The market is “overbought” or “oversold” are common phrases you will hear across the finance space. However, it is actually extremely rare for these conditions to be true.

Today, we’ll attempt to show how trading rules can provide a better picture of the market while enhancing trading performance.

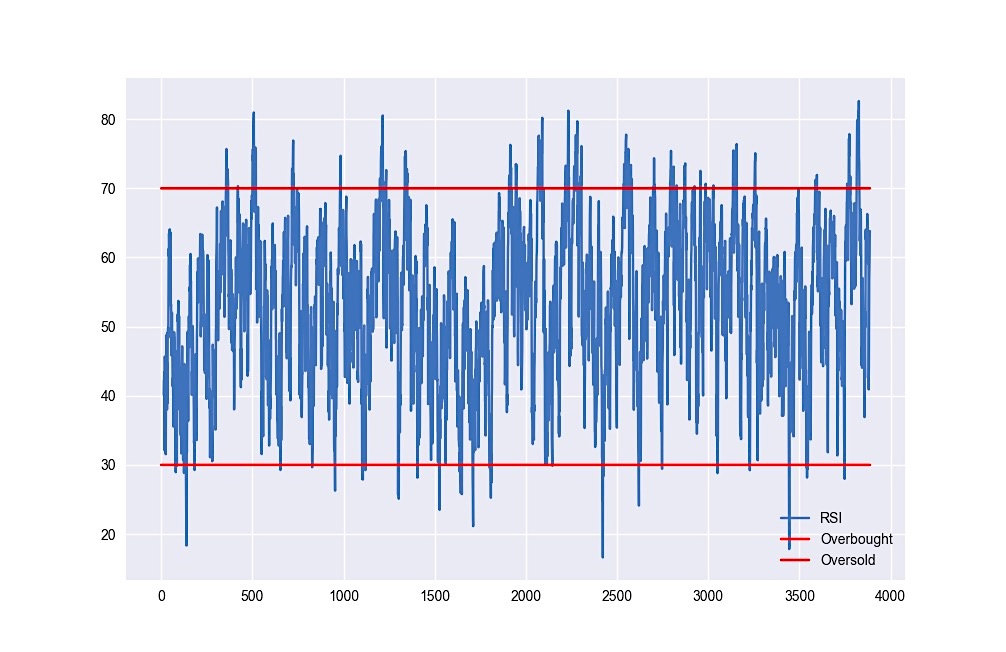

First, let’s simply define overbought as a 14 period RSI of greater or equal to 70.00 and let’s simply define oversold as a 14 period RSI of less than or equal to 30.00.

Below is a chart showing the RSI of the S&P 500’s ETF (NYSEARCA:SPY) with the overbought and oversold levels plotted.

From January 2002 to May 2017 here are some stats:

- Days overbought 214 out of 3,878 or only 5.5%

- Days oversold 60 out of 3,878 or only 1.5%

- Days in the middle roughly 3,604 out of 3,878 or 92.9%

Of course when these overbought or oversold conditions are true the markets do appear easier to trade as volatility often expands and it seems easier to skim some meat off the bone, if you will. However, many strategy developers and traders focus on these overbought and oversold conditions when in reality it is extremely difficult to be patient 92 to 98+% of the time.

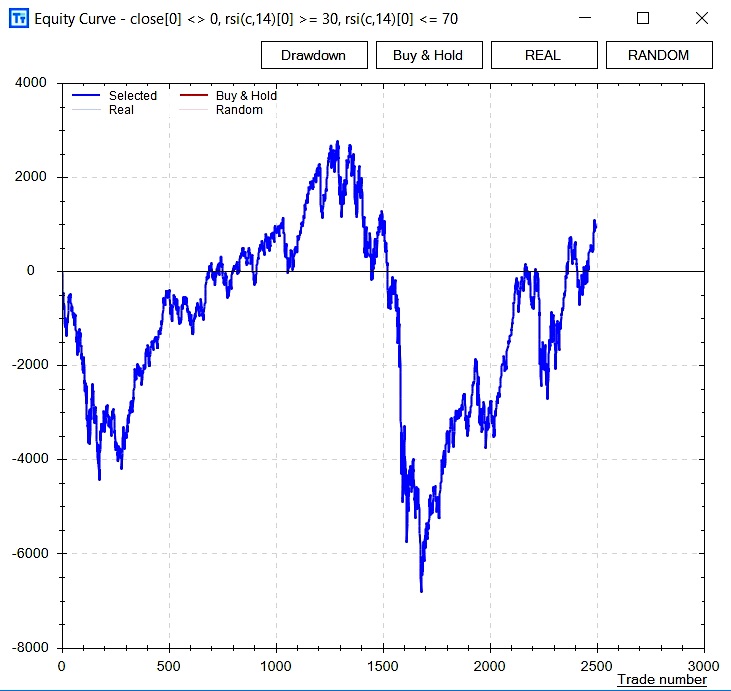

A simple solution is to augment your trading with trading systems that do well in these “common” times or regular conditions. Let’s look at how SPY did during this 92% of the time period the market was not overbought or oversold. The test period covers January 2002 to September 2012 (as we will save Q4 2012 to present day as out of sample data for later testing).

As you can see that trading in these 92% of the time when the market is neither overbought or oversold is extremely trendless and encompasses some serious drawdowns; making life extremely difficult for traders.

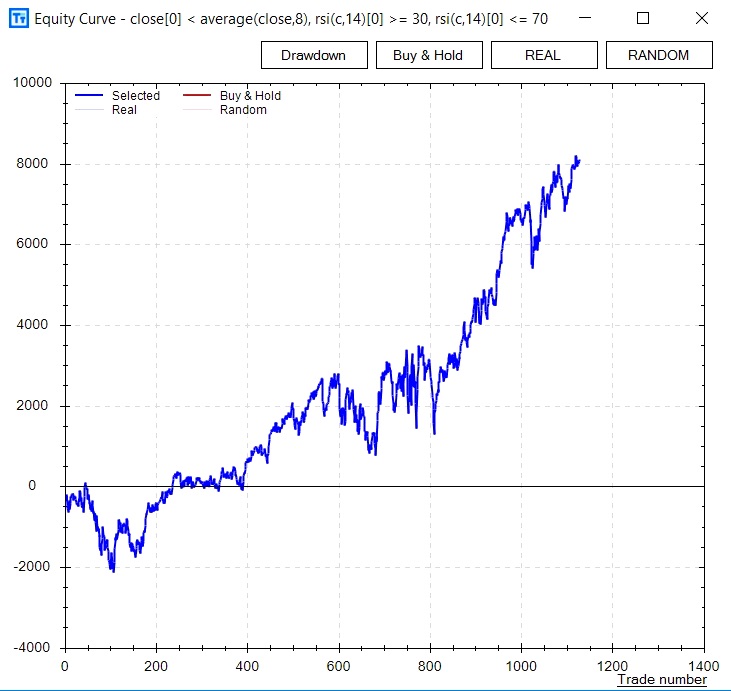

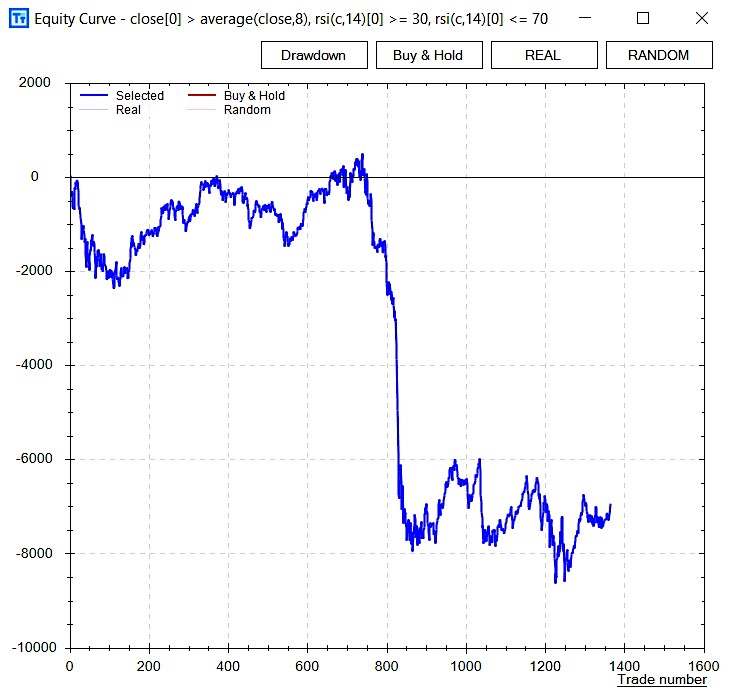

Let’s add an 8 period moving average filter and see if we can smooth out performance (performance only based on 100 shares for testing/demonstration purposes).

As you can see the moving average filter makes a significant difference albeit not perfect. That is, trading when prices are below the 8 period moving average produced significantly greater performance than when price was above the 8 period moving average. This is counter-intuitive for sure.

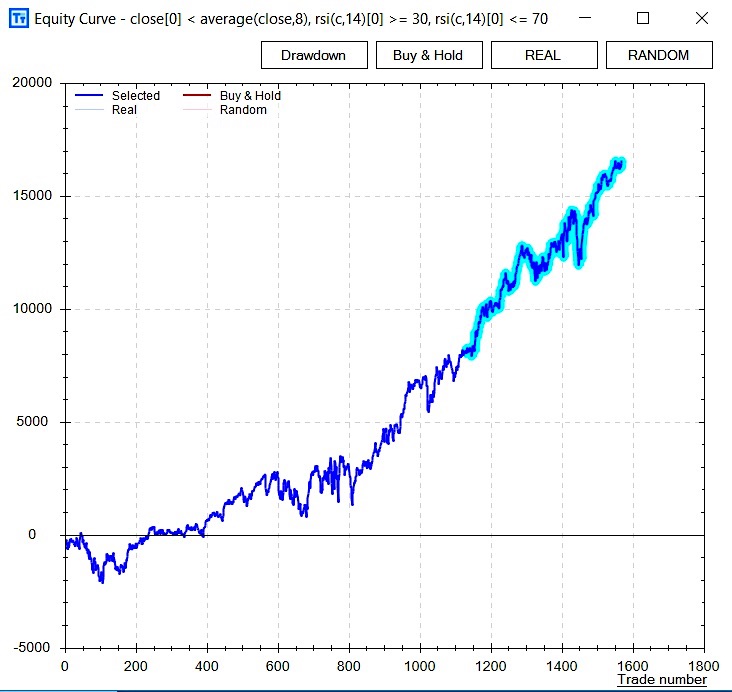

The process of continuing to refine and add filter and rules to our trading “system” is part of the strategy development process. It can be long and arduous. To keep this post short and sweet let’s “accept” these two rules (1. RSI between 30 and 70 and 2. Price below 8 SMA) and go ahead and see how this system would have performed on the out of sample data from September 2012 to May 2017.

The strategy holds up quite well and we now have some simple rules to follow/guide our trading in the “doldrums” that occur 92% of the time.

The long and arduous process of refining and adding conditions can be greatly simplified with modern computing power and software. Build Alpha attempts to make this process simple and fast! Build Alpha is trading software designed to create trading strategies from thousands of inputs, filters, and signals for the research-oriented trader and investor – no programming required!

Thanks for reading.

Twitter: @DBurgh

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.