With the summer fast coming to a close I thought it would be a good idea to review some COT Report data and seasonality analysis to see where select commodity markets may be headed into year end. Note that the COT Report stands for the Commitment Of Traders Report.

With the summer fast coming to a close I thought it would be a good idea to review some COT Report data and seasonality analysis to see where select commodity markets may be headed into year end. Note that the COT Report stands for the Commitment Of Traders Report.

Last year, I wrote a post about using COT report data for trading and making macro forecasts. You may want to check that post out for further understanding.

For this research study, I also incorporated a seasonality forecast that is based on each markets behavioral tendency over the past 20 years. Let’s review the data.

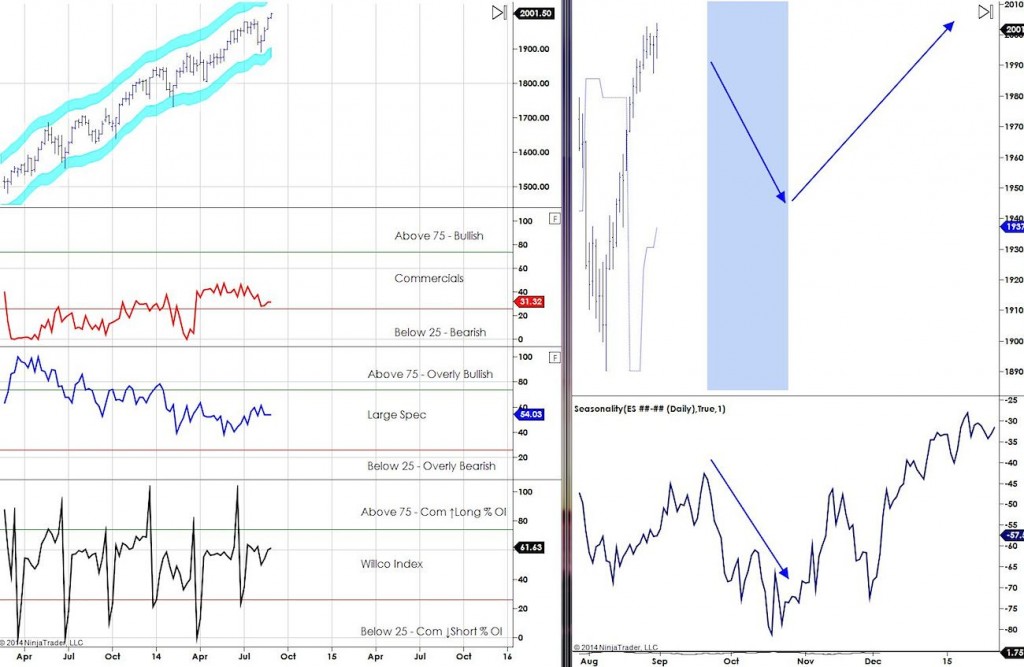

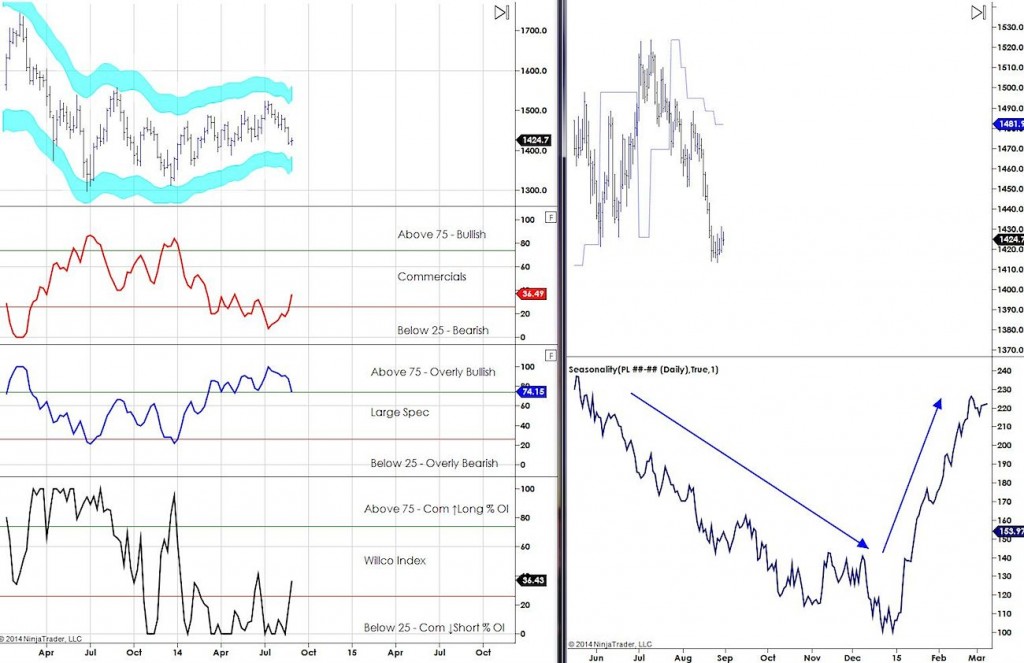

ES – SPX

Since there is much more Hedging and Arb trading with ES futures it is a little more difficult to get data points of value out of the COT Report. That being said, you can see that since April of last year the Large Speculator Group has been scaling back on the % of there overall long exposure. This could be interpreted in a couple of ways: 1) Large speculators are losing faith in this rally and don’t want to put their money where their mouths are 2) Retail money has been carrying the market to new highs for much of this year. Since the WILCO or COT Commercial index are not at extreme readings it could mean that the market is currently in balance and has no real expected tendency to the up or downside at the moment.

Seasonality suggests that a pullback could take place in mid to late sept and bottom out around Halloween before seeing another strong up move towards the end of the year.

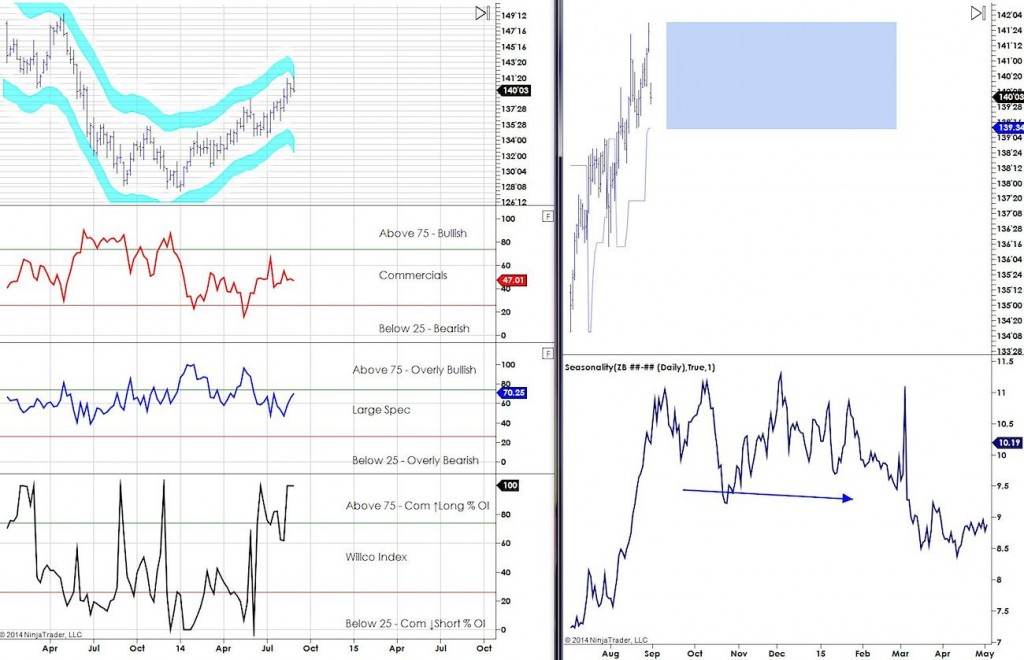

30 Year Treasury

The WILCO is reading 100, thus suggesting the upside potential is limited in the near to mid-term. With a really choppy seasonality going forward, we could see some price compression or range bound price action until March 2015

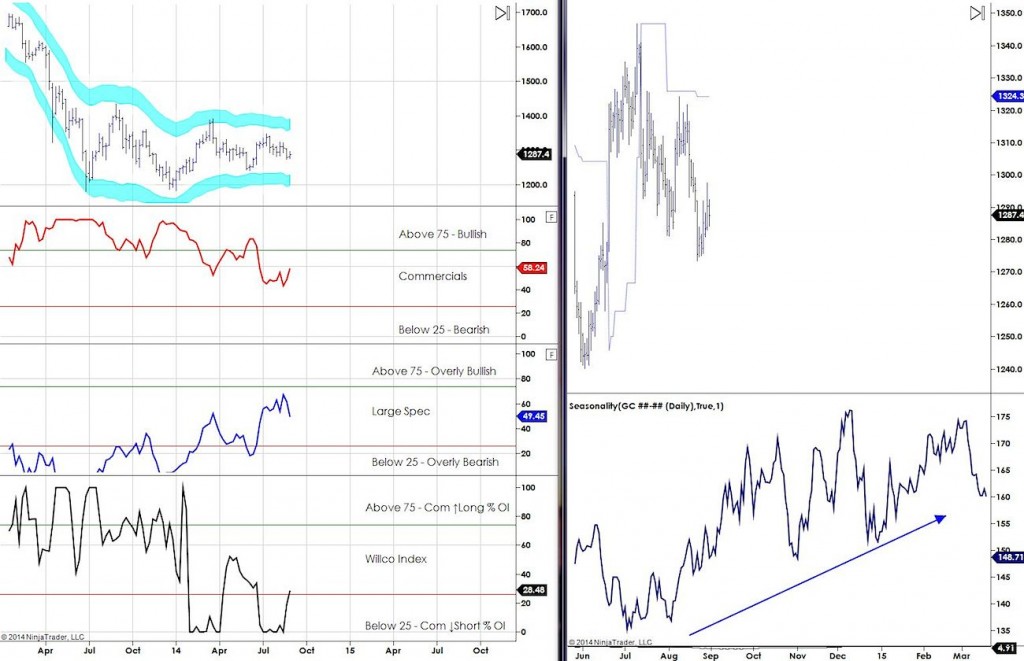

Gold Futures

Gold COT Report analysis – Gold can currently be summarized as a “Mixed Bag”. With Commercials and Large Spec pretty neutral there is no real expectation in terms of how they are positioning themselves going forward. But seasonality suggests a moderate uptrend could ensure towards March of next year.

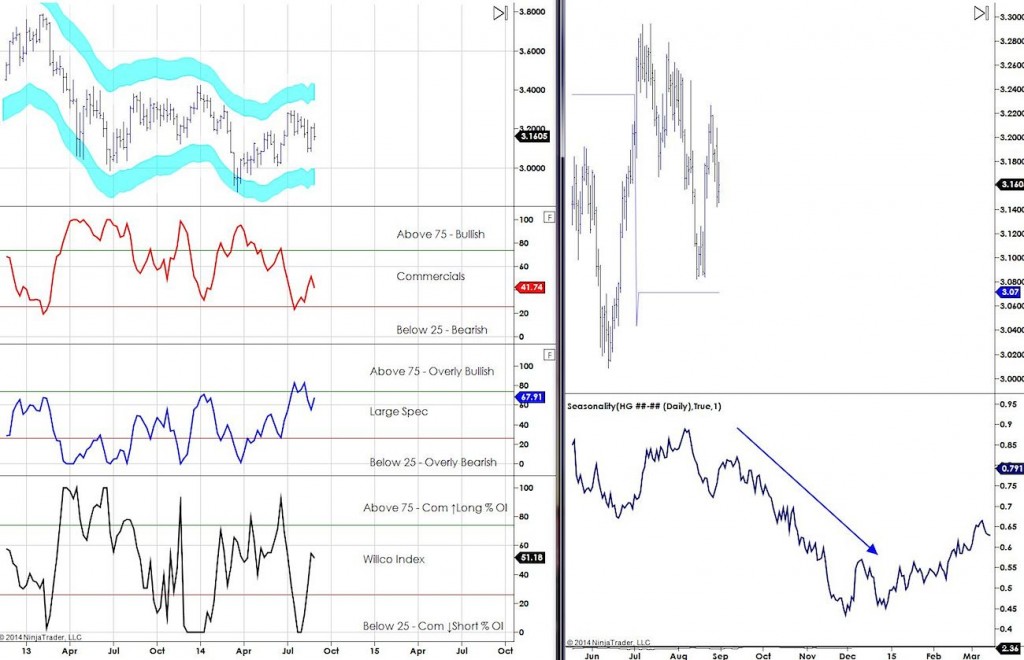

Copper Futures

Copper COT Report analysis – Also a mixed bag (currently neutral).

Seasonality suggests a possible down move towards the new year.

Platinum Futures

Still more to go….? Increasing Commerical COT index reading could suggest that a strong downside move could happen.

Seasonality remains bearish until the new year.

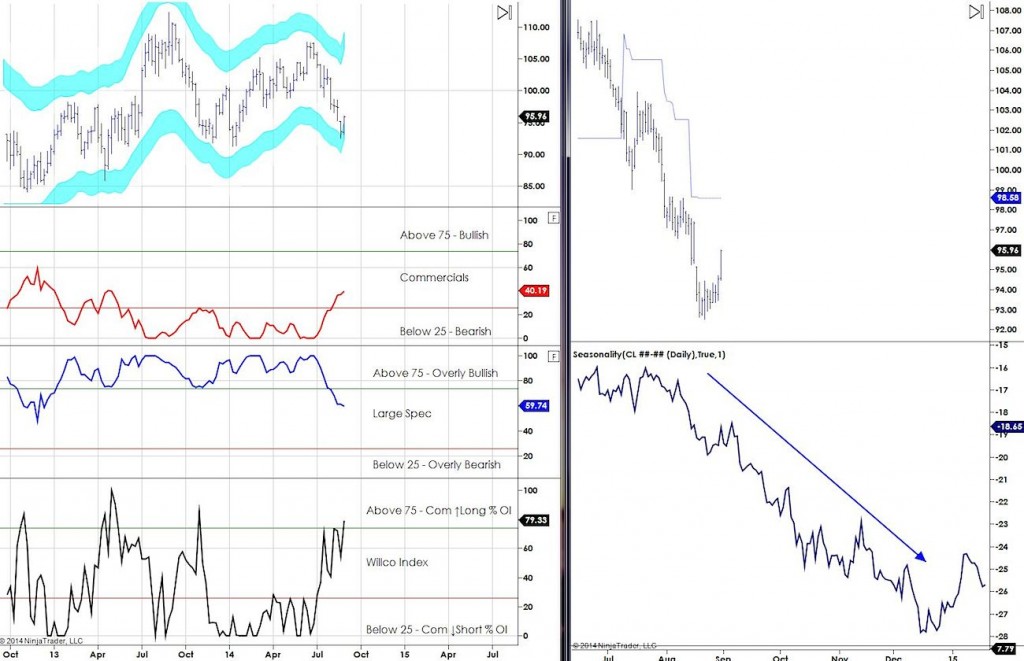

WTI Crude Oil

The COT Report indicates that the stance of the Large Spec and Commercials has been quite bullish for some time. And with this recent decline, it is clear that the Commercials are shifting their portfolios from being NET short to being NET long (in terms of the total % of open interest). This would be considered bearish behavior and it curiously coincided with a nice agreement with the seasonality forecast of a macro down move towards the end of the year.

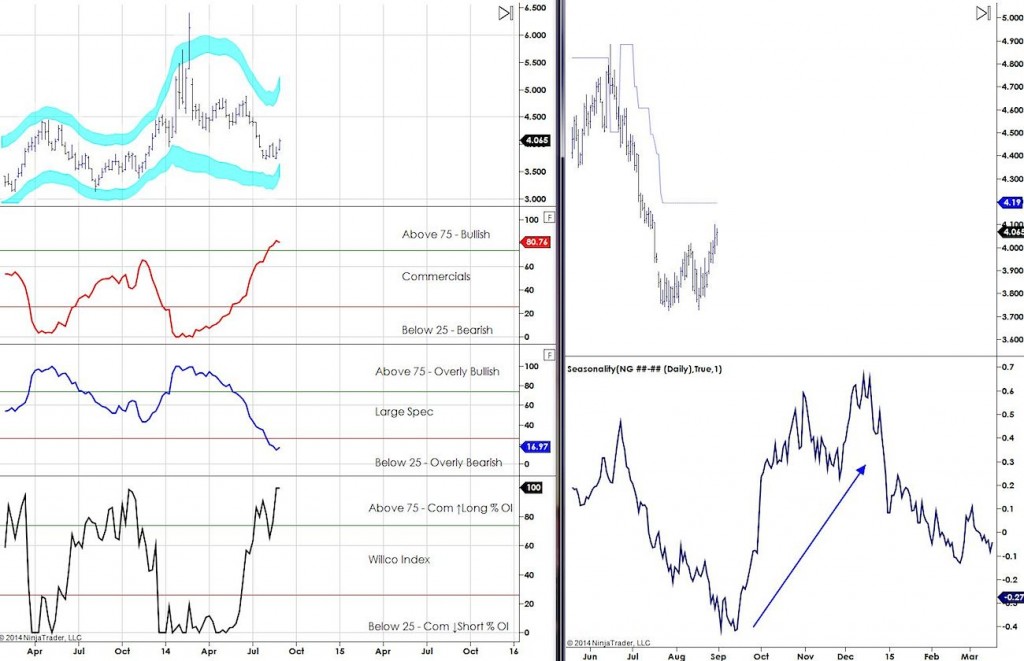

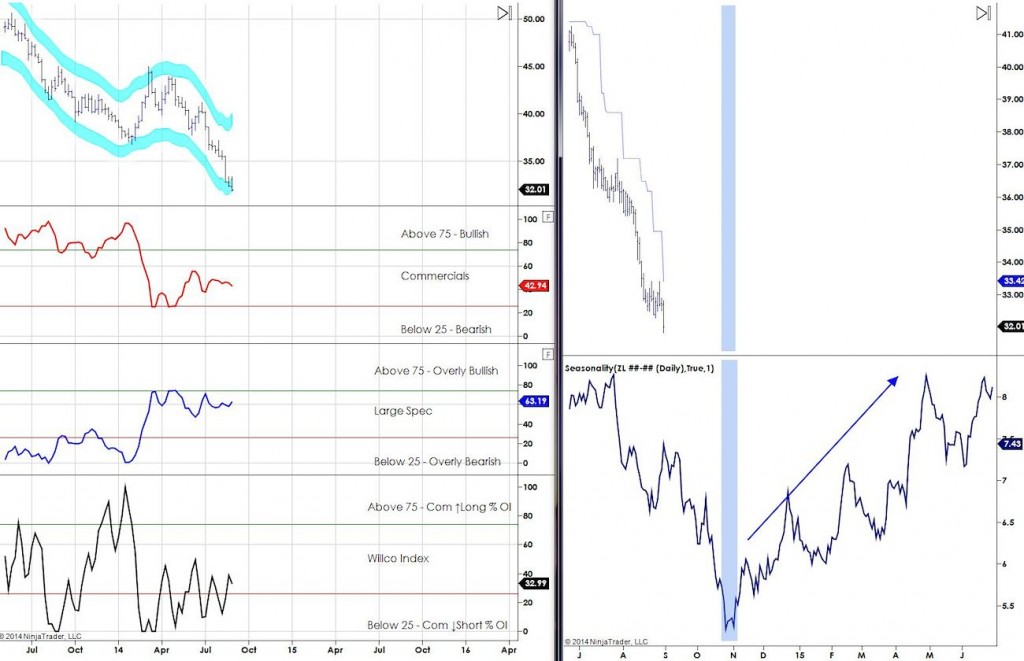

Natural Gas Futures

Natty Gas currently has COT conditions that I like to use for possibly setting up a larger scale trend reversal. With the Commercials and Spec COT indices at extremes it suggests a bullish move could follow. I would like the WILCO to indicate that Commercials are shifting out of there long positions before the green lights will be lit.

Seasonality also suggests a strong up move towards January 2015.

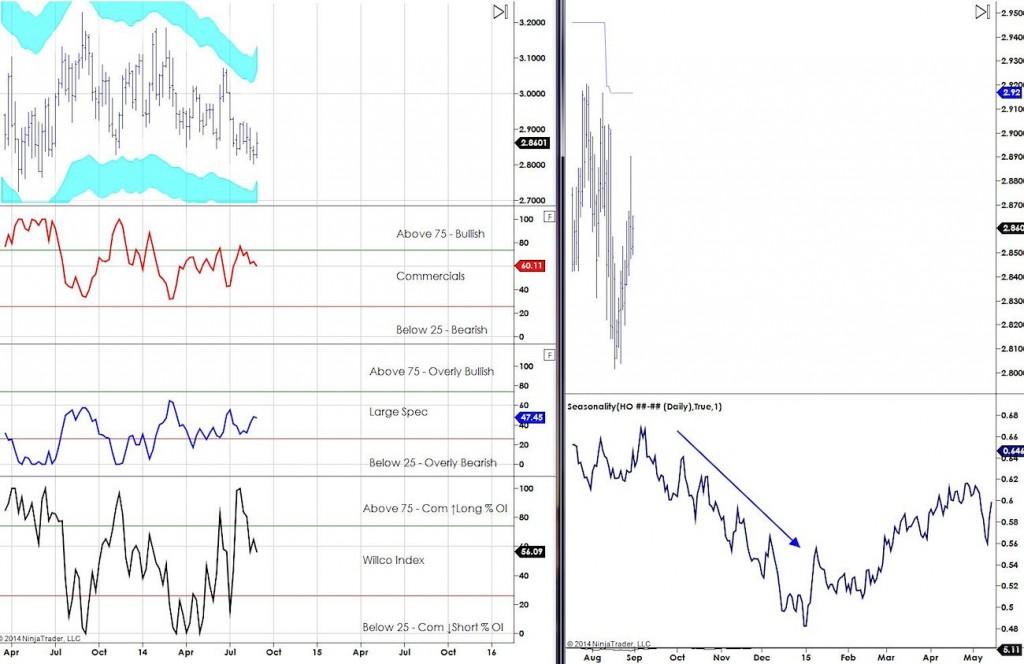

Heating Oil

COT Report analysis is currently neutral.

Seasonality suggest downtrend towards January 2015.

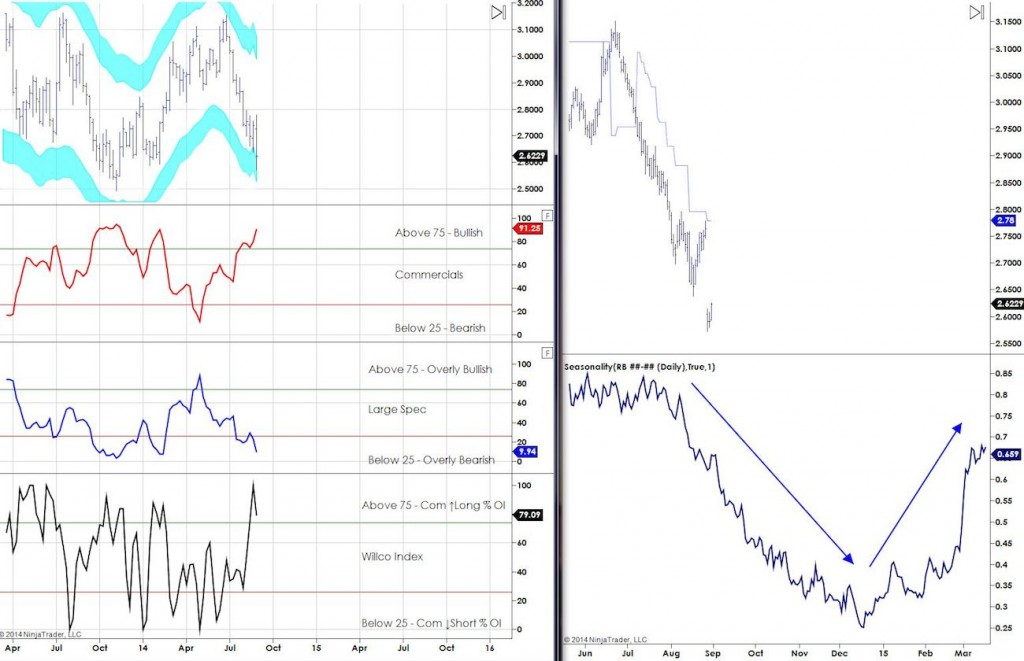

RBOB Gasoline

The COT report data shows that RBOB is at an extreme condition that typically suggests a near-term low is in or could be near. If this capitulation holds and starts to form a base, then an upside move with seasonality could start by mid-December.

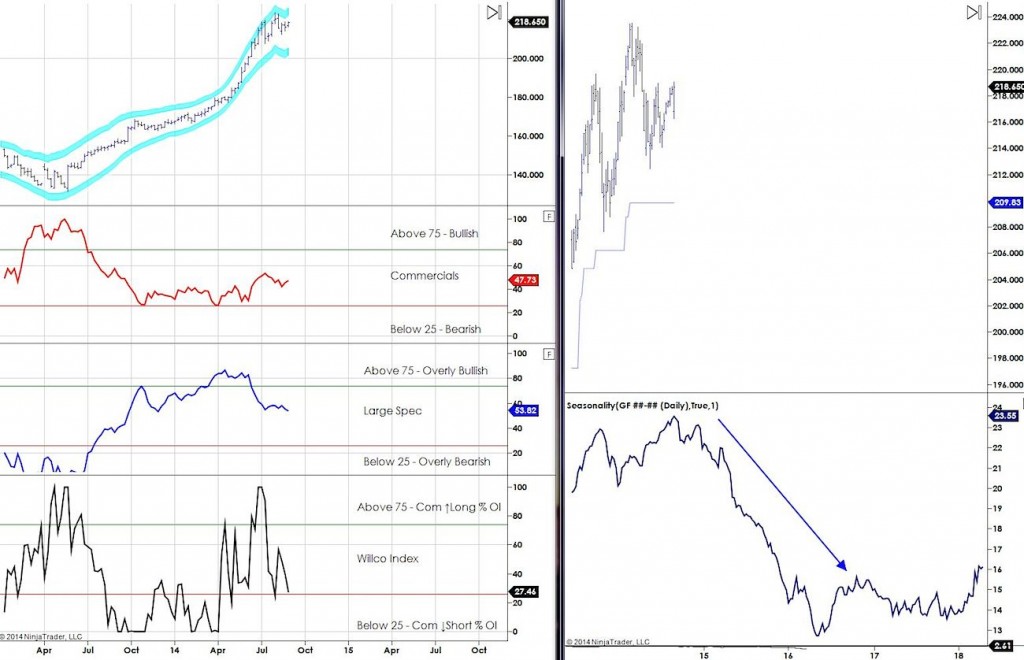

Feeder Cattle

Ripe for a pullback? Feeder has been on quite a rally for the last year. Recently the WILCO index spiked in July showing that the Commercials have shifted their portfolios to being a Large % NET long of the total open interest %. This can be interpreted as a bearish signal going forward. Large Spec has also scaled back from a fully committed bullish position. With seasonality showing the possibility of a large scale decline into 2016, it seems as if they are seeing the same possible trend change coming forth.

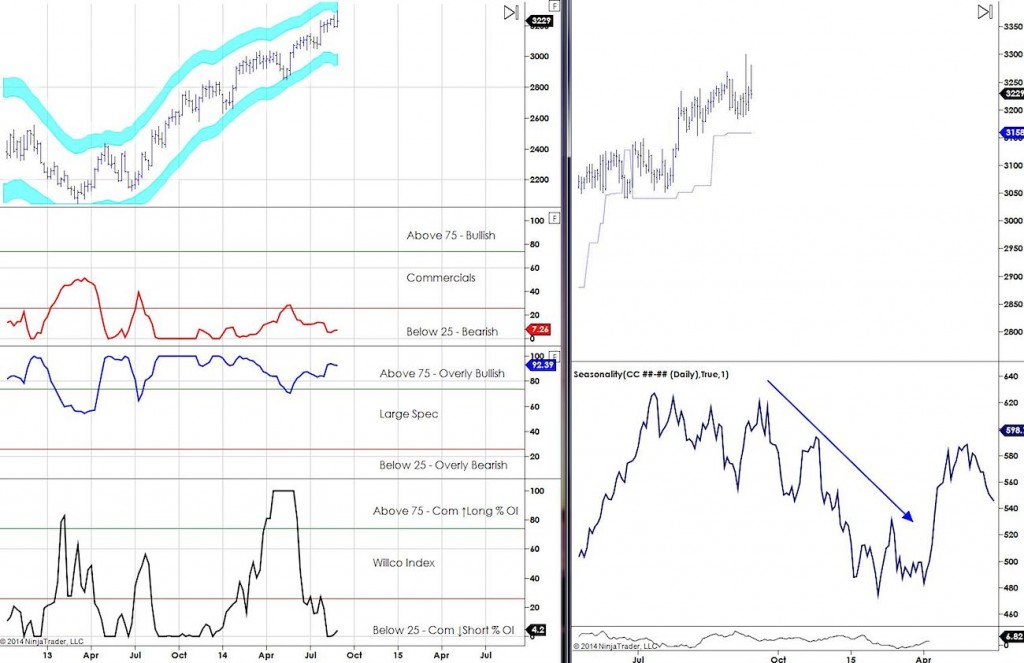

Cocoa Futures

COT Report Analysis – THE Commercials have been strongly bullish pretty much all of this year. With the WILCO index reading 4.2 (extremely low) it suggests that Cocoa is in an environment where a large shift in the overall trend is very likely. To complement the COT data you can see in the bottom left panel that the Seasonal forecast for Cocoa is down until April of 2015.

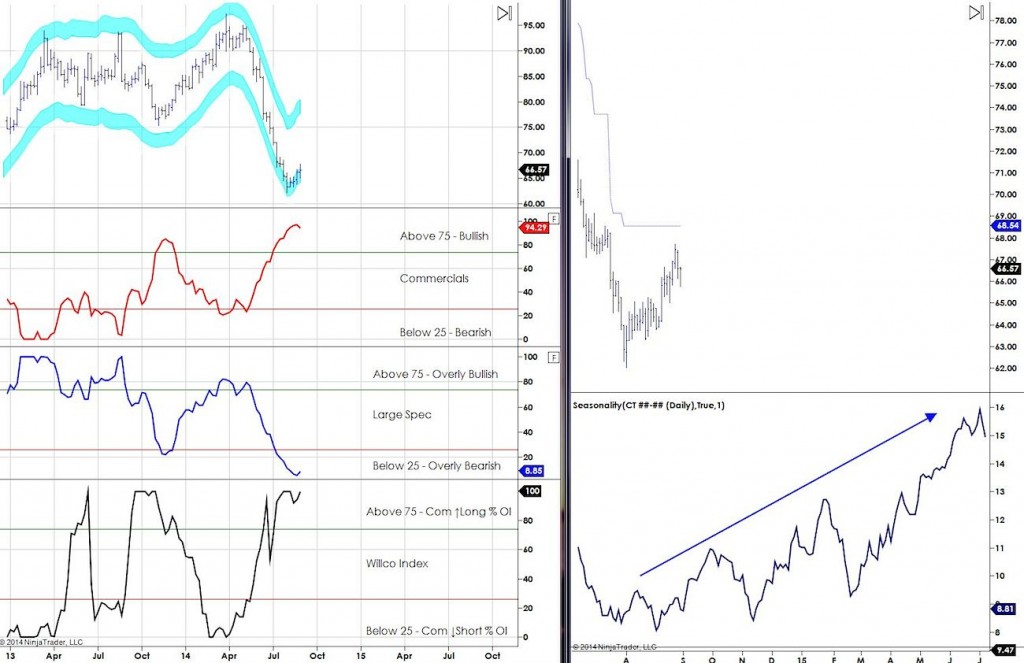

Cotton Futures

COT Report Analysis – Rotten Cotton? Cotton is showing signs of being at very extreme emotional levels. With a very high Commercial and very low Large Spec COT readings it suggests that a capitulation is near and that a base could form in the near future.

Seasonality also suggests that we could make a possible trend change to the upside towards the end of the year as well.

Soybean Oil

Seasonality indicates the possibility of a large scale low in November.

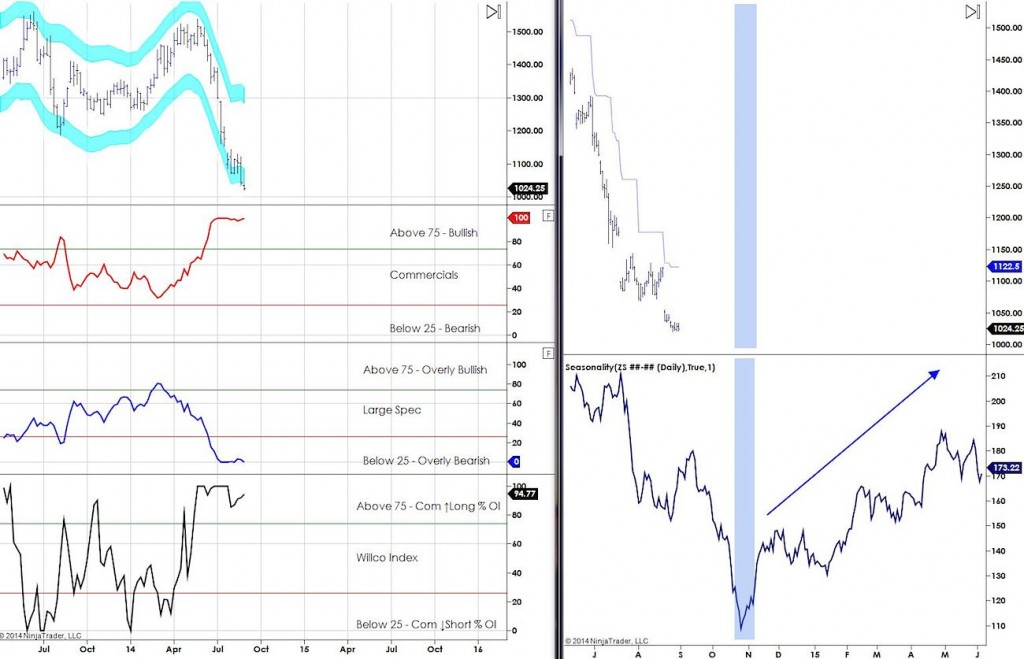

Soybeans

As you can see in the COT Report data, Soybeans have much more extreme readings than Soybean Oil. We have all three indexes pegged. This usually means that a capitulation is underway and we are just waiting for the last of the longs to be washed out.

Like Soybean Oil, Soybeans also have a seasonal tendency to bottom in November.

IMPORTANCE OF PRICE CONFIRMATION

I get a lot of questions from clients on how to use COT Report and seasonality data. I want to stress that even though data may assist in identifying possible turning points, it doesn’t mean that anyone should take counter trend positions without the use of price confirmation. When I see a market ripe for a turn I typically scale down on my charts in terms of time frame, and then start looking for price reversal patterns that confirm the direction of my overall COT and seasonality forecasts. It is important to remember that even if the seasonality forecast suggests the market may move in a certain direction, the market does not ALWAYS end up pursing that course of action… thus we wait for confirmation. The value of seasonality data is the ability to visualize how the market has behaved on average over many years so we can prepare for the same seasonal tendency.

Follow Alex on Twitter: @InterestRateArb

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.