The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Executive Summary

- The consumer is holding up despite surging inflation. A hot jobs market helps.

- An equal-weight basket of retail stocks has plunged 30% this year as a pessimistic outlook permeates the market

- Will investors shop for value among some beaten-down names?

- We highlight two non-consumer companies that have yet to confirm an earnings date for next quarter – is that a bearish sign?

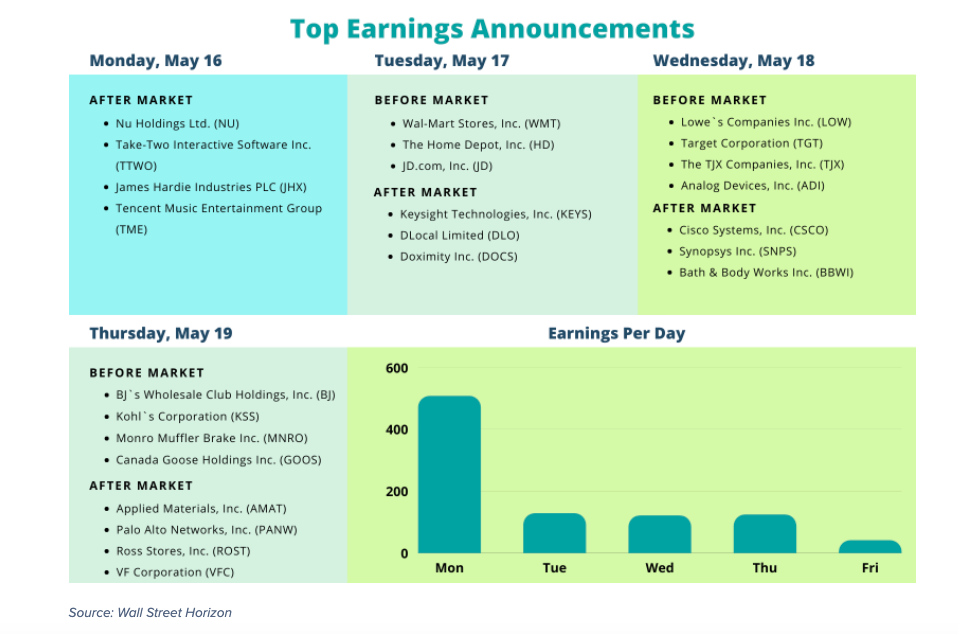

The U.S. corporate earnings season is winding down. There are still key companies that have confirmed earnings dates, though. Retail is in focus. The week of May 15 could be particularly crucial since the economy appears on the downhill considering weakening GDP and stubbornly high inflation. The weight of the world rests on consumers to keep doing what they do best: spend, baby, spend. The outlook could be challenging for well-established stores as folks transition from product/retail spending to services. It could be a bumpy week ahead.

Retail Therapy

Earlier this month, Costco (COST) reported strong interim sales data in its April same store sales update. Moreover, recent card data from Bank of America and JP Morgan Chase indicate folks are swiping away despite being incredibly sour on both stocks and the economy. We’ll get the full spending story from a range of retailers reporting soon.

“Clean Up on Aisle Retail!”

Let’s take a trip down the earnings aisle to know when the biggest earnings hit the tape.

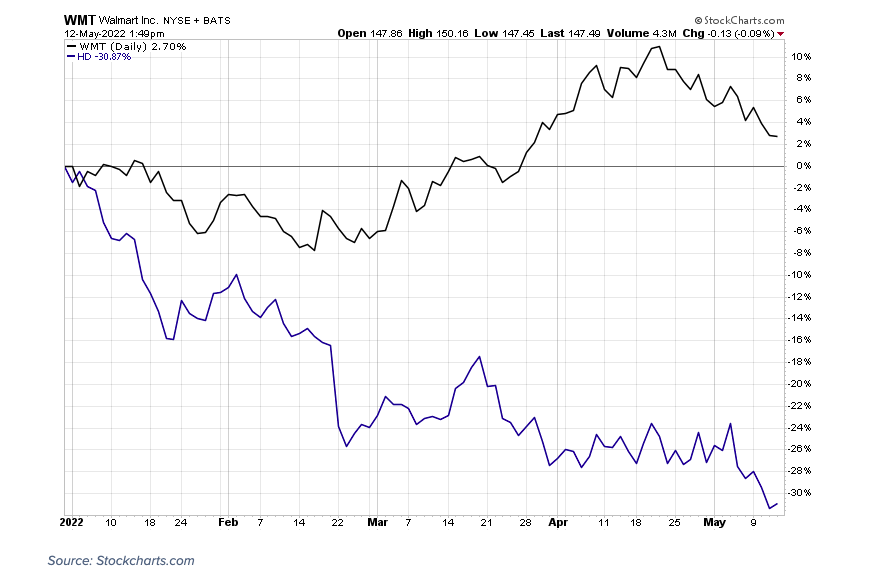

Tuesday before the bell we will hear from maybe the most important pair of big-box stores: Walmart (WMT) and Home Depot (HD). It has been a tale of two consumers between these firms. Walmart is the biggest discount store in the Consumer Staples sector and its shares are up fractionally year to date. Meanwhile, Home Depot, the 3rd largest Consumer Discretionary company, behind only Amazon (AMZN) and Tesla (TSLA), has seen its stock drop hard in 2022. HD is off by more than 30%, among the worst Dow components this year.

WMT & HD Stock Performance YTD

Wednesday morning will be bustling with Target (TGT), Lowe’s (LOW), and TJX Companies (TJX) all reporting Q1 earnings. The S&P Retail ETF (XRT) will be in play as all these companies report results. Also important will be any earnings guidance and added color on the consumer.

On Thursday, Kohls (KSS) and Ross Stores (ROST) have confirmed earnings releases. Keep ROST on your radar as its shareholder meeting takes place the evening before earnings hit the tape. HD’s shareholder meeting happens Thursday morning, too. Finally, Thursday AMC we’ll hear from VF Corporation (VFC) – one of the world’s largest apparel, footwear, and accessories companies.

Late Earnings Confirmations

You don’t have to look just to the consumer for uncertainty right now. Traders can get clues on a stock’s next big move and volatility spikes by spotting late earnings date confirmation events. A company late to confirm its upcoming earnings date is often a telegraph of unusual and potentially unfavorable news. We highlight two S&P 500 large-caps that have yet to confirm Q2 earnings dates.

Intel (INTC) jumps out to us. The chipmaker in the Information Technology sector usually confirms its Q2 earnings date right after posting Q1 results. Here we are more than two weeks after the company reported, and there’s still no confirmed earnings date. As of May 15, that is a whopping confirmation date Z-score of 6.06 since its average Q2 earnings confirmation date is April 26 +/- 2.4 days. This outlier is particularly interesting since Intel has never been late in confirming an earnings date, according to Wall Street Horizon data.

Amid enhanced macro- and micro-economic risks, traders should be particularly wary about what Intel could report over the coming weeks and in its next 10-Q filing. The firm’s CEO, Pat Gelsinger, cast an ominous shadow over the industry in late April when he forecast that the semiconductor chip shortage will extend into 2024. Shares plummeted as the tech giant missed street earnings estimates. First-quarter sales dipped 7%.¹ Intel does have an Unconfirmed Q2 reporting date of July 21 AMC.

Shares are down more than 35% from their 2021 peak as the tech wreck persists. The upshot is that shares are arguably cheap considering the $180 billion market cap company trades at just 7x last year’s earnings² with a 12x forward P/E.³

INTC Stock Price History

Anthem Inc (ANTM), like Intel, historically confirms its next-quarter earnings date immediately after posting results. The $118 billion market cap stalwart in the Health Care sector still has not confirmed its Q2 reporting date. The late-confirmation date Z-score is very high at 4.56 as of yesterday considering a mean Q2 confirmation date of April 27, +/- 3.1 days.

Perhaps we will get more color on what’s going on with the health insurance provider at its upcoming shareholder meeting on the morning of Wednesday, May 18. At the meeting, shareholders will vote on a proposed name change to Elevance Health Inc.⁴ At last week’s Bank of America Global Healthcare Conference, Anthem’s leadership team said Q2 is coming in as expected, according to BofA. Looking ahead, we have an Unconfirmed earnings date of July 20 BMO that traders should keep on their radar.

The stock has been a relative winner this year as investors seek safety in the somewhat stable health care sector, but ANTM has succumbed to some selling pressure lately, correcting more than 10% from its April high above $500.

ANTM Stock Price History

Earnings Wave

The week of May 15 starts getting a bit calmer as the Q1 reporting season starts to wind down with around 900 companies expected to report. At this point, 88% of companies have confirmed their earnings date (out of our universe of 10,000 global names).

Conclusion

It’s been a strong quarter for corporate earnings. You might have heard this refrain before! The stock market has not cared. Firms beating on the bottom line have not been rewarded while those that miss (and heaven forbid, guide lower) have been taken to the woodshed. Managing volatility is more important than ever right now as implied vol on the S&P 500 rises above 30% and higher than 40% on the Nasdaq. Wall Street Horizon’s corporate event coverage keeps traders and portfolio managers ahead of the game with the most accurate data.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.