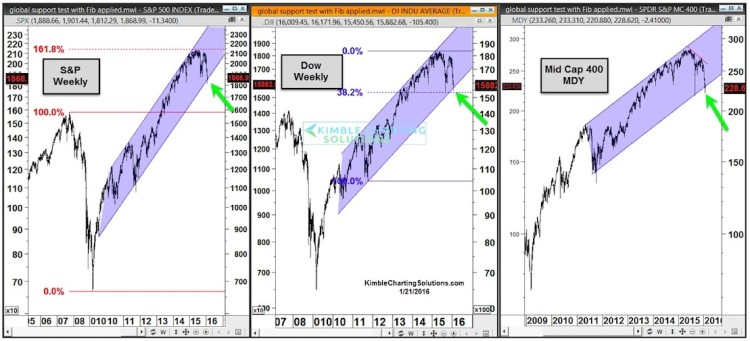

Lastly, Crude Oil prices tested support at the same time as the major stock market indices. So this support level may be bigger than we think.

Stay tuned and thanks for reading.

Twitter: @KimbleCharting

The author does not have a position in the mentioned security at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.