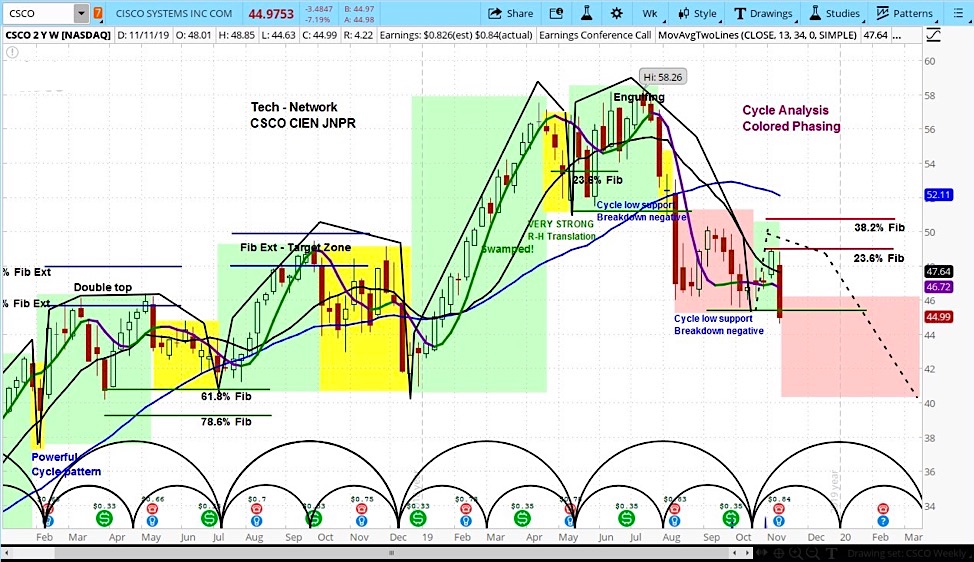

Cisco Systems NASDAQ: CSCO Stock “Weekly” Chart

Cisco Systems (ticker: CSCO) stock price declined 7 percent on Thursday, after the company posted good earnings but missed Wall Street expectations on guidance.

Based on its market cycles, we believe the stock has broken down and that the coming cycle is going to be rough.

Cisco reported earnings per share of $0.84 and total revenue of $13.2 billion, compared to analyst estimates of $0.81 and $13.1 billion.

Looking ahead, management expects revenue of $0.75-0.77, compared to the $0.79 consensus.

Cisco Systems CEO Chuck Robbins explained that, “It feels like there is a bit of a pause. We saw things like conversion rates on our pipeline were lower than normal, which says that things didn’t close the way we would have historically seen it.”

Our approach to stock analysis uses market cycles to project price action.

CSCO appears to be in the declining phase of its current cycle. If that is so, then the stock has broken down from the low at which it started the cycle. This is quite early in the cycle, giving it plenty of time to decline. Our target is $40 by March.

For the “Best and Worst Stocks of the Week” check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.