The intermediate-term trend indicators that I am watching (and use) are designed to signal the trend of the market over the next 3 weeks to 3 months. I do not use these indicators to out-perform the underlying market index; rather, I use them to better manage the risk associated with investing in stocks. For those that are retired or near retirement, the number one priority should be preventing devastating losses because your ability to recover is limited. When you are working full-time and contributing monthly to something like a 401k, then you have the ability to recover from a loss more quickly because of the new money contributions you keep adding. Once you are retired and stop contributing, then the recovery time is dependent solely on market forces. And if you are taking distributions from your retirement accounts then it is virtually impossible to do so. That’s why I emphasize risk management in all cases and the minimization of losses for those nearing or in retirement. And that’s why I rely on tools like a trending indicator to help identify when I should be aggressive versus when I should exhibit caution.

Why does this matter today? It matters because the intermediate trend indicator that I use for the U.S. stock market is now down. That indicator changed from ‘up’ to ‘down’ on Monday, September 15. The Canadian stock market indicator changed today. Canadian equities have been very resilient and have out-performed the U.S. stock market throughout the year. So the fact that both the U.S. and Canadian equities markets are signaling a down trend on my indicators is notable.

Trending Indicators

US Stock Market Trending Down

Canadian Stock Mkt Trending Down

US Bond Yields Yields Trending Down

With the indicators turning down, I have lightened up on several Canadian equities and continue to remain invested in outperforming bond funds.

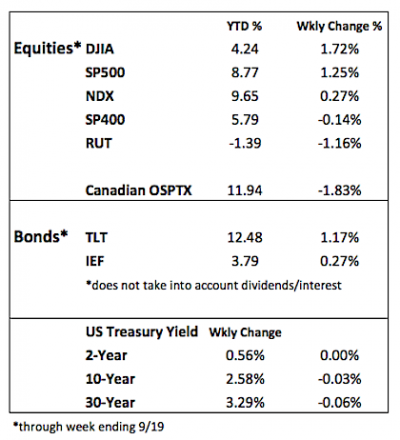

Here’s a look at the financial markets performance metrics for the week and year:

Data Bank:

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.