The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

CEO Optimism Abounds

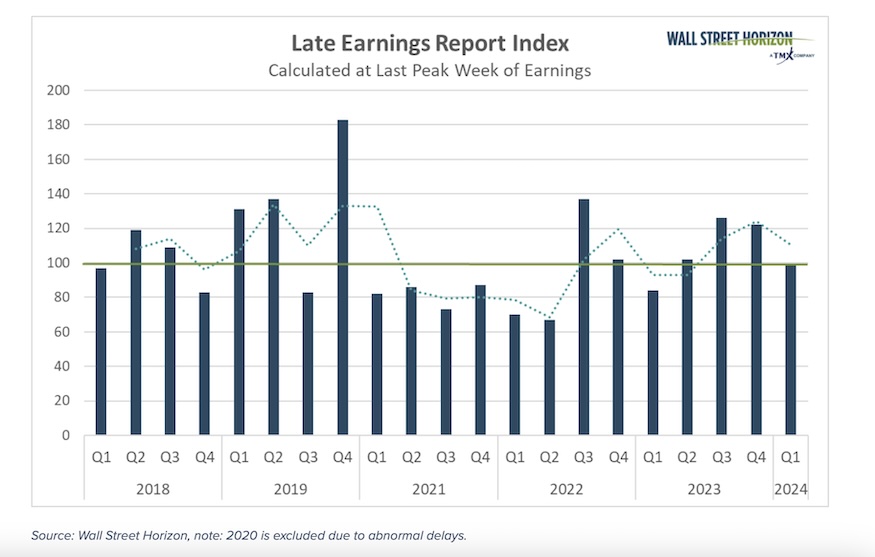

After a volatile 2023, CEO confidence seems to be rebounding in 2024. A number of readings on CEO sentiment, including our own Late Earnings Report Index (LERI), seem to be indicating that executives are feeling more certain about corporate growth prospects. Investor sentiment has also been improving as of late.

LERI Hits Its Lowest Level in a Year

The Late Earnings Report Index (LERI) tracks outlier earnings date changes among publicly traded companies with market capitalizations of $250M and higher. The LERI has a baseline reading of 100, anything above that indicates companies are feeling uncertain about their current and short-term prospects. A LERI reading under 100 suggests companies feel they have a pretty good crystal ball for the near-term.

The LERI ended the Q4 2023 earnings season (data collected in Q1 2024) with a post-peak reading of 99, the lowest in a year, showing that the unwarranted skepticism that built up throughout 2023 was starting to dissipate. The prior low of 84 was reached during the Q4 2022 earnings season (data collected in Q1 2023).

This is in line with other metrics of CEO sentiment such as the CEO Economic Index published by Business Roundtable which also showed business leaders were more confident in the economy with expectations for stronger sales and capital investments.1 Similarly, the Conference Board’s quarterly Measure of CEO Confidence™ also showed an improvement in Q1.2

Survey Says: Investors are Feeling More Bullish Too

It’s not just top management whose sentiment is improving, but investors’ attitudes are positive as well. A recent Bank of America survey showed that Wall Street’s optimism is at its highest level since January 2022. In its survey of 226 fund managers they found the group was also the most bullish they’ve been on stocks since February 2022.3 The main reason for the sunny outlook? Over 90% of participants believe the Fed is done raising interest rates. This could very well be one reason that corporate America is also feeling optimistic.

Looking Ahead

As we head into the Q1 2024 earnings season in a couple of weeks we’ll be monitoring this trend to see if it continues. The next reading of the pre-peak LERI will be published on April 14.

Sources:

1 Business Roundtable Q1 CEO Economic Index Signals a Resilient, Accelerating U.S. Economy

https://www.businessroundtable.org

2 CEO Confidence Improved in Q1 2024, February 8, 2024, https://www.conference-board.org

3 Optimism Abounds on Wall Street This New Year, Wall Street Journal, January 1, 2024, https://www.wsj.com

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.