Rising trade tensions have remained a recurring theme over the past year, not just with the ‘modernizing’ of NAFTA talks, but with the introduction of tariffs targeting specific goods and specific countries.

We believe nobody wins in a trade war, because it often raises prices to consumers, causes misallocation of capital, can result in company asset write-downs and is certainly not stock market friendly.

Some parties in a trade war fare much better while others fare much worse in a rising protectionist global economy.

The U.S., which carries a trade deficit with just about every major trading partner (aka net importer), stands to potentially win on a relative basis should a trade war continue.

That being said, the negotiating tactics used in this trade dispute could certainly result in more retaliation. It is one thing to sit down and negotiate, hash things out, then announced the changing landscape. But in this case, simply Tweeting news of more tariffs actually encourages the targeted countries to impose retaliatory tariffs themselves. If they don’t, it may be viewed as weakness among their respective voters.

The current size of these tariffs remains pretty small given the size of trade and the size of the relative economies. Canada (NYSEARCA:EWC) however is not well positioned should these trade disputes intensify. Steel and aluminium is an economic annoyance, but should these tariffs be pointed at the integrated auto industry with parts and products moving across the U.S./Canadian border multiple times, this would be a big problem for our economy. The problem is we need them more than they need us and this is certainly weighing heavily on the Canadian dollar (CURRENCY:CAD) as can be seen on the chart to the right.

A rising protectionist environment would hurt global economic growth more than U.S. economic growth, since the U.S. is a big net importer. As a result, a rising trade war may continue to put upward pressure on the U.S. dollar relative to many of its peers, including the Canadian dollar.

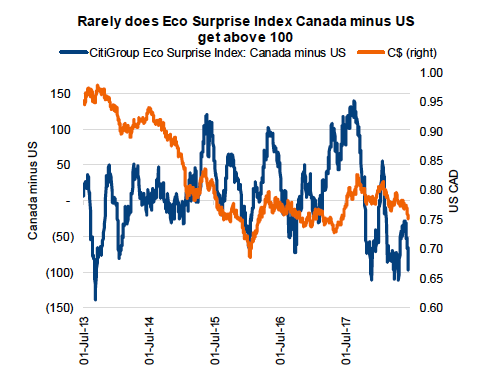

If trade uncertainty is acting as one weight tied to the loonie’s leg, disappointing economic data is certainly another. Recent data has been less than exceptional, the chart to the right shows the spread between the Canadian and U.S. Citigroup Economic Surprise Index, which currently sits at -97. This level is near the extremes and usually is not sustainable as expectations simply become so depressed that the data eventually begins to beat. After some strength early in the year, the spread turned negative on February 22, 2018, and has been near extreme levels for the better part of the past four months. The street held out some hope that the weak data would be only temporary, unfortunately it’s persisted for a number of months.

This past week the Canadian dollar reached fresh 12-month low relative to the U.S. dollar. Oddly enough, give or take a cent the Canadian dollar is trading in line with where it sat last June before the Bank of Canada decided it was time to play catch up with the Fed.

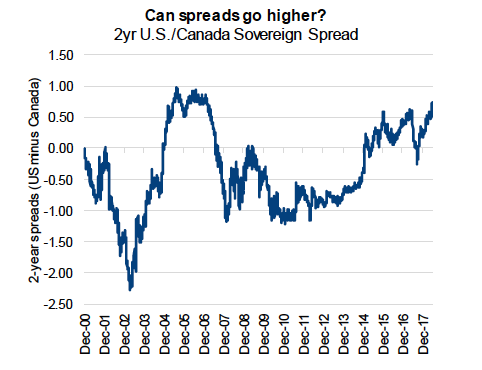

On Friday the loonie traded as high as $1.3382 following a headline miss in Canadian inflation data. Both core (1.9%) and the headline (2.2%) numbers failed to meet consensus expectations. Canadian bond yields promptly fell as did the loonie in early morning trading. The move lower in Canadian bond yields pushed the spread between U.S. and Canadian 2-year yields to an eleven year high, which leaves us wondering just how much higher they have to run.

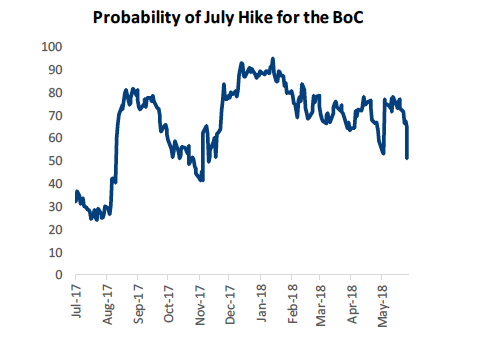

Over the course of the month, the odds of a July rate hike dropped from nearly 80% to just 51%. The markets are leaning towards a continued divergence in monetary policy between the Fed and the Bank of Canada.

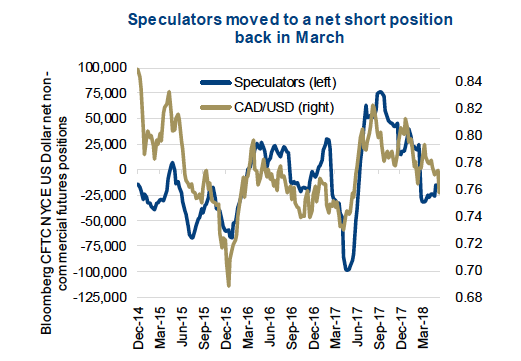

With the odds still roughly 50/50, it may take some more datapoints to tilt expectations in one way or the other. Fresh looks at unemployment, housing or GDP in the coming weeks could further sway the odds. Speculators remain net short the loonie, though bearishness has eased over the past few weeks. Despite speculators being net bearish, current levels are far from the extremes seen over the past few years (2015, 2017).

It’s always risky being a contrarian, but being a contrarian in a market without extreme sentiment more often than not is just called being wrong. We’ll be keeping an eye on the derivates market for any sudden large shifts.

Portfolio Implications

The trade dispute risks to the Canadian economy are a large concern, mainly for our economy and our business confidence. It’s tough to make decisions about expanding, when there is this much uncertainty. The loonie is a victim of collateral damage to some extent from the escalating uncertainty surrounding the trade tiff as well as actual economic weakness. Though the move has been swift, we believe there is still some room to run before levels reach sentiment extremes. We are underweight Canadian equities, in favor of foreign equities in an unhedged manner to benefit from potential future currency weakness.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.