Central Bank intervention works and sometimes it works a little too well. However, what happens when Central Bank policies fail to generate growth? Japan is the canary in the coal mine for that scenario and a country that we should be watching closely. At some point, the U.S. will probably have the misfortune of finding out what happens when accommodative policies stop working, but for now everyone wants to follow the lead of the U.S. markets and dip their cup in the punch bowl.

Central Bank intervention works and sometimes it works a little too well. However, what happens when Central Bank policies fail to generate growth? Japan is the canary in the coal mine for that scenario and a country that we should be watching closely. At some point, the U.S. will probably have the misfortune of finding out what happens when accommodative policies stop working, but for now everyone wants to follow the lead of the U.S. markets and dip their cup in the punch bowl.

This week the European Central Bank (ECB) announced their version of QE (quantitative easing). That announcement was met warmly by markets and coupled with an unexpected decrease in Canada’s interest rate. There are also rumors that the Bank of England may be considering a similar move. The latest Central Bank policies have pushed interest rates around the world to extremely low levels and Bonds are remain well bid. Remember that interest rates and Bond prices are inversely related so a decrease in interest rates leads to an increase in Bond prices.

The enthusiasm in equity markets for looser monetary policy was accompanied by another drop in the Euro. The chart below is a Euro Hedged European Equities ETF (HEDJ). The Euro is incredibly weak right now and, as a result, it’s more illustrative to look at an ETF that isn’t suffering from the effects of a weak currency.

HEDJ Daily Chart

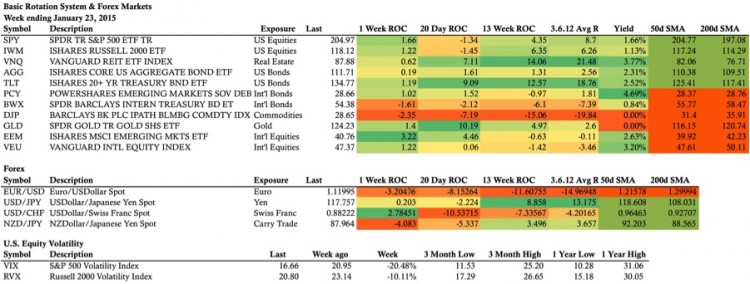

Last week I mentioned that it looked like there was some risk taking in the Emerging Markets ETF (EEM). With the help of a little international QE, I was proven right this week with both Emerging Markets (EEM +3.22%) and Emerging Markets Debt (PCY +1.02%) performing well. As of the close on Friday, Emerging Markets Debt (PCY) yields a little over 4%, which is the highest yield of any asset class in my Basic Rotation System. Yields around the world are historically low and I wouldn’t be surprised to see a continuation of the move in Emerging Markets Debt as investors around the world go on a hunt for yield.

The State of the Union Address took place in the U.S. this week with President Obama announcing a host of policies without a serious discussion of economic implications or plans to pay for proposed policies. My belief is that he knows his policies won’t pass and in 2016 the Democrats will be able to point to the policies as something Republicans failed to support. That would make the Democrats look like givers who care about the “little guy” while the Republicans wind up looking like the parents who keep assistance on a tight leash. Politics 101. The political posturing is appalling and, unfortunately, many people are too emotionally invested to see it for what it is.

In my mind, both parties are equally bad and I’m not taking a political stance on any of the policies. I always think about things in terms of money and I don’t like pushing through policies that will increase spending when we have no ability to pay down existing debt. Additionally, it doesn’t make sense to support tax policies that decrease GDP and are unlikely to leave anyone better off. I have big concerns about the future of the U.S. and most of those concerns center around excessive debt in an ever-increasing number of forms. My fear is that nobody walks away unharmed.

Weekly ETF Rotation Performance Stats

ETF Rotation System Positions:

With a little help from the ECB, U.S. Equity markets lifted this week and that helped the Russell 2000 ETF (IWM) position. The US Real Estate ETF (IYR) and Global Real Estate ETF (SCHH) pushed slightly higher again this week and those positions are now a good distance from the entry points.

The Week Ahead:

This week I’ll be taking some new positions. As of Friday, it looks like the Russell 2000 will fall out of the top two slots for the Basic System, but that could certainly change by the end of the week.

The S&P 500 ETF (SPY) finished a bit higher this week (+1.66%) and that was accompanied by a big drop in implied volatility (the VIX was down 20.48%). That combination makes me wonder if we won’t see some more upside in U.S. Equities next week… as investors continue to cheer accommodative central bank policies. Thanks for reading and have a good weekend.

Read more from Dan on his blog: ThetaTrend

Follow Dan on Twitter: @ThetaTrend

Author holds positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.