Shares of Costco (COST) declined 1 percent on Thursday, after an analyst downgraded the stock.

Costco’s stock began its reversal in earnest last week and it now appears the retailer may be topping.

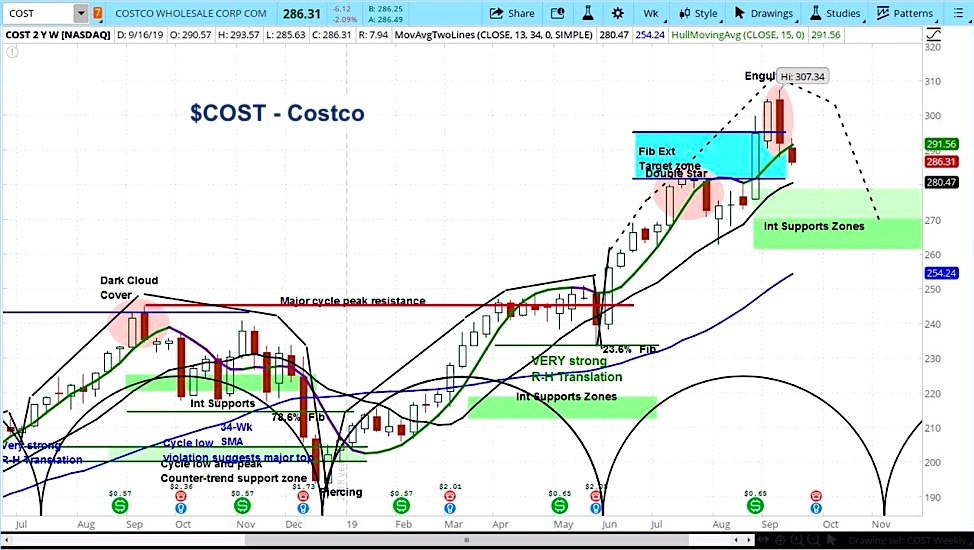

Costco may have topped for current cycle

Investment management firm Bernstein’s Brandon Fletcher downgraded COST from underperform from market perform. He also raised his price target to $230 from $220, which is over $50 lower than the current price.

Fletcher explained that, “We think valuation is too high and investors are likely overestimating the continuation of its trend and/or pace of reinvigorated growth.” He also noted that annual fees like Costco’s may be the first expense that consumers cut in an economic downturn.

Based on its market cycles, we believe the stock has more downside risk in the coming months.

Our analysis is that the stock may now be in the declining phase of its current cycle. In fact, it may have made the top for this cycle. Our target is for a drop below $270 by November.

$COST Costco (COST) Weekly Stock Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.