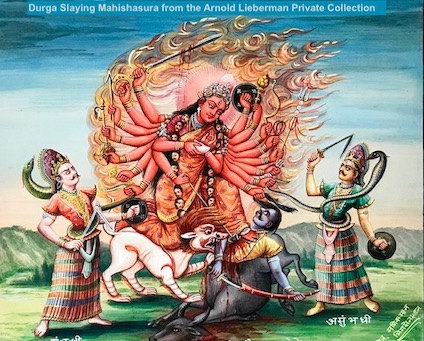

Thousands of years ago, the tyrant Mahishasura, part demon and part buffalo, asked for immortality.

In his quest for immortality he added, “No man shall kill me.”

In his rage and pride, he nearly destroyed the earth.

The lords Brahma, Vishnu and Shiva got so mad, they radiated a blinding light. From this light, the ten-armed Goddess Durga was born.

The gods were clever!

They created an immortal woman, since Mahishasura could not be destroyed by a man.

Armed with gifts of ten different weapons, the Goddess Durga took on the job of slaying Mahishasura.

Thus, she succeeded, and the earth was saved.

I love a good story, especially one as old and as prophetic as this one.

I love a good story, especially one as old and as prophetic as this one.

I will not attempt to attach any names to the characters or to the moral of this story.

Rather, I tell this story because of the colorful way it describes these last few weeks in the stock market.

Did the stock market, like a demon, get too big?

Can a Goddess save it?

If so, what 10 weapons might she use?

The stock market definitely got too big.

The tax cuts made a year ago, empowered many corporations to greedily buyback their own stock.

The stock market ignored rising rates, a strong dollar and crashing oil prices during the early fall.

The stock market ignored homebuilders and real estate issues.

The U.S. market ignored rising debt and a decreasing desire for foreign powers to buy U.S. debt.

I could go on, but for the sake of brevity, I won’t.

What might a Goddess sent by the gods to save the market look like?

The most classic example would be a blow off bottom.

A blow-off bottom is when the volume increases as the selling accelerates, which then leads to a green close, also with huge volume.

Yet, we need a Goddess with ten weapons to help achieve that.

First weapon is that the S&P 500 holds 2450. That is a perfect retracement to where the fun began post the 2016 election.

Second weapon is that buyers come in and the S&P 500 closes out the week over 2500.

Third weapon is that Transportation IYT (my go -to) retakes the 200-week moving average at 163.90.

Fourth weapon is that Semiconductors SMH can get back and close above 86.95.

Fifth weapon, is that the T-Bonds (looking at TLT), have peaked in its corrective bounce, hence the “flight to safety” mentality decreases.

The next five weapons are for the Russell 2000, NASDAQ 100, the Financial sector, Retail XRT and Oil. The bearish moves and their wounds must magically heal.

Ultimately, Durga chopped off Mahishasura’s head.

We are hoping she can accomplish this for stocks, so that we market watchers can see that blinding light.

S&P 500 (SPY) – 245 now key support or 235 next. Over 251 I expect some relief.

Russell 2000 (IWM) – A blinding light would be this closing the week over 134.58. 129.00 next support if it cannot

Dow Jones Industrials (DIA) – A weekly close over 232.10 would be a good start.

Nasdaq (QQQ) – 150.13 the 2018 low. Today’s low 150.39. Would like to see a move back over 155.50

KRE (Regional Banks) – 44.00 support. 50.15 resistance

SMH (Semiconductors) – 86.95 resistance. Like to see 84 hold

IYT (Transportation) – 163.90 the 200 WMA-best bet to watch for any strength. Our Durga.

IBB (Biotechnology) – 89.50 major support

XRT (Retail) – 40.00 support pivotal for tomorrow

Twitter: @marketminute

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.