When the economic data started to slow in a few select markets more than a year back, few gave it much attention.

Trouble in emerging economies such as Turkey, Brazil and Argentina were chalked up to them being either too financially fragile, sensitive to higher global yields or single country issues.

Plus, there was so much positive economic momentum from developed markets that few were worried.

That softness in a few spread to most emerging/developing economies, including China. It then gradually spread to developed markets that are more trade sensitive (Europe & Asia). Now, finally, it’s come to the U.S.

A few months back another asset management firm used the ‘synchronized moderation’ term, denoting just about every major economy was slowing. Not by huge amounts, but slowing nonetheless.

This moderation shifted into a higher gear this past week. The Bank of Canada sees enough weakness to almost imply rate hikes are off the table. The U.S. just had one of the smallest job prints of this expansion, at +20k. Germany’s economy didn’t grow in Q4. And then the OECD came out and slashed 2019 economic forecasts for Europe (1.8 to 1.0%) and Canada (2.2 to 1.5%). This brought their global growth forecast down from 3.5% to 3.3%.

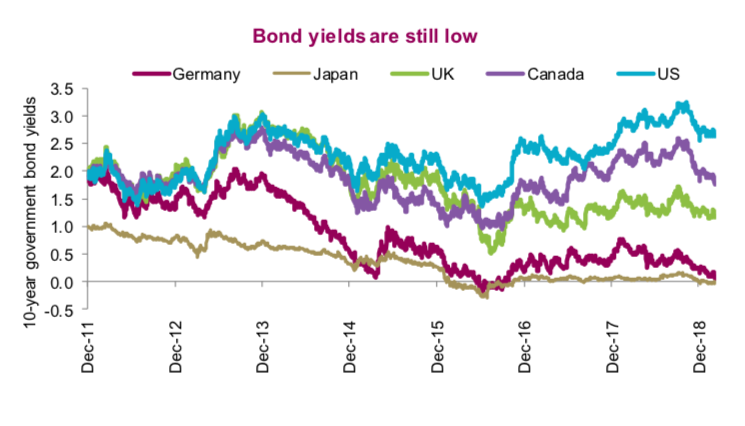

Tempered growth is certainly being reflected in the bond market. After trending higher since mid-2016, yields have been falling just about everywhere. German yields are back down to a mere 0.06%, U.S. yields have fallen from 3.25% to 2.63% and Canada down from 2.5% to 1.77%. Even with global equity markets recovering in 2019, yields have bowed to the soft data and continued to move lower.

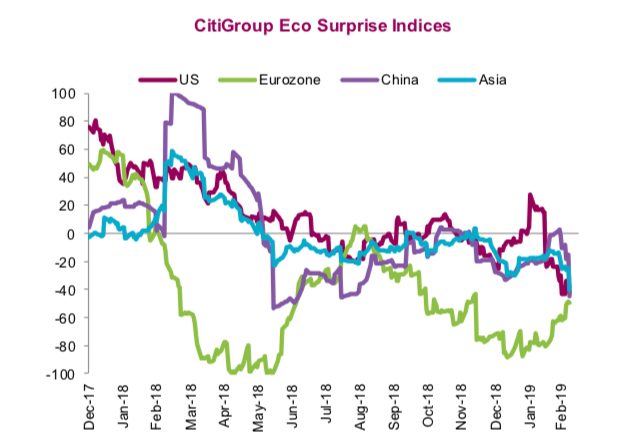

If you need more evidence things are slowing, just look at the Citigroup economic surprise indices. These measure the economic data relative to expectations. Even with expectations coming down, the data does keep missing to the downside. Eurozone coming back up is a little comforting but given how bad they’ve been doing, they’re certainly not crushing it.

Equity markets had been ignoring the soft economic data so far in 2019, likely just rejoicing in lower bond yields and central banks moving back to the sideline. At some point though this will change, and the markets will fret over the data. Perhaps we got a sampling of that with the equity market weakness last week.

Next earnings season may also prove more challenging. In Q4 the S&P 500 enjoyed a solid 6% sales growth pace. Slowing economic growth makes sales growth that much harder to come by. And if sales growth slows, margins will be pressured which is one of our longer-term concerns.

Two scenarios

After growing at an elevated pace in 2016-18, the global economy is slowing. This raises the two most likely future paths.

Economic data could continue to weaken and talk of a global recession or the end of this cycle will become more prevalent. Looking back at the end of past global growth cycles, this is what the beginning of the end looks like. There is still growth but it is slowing, which then accelerates.

The other scenario, which is much more encouraging, is that this period of soft data passes. This would provide a bit of a reset, alleviate inflationary pressures and potentially allow for an even longer cycle (this one is already pretty long).

At this point, we are in this second camp. The OECD news is hardly news. They do some fantastic work with expertise around the globe, providing added insight. Notably Figure 7, chart B showing how much emerging market debt is coming due in the next three years (link to report that anyone with considerable emerging markets exposure may want to read). But they also tend to move slowly with forecasts and this change likely surprised very few.

It isn’t nearly that gloomy out there. OECD has global growth in 2019 at 3.2%, consensus economists have it at 3.4%. Yes, slower than 3.7% in 2018 but still good, especially in a world with lower bond yields.

Turning to forward-looking indicators, such as leading economic indicators (LEI), we are seeing a turn higher. We track 11 countries with LEI indices, watching the 3-month rate of change. In September only 3 were rising, October this dropped to 2 and in December down to 1. By the end of January, we were back to 3 in the green.

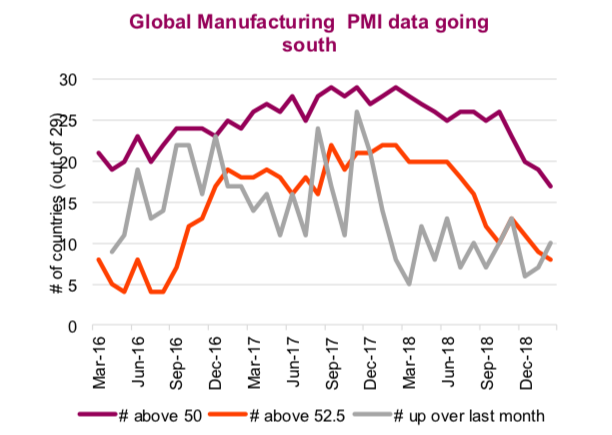

Global PMI data, which tracks manufacturing activity and tends to be a forward looking indicators, continues to trend down. The chart below tracks all 29 countries that release this data. But the grey line has turned up which is the number of countries seeing their data rise.

Could be too early to celebrate but given the countries seeing improvement include Turkey, Indonesia, India and China, it’s encouraging as this is where the weakness all started.

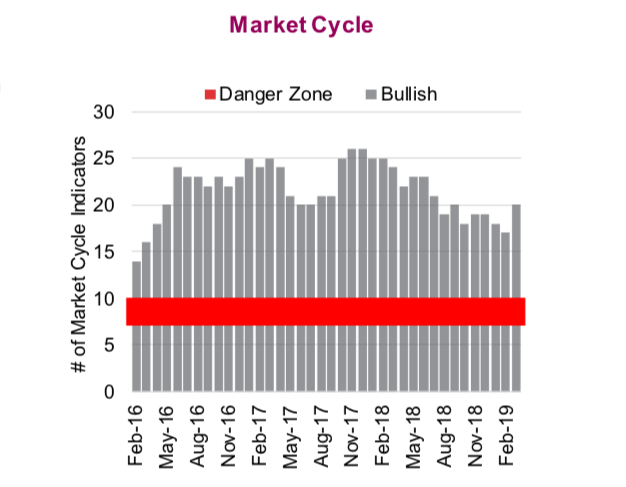

Finally, our Market Cycle indicators which held steady during the Q4 correction, have turned up. Just over last month we saw signals turn back to being bullish in the global economy side and the U.S. with a nod to housing.

At this point we see the weakening economy data as just moderation and not anything worse.

Charts sourced to Bloomberg unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.