Over the weekend, I shared a chart brief on my website looking at two sentiment charts while discussing their role alongside the rally in global equities in 2017.

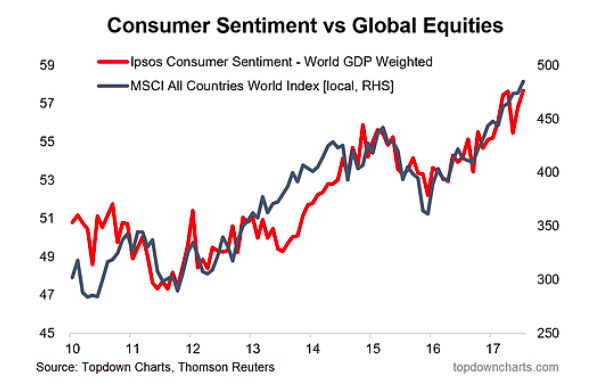

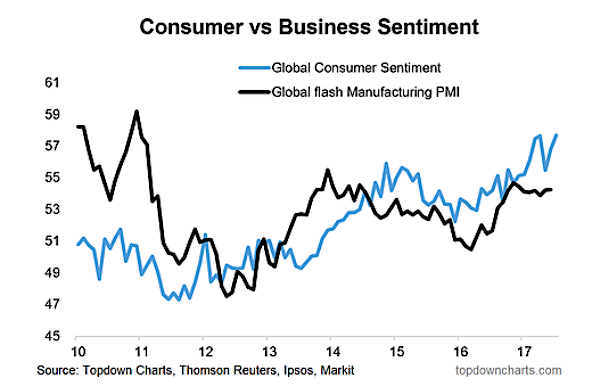

The two charts pit the Ipsos Consumer Sentiment vs Global Equities (All-World), along with the same consumer sentiment charted against the Global Flash Manufacturing PMI.

In both cases sentiment is rising to new highs, along side global equities. As I mentioned in that post, emerging markets strength is a big reason for this. 2017 has seen strong gains across China, India, and Brazil, helping to push the Ipsos Consumer Sentiment to new highs (1st chart below).

Here are the charts, with a couple quotes from my post.

The strength in emerging markets has also helped drive global equities higher, and EM equities have been a solid performer this year. This improved economic and market performance by emerging markets has also been a contributor to lower economic and market volatility.

Consumer sentiment is outpacing business confidence, and if the consumer sentiment indexes can drag the manufacturing PMIs higher it would see an acceleration in global growth which would be inflationary and push up bond yields, so this is a key chart to have on your radar.

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.