July was an eventful month on the political and economic front, as the conflict in the Ukraine was joined in the headlines by renewed U.S. involvement in Iraq. The Fed continued to unwind QE and is on pace to conclude all ‘money-printing’ within a few months. Stocks drifted slightly lower, as did bonds. Here is what happened in the capital markets, by the numbers:

July was an eventful month on the political and economic front, as the conflict in the Ukraine was joined in the headlines by renewed U.S. involvement in Iraq. The Fed continued to unwind QE and is on pace to conclude all ‘money-printing’ within a few months. Stocks drifted slightly lower, as did bonds. Here is what happened in the capital markets, by the numbers:

Stocks & Bonds

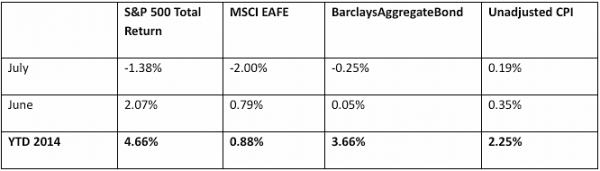

In July the U.S. capital markets took a breather, although both U.S. equity and credit markets have seen solid gains. International stocks were hurt somewhat by the strengthening dollar. Inflation has jumped a bit in the last few months, although its annualized rate is still well within Fed parameters.

By the numbers:

Commodities & Currencies

NYMEX crude prices declined in July, from $103.85 to $97.32 per barrel. Year to date, prices are up about 3.5%. A glut of oil and a soft global recovery are providing headwinds for oil prices, while tailwinds come from factors such as uncertainty in the Ukraine and Syria. Gold prices declined about 3% in July, to $1,282.80 per ounce. Year to date gold prices are up about 6.4%. As central banks weaken currencies around the world, the dollar suddenly is the less weak currency. And if this continues, it will likely shake up the capital markets a bit. On a trade-weighted basis the dollar gained 2.11% in July, erasing its year-to-date losses and leaving it up 1.77% for 2014.

Economy

The Department of Commerce released its second estimate of 2nd quarter GDP. They estimated that the economy grew at a 4.2% annual rate in the second quarter of 2014, a sharp contrast to the first quarter’s contraction of 2.1%. Many economists believe that the first quarter number was a fluke due to severe weather. Inflation also appears to be muted, with government estimates for the 2nd quarter pegging it at 1.9% annualized. Overall, it appears possible that the economy is on track for another year of low single-digit growth.

The unemployment rate ticked up slightly from 6.1% in June to 6.2% in July as a meager 209,000 jobs were added to the economy.

The Institute for Supply Management had continued good news, reporting that July’s manufacturing PMI was 57.1, up from June’s 55.3. A reading above 50 indicated economic expansion.

The National Association of Realtors (NAR) reported that the annual rate of existing-home sales in July fell by 4.3% from July 2013. This is the best annualized rate of 2014, although this year’s sales are still below last year’s. The national median price rose from the prior year by 4.9% to $222,900. Foreclosures and short-sales, as a percentage of overall sales, were at 9%, much lower than the 15% reading of July 2013.

Summary

At this year’s annual Economic Policy Symposium, attended by key central bank figures from around the world, Mario Draghi made a variety of comments related to his concerns about a lack of growth in the Eurozone. He reiterated the ECB’s commitment to protect the Eurozone, leading many observers to read between the lines and assume further ECB stimulus is coming sometime soon. As the euro has declined for almost a year against the dollar, apparently the capital markets might also be anticipating further euro stimulus.

As the Fed is on schedule to end its monthly bond purchases in October, the U.S. looks more and more alone amongst developed economies. Both Europe and Japan are pursuing ad hoc or systematic currency weakening to try to spur economic growth. The dollar looks like it may continue to gain strength if other countries continue to weaken their currencies. This could be bullish for U.S. equities, and even U.S. bonds, relative to foreign equities and bonds.

In addition, the government deficit in the U.S. appears to be improving. The CBO projects the deficit for this fiscal year to be 2.9% of GDP, lower than the 3.0% average of the last 40 years.

Data Sources:

- www.standardandpoors.com – S&P 500 information

- www.msci.com – MSCI EAFE information

- www.barcap.com – Barclays Aggregate Bond information

- www.bloomberg.com – U.S. Dollar & commodities performance

- www.realtor.org – Housing market data

- www.bea.gov – GDP numbers

- www.bls.gov – CPI and unemployment numbers

- www.commerce.gov – Consumer spending data

- www.napm.org – PMI numbers

- www.bigcharts.com – NYMEX crude prices, gold and other commodities

- https://data.bls.gov/timeseries/LNS11300000 – Labor participation data

- https://www.bloomberg.com/news/2014-08-22/ecb-ready-to-act-as-draghi-sees-inflation-expectations-sliding.html – Mario Draghi comments

This material was prepared by Greg Naylor, and does not necessarily represent the views of Woodbury Financial or its affiliates. This information should not be construed as investment, tax or legal advice and may not be relied upon for the purpose of avoiding any Federal tax liability. This is not a solicitation or recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. The S&P500, MSCI EAFE and Barclays Aggregate Bond Index are indexes. It is not possible to invest directly in an index.

Investing involves risks and investors may incur a profit or a loss. Past performance is not an indication of future results. There is no guarantee that a diversified portfolio will outperform a non-diversified portfolio in any given market environment. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.