The equity markets rallied for the second straight week, carrying the S&P 500 Index to within 1% of the record highs and the NASDAQ to an all-time record high.

And it was nice to see other areas besides mega-caps Apple (AAPL), Amazon (AMZN), and Facebook (FB) getting all the attention (and flows).

The strongest gains were found in economically sensitive areas of the market including the Dow Industrials and Dow Transports.

Industrials was the best performing sector of the week, increasing 4.5%. The Russell Small Cap Index soared 6.0%.

The reawakening of the broad market away from the mega tech dominance suggests a growing confidence in the economic recovery and the sustainability of the bull market.

Market Domination?

Seven stocks have ruled the market this year: Apple (AAPL), Amazon (AMZN), Facebook (FB), Alphabet (GOOGL), Microsoft (MSFT), Netflix (NFLX) and Tesla (TSLA).

According to my friends at Ned Davis Research, these seven stocks (except Tesla) have grown from around 9% of the S&P 500 Index in 2014 to currently 24.7% of the S&P 500 and sell at a record 40.7 times earnings and 6.8 times sales based upon the latest 12 months of data ending in July.

The median stock in the S&P 500 is down for the year. The rapid growth in these mega-caps was brought on by the COVID-19 virus and the immediate need to move our lives online in order to work from home, learn, and shop. These companies will likely continue to grow over the long term, and the low interest rate environment provides good support. The challenge they now face is the possibility of increased federal regulation. Strong companies with solid earnings such as these can become overpriced. While tech has become the new defensive sector of the day, investors should be mindful as the prices of these stocks rise, not to be over-allocated in any one sector.

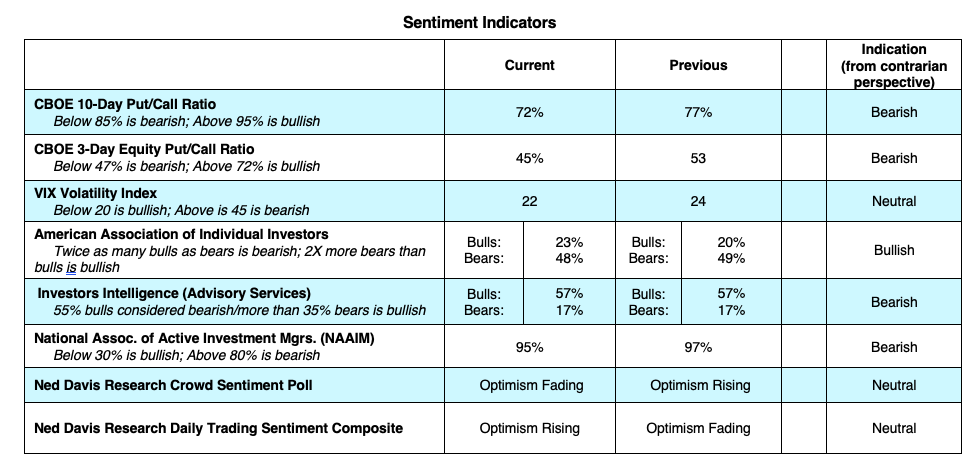

The Bottom Line: Seasonally, August and September are historically weak months of the year. However, the deterioration in stock market breadth may be reversing and sentiment indicators, although elevated, are below what is considered excessive optimism. The Federal Reserve is committed to keeping short-term interest rates low and to do everything in their power to support the financial system.

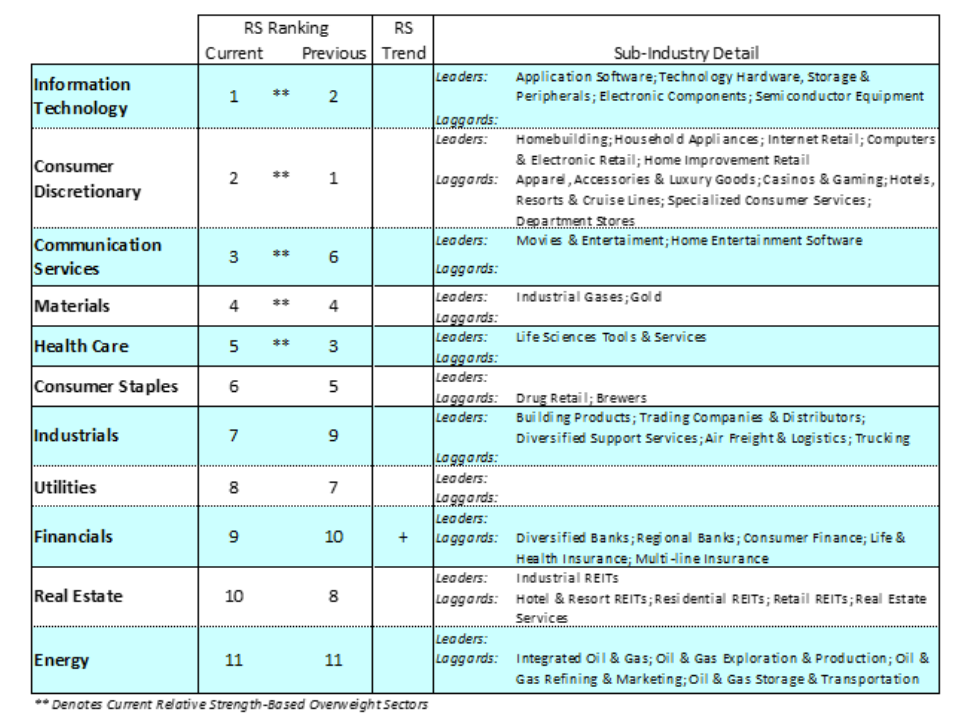

As the economy improves, we think information technology, healthcare and cyclical sectors will benefit.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.