I’ve been busy with travel and non-market stuff for the last several weeks but wanted to provide a quick update on how the credit markets are faring into April.

Here is a summary of my thoughts looking across the credit markets… with a final note on what it may mean for equities:

- Accounting for the 11bps price drop in the price of the IG CDX (Investment Grade) after it rolled into the latest series, the index is now meandering within a neutral range fully supportive of the stock rally we have had, but probably not enough to push stocks higher without more improvement. Same can be said of the HY CDX (High Yield).

- IG and HY spreads have recovered all of the Q1 losses and are now back or below where they began the year.

- In cash bonds, the news is way better: Q1 corporate bond issuance was $433B (and I exclude all quasi-governmental agencies or High Yield sovereign issuers). The first 3 days of this week have tallied $14B, $8.9B and $12.2B respectively.

- Flows of fresh allocations of money from pension funds to credit continue relentlessly at $5-7B every two weeks. Multiply by your preferred leverage amount, and you get how much new money is added to the pile that is already looking for a home.

- Over the last few weeks, the minimal issuance of junk bonds – which has been a focus of credit and equity bears – has turned, with several tens of billions being offered and bought for spec deals such as Western Digital (WDC) for Sandisk (SNDK). Yesterday, France’s telco Numericable (NUM FP) sold the largest single junk issue ever $5.19B at 7.375%.

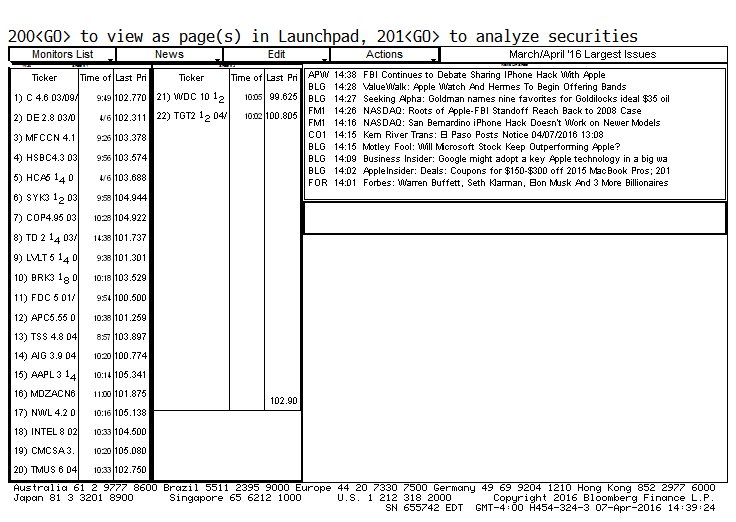

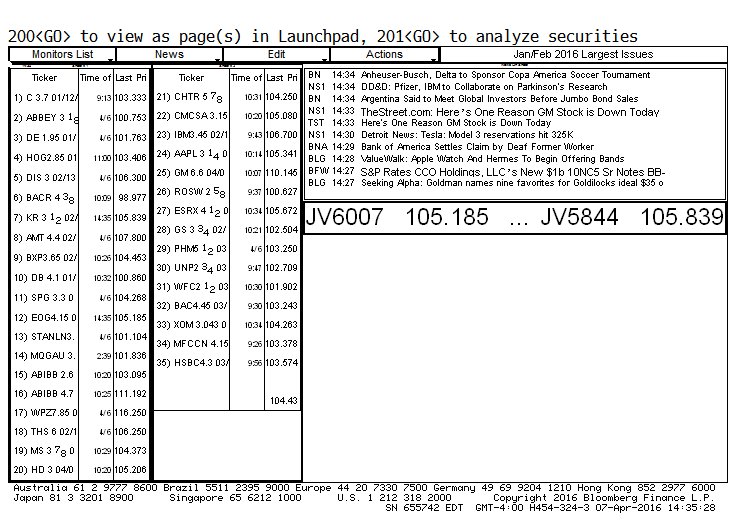

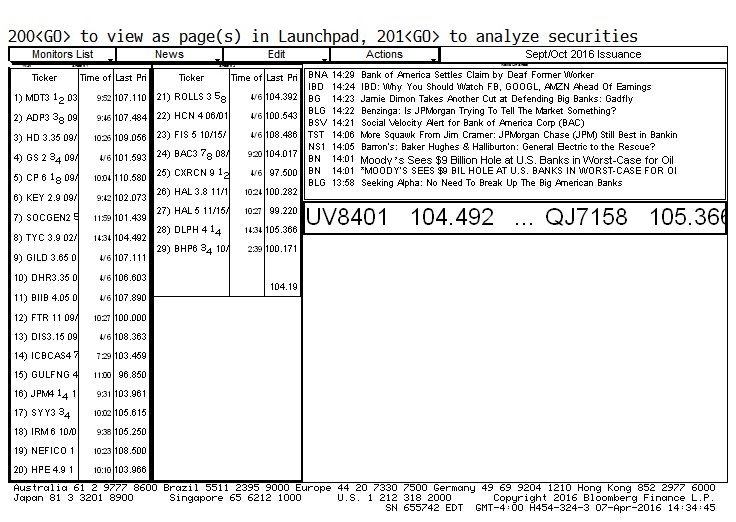

- Even more important to the mood and the appetite of large bond buyers, the screens below show a broad sampling of the $900B in new bonds sold since September: say what you will, but credit will not fall into the abyss as long as bond buyers have these kind of price gains on their holdings. (How would you like to have bought Apple’s (AAPL) 3.25% of 2026 when issued on 2/23… and seeing them trading at $105 of late?)

(See charts from Bloomberg below)

- Stocks have reached significant exhaustion / resistance levels, through traditional technical analysis and using DeMark tools. It will likely take time to pierce through to the upside, but if credit stays as it is or improves, it will only be a matter of time.

Good luck and good trading!

Position in WDC

More from Fil Zucchi: “Corporate Credit Markets Set For Extended… Period Of Balance?“

Twitter: @FZucchi

The author has a position in WDC at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.