After the bell today, Cisco Systems (CSCO) reported 1st quarter earnings. Although the Cisco earnings report beat on the top and bottom line, investors were mixed about their 2nd quarter forecast. And Cisco also announced that their CFO will be stepping down.

After the bell today, Cisco Systems (CSCO) reported 1st quarter earnings. Although the Cisco earnings report beat on the top and bottom line, investors were mixed about their 2nd quarter forecast. And Cisco also announced that their CFO will be stepping down.

At the time of this writing, the stock is down 1.47% in after hours.

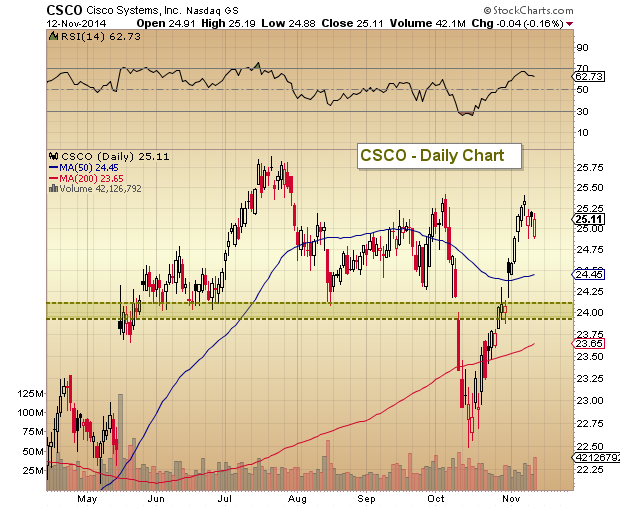

All things considered this isn’t much of a reaction to Cisco earnings thus far, especially considering where the stock price has rallied from: Since the October correction lows ($22.49), Cisco’s stock has rallied over 11.6% through today’s closing price. As well, the recent rally created a vertical V-Bottom pattern on the stock chart, so some consolidation or pull back isn’t abnormal. With that said, the price action over the coming days will be telling.

Near-term technical outlook: Should the stock continue to dip, the first key support level to watch will be the 50 day moving average ($24.45). Below that resides even more important support at the $24.00 / $24.25 area. This level is particularly important because it represents open gap support from the October 30th/31st gap higher. It also resides within the .382 Fibonacci retracement (from the October lows to last Friday’s highs) at $24.29 and .500 Fibonacci retracement at $23.95.

Lastly, the Relative Strength Indicator (RSI) reached up near 70 recently. Typically a strong stock will hold above RSI 50, so that’s something else to watch going forward.

Cisco Systems (CSCO) Stock Chart

Thanks for reading.

Follow Andrew on Twitter: @andrewnyquist

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.