Could this be the largest head & shoulder top in the past 50 years?

click to enlarge

To help myself reduce my own bias towards investments, I hide the names of charts and just look at patterns that I find interesting. I shared the above chart last week at the annual Stocktoberfest meeting and asked the audience, ”What would you do with this pattern?”

What do I see happening here? I see a well-defined channel that has been in play for the past 50-years. The light green arrows represent that this asset rallied around 250% over an 11-year time frame twice. I also see the potential of a multi-year head & shoulders top.

Even if I am 100% wrong on the H&S topping pattern, there is NO DOUBT that a 13-year support line has been broken (see blue line in chart). We shared this pattern with Premium Members back in April as many investors grew very bullish this sector (as many bulls in April 2014 as the 2011 top).

What is this chart of? It is the CRB Commodity Index (with monthly bars). Now that you know this, are you surprised that Crude Oil and Gold have been weak over the past couple of months. You shouldn’t be based upon this pattern in commodities!

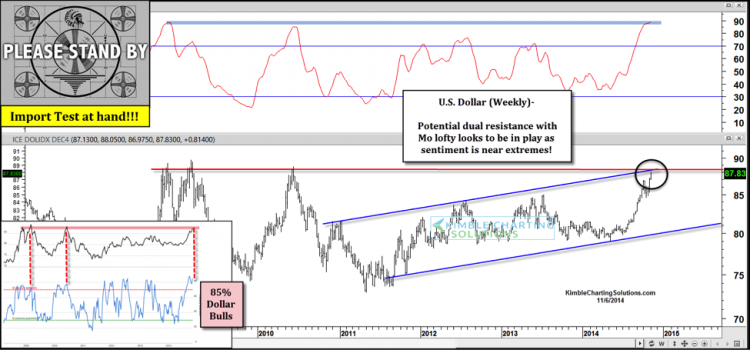

To add another layer of intrigue to this situation, let’s take a look at the U.S. Dollar Index. The chart below shows that the Dollar is at a critical price point and what happens from here on out could have a profound impact on the CRB chart above.

U.S. Dollar Index Chart

As you can see the U.S. Dollar Index is back at its 2009/2010 highs, up against channel resistance, with momentum as high as it has been since 2009… and U.S. Dollar bulls are easy to find at this time.

When the CRB index hit channel resistance back in the early 1980’s, commodities ended up falling for the next 20 YEARS! What happens here in the U.S. Dollar and with the CRB is very important for portfolio construction.

I will keep you updated on what I feel is a very important situation for Commodities in general and for portfolio construction overall! Thanks for reading.

Follow Chris on Twitter: @KimbleCharting

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.