This post was written with Chris Kerlow of Richardson GMP.

Housing related expenditures are becoming an increasing component of the Canadian economy and have helped propel Canada to its current status as one of the fastest growing developed nations in the world. Could this data point be part of a broader Canadian housing bubble? Let’s take a closer look.

The prolonged run in home sales coupled with price appreciation has tripled the contribution to GDP during this cycle, according to RBC economics. On Thursday, the Bank of Canada released their semi-annual Financial System Review which centered around the vulnerabilities of elevated Canadian Household indebtedness and imbalances in the Canadian housing market. With legislative changes in two of our largest metropolises, Toronto and Vancouver seemingly taking grip, and the pressuring of alternative lender Home Capital Group, we wanted to consider the investment implications a potential pullback in the housing sector would have for Canadian investors.

During his webcast on Thursday, BoC governor Stephen Poloz noted that the risk of a housing correction is growing over time, not becoming less. This only highlights something that is quite apparent to all Canadians. However, they labeled the risk of a housing correction as moderate. They think the impact of a pullback would be limited but still cause financial stress. This is because of the vulnerabilities caused by a supply and demand imbalance and increased household indebtedness are being offset by growth and strength in other parts of the economy. “The reliance is rising in the background, even if the vulnerabilities are rising in the foreground,” said Poloz.

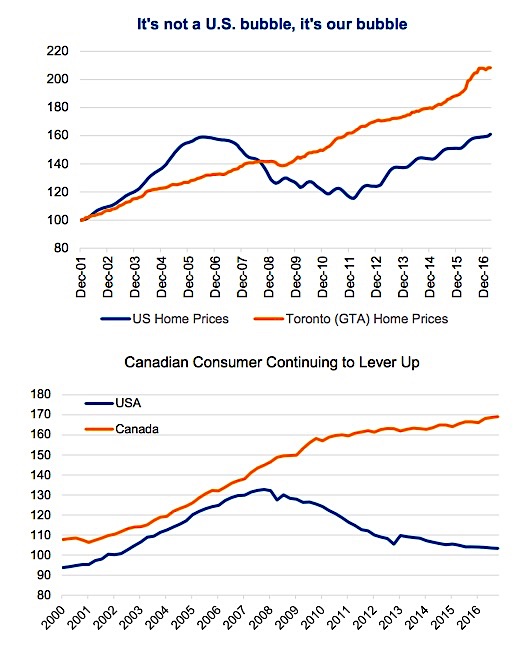

Observers are quick to draw parallels to the American housing market that catalyzed the great financial crisis in 2008. The reality is Canada’s situation is quite different. Underwriting standards are much more stringent, delinquency rates are much lower, in some cases lenders have recourse to other assets, and there is much less securitization of mortgage debt because our banks keep most of their mortgages on the balance sheet unlike other countries that off-load a lot of that debt.

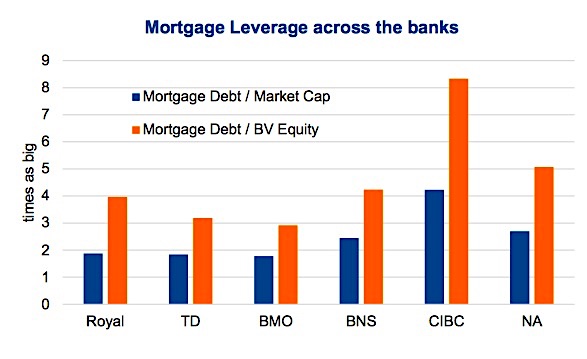

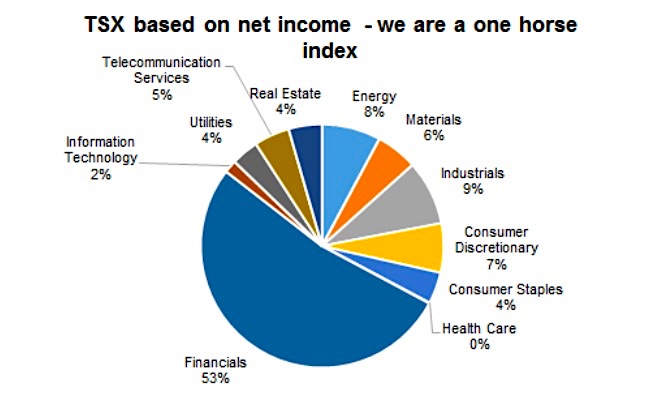

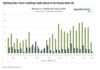

The growing level of household debt and exposure to Canadian housing was cited as one of the reasons Moody’s downgraded the credit rating of six of the Canadian banks on May 10th. The level of exposure across the banks varies, but mortgage lending is a bread and butter business for all of them. Canadian banks are core holdings in all of our mandates, however a sector we have a hard time justifying being market weight in, when they account for 23% of the index. The prolific growth in bank earnings and other financial institutions have growing net income of the financial sector to account for, and Canadian banks now accounted for more than 52% of the TSX net income. Within our portfolios, we are more allocated to banks that have larger contributions from capital market divisions and U.S. operations, such as RBC, TD and BMO.

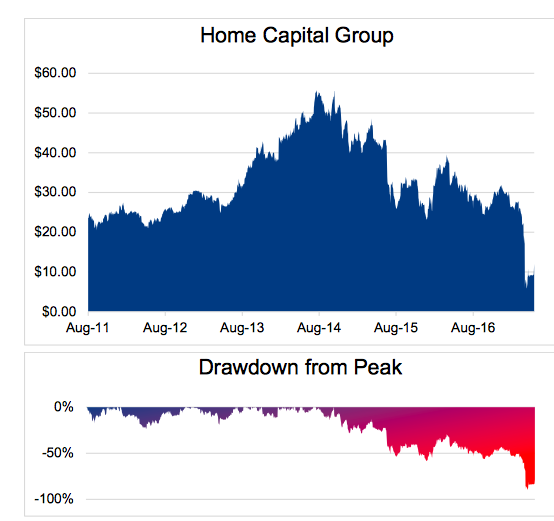

The financial sector has been a laggard over the past three months, down -4.3% vs the TSX which itself is nearly flat down -0.3% as of the end of May. The softness could simply be a cooling after a solid run but it may also be fears that the issues at Home Capital are not isolated.

Home Capital fell precipitously in April following revelations of an OSC investigation that unveiled fraudulent mortgage applications. We have observed some investors concluding that the decline of their share prices is an indication of weakness in the housing market, which is not necessarily the case. The quality of their mortgage book is actually quite high with delinquency rates of just 0.21%. The problem they have run into is an access to funding, as investors have been redeeming High Interest Savings Accounts and GICs, two of their primary sources of funding mortgages.

Home Capital is considered an alternative lender, focusing on individuals that do not meet all the criteria laid out by traditional (banks) lending institutions. They only account for roughly 1.5% of all mortgage lending in Canada but their fallout has coincided with what appears to be a sentiment shift in the booming Greater Toronto housing market.

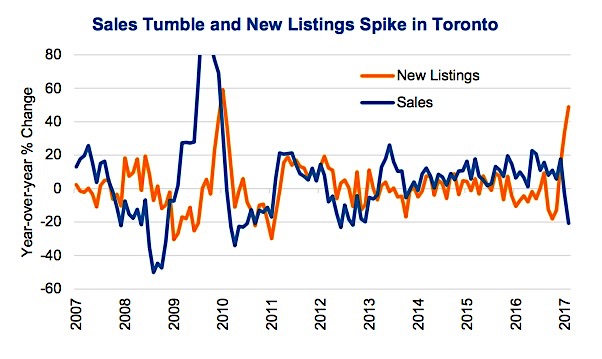

In May, sales in Toronto fell -20%, while listings increased by 49%. This is only one data and could be aberration, the next data will be released by the CREA on June 15th. It will be interesting to see if this trend continues. In speaking with a real estate agent that focuses on the Toronto condo market, he believes that the flux of new listings has come from unmotivated sellers that want to see if they can get a stretched valuation for their home. Those are not being bought up as quickly as before but properly priced properties are still being sold.

The other catalyst to the recent change in sentiment could be attributed to regulatory reforms instituted by Kathleen Wynn and the Ontario government. These were focused on cooling a raging market in the Greater Toronto Area, which increased 24.6% over the past year, as of the end of April. They released their Fair Housing Plan on April 20th, which had numerous measures aimed at helping balance the demand and supply of housing, including a 15% tax on purchases by people who are not Canadian citizens. They also provided measures aimed at the rental market such as expanding rental controls, providing a rebate for construction of new rental units and potentially taxing vacant homes.

The intention of the second wave of reform is intended to reign in rental costs which have been rising quite quickly as the market has a low supply of vacant units and high demand from individuals that cannot afford high flying home prices. GMP Research estimates that home ownership in the GTA is roughly 68%, near the same level of the U.S. before the housing crisis. During the crisis, homeownership in the U.S. fell 6%. Subsequently, net operating income growth for the largest U.S. apartment REITs increased 35%. If we were to see a fall in ownership rates, this could be bullish for Canadian apartment-focused REITs. During a downturn, it is likely that consumers migrate to more affordable housing, with condo rent 1.55x (Source: CMHC, GMP Securities.) higher than apartments, these apartment providers of supply could benefit.

The reality is homeownership rates do not fall in an expanding economy, nor do you typically see a housing crash. For a major pullback in aggregate home prices across the country we would likely need to see an economic slowdown or even a recession. As we wrote about last week our macro indicators and market cycle work does not indicate that we are on the precipices of something catastrophic. However, if and when the next recession takes grip in Canada we corroborate with the Bank of Canada that the housing market is highly vulnerable.

One area we think could be the tip of the spear for a housing market correction would be the mortgage investment corporations (MICs). These alternative lenders focus mainly on providing financing to mortgage applicants that are usually unqualified to access capital through traditional lenders. They then package up these mortgages and offer the income stream to investors. The investment product is attractive because the net asset value is typically fixed, based on the premise that underlying home price rise or are stable and defaults are minimal. All mortgage payments then flow through to the end investor, less some fees along the way. The quoted NAV stays consistent because mortgages are not marked-to-market unless they default. During a recession or housing correction, that thesis will be tested and these less qualified home buyers are the most likely to be the first to default. This investment has gained in popularity as investor search for yield in this low rate environment. But after such a good run, and considering we are deep into this economic cycle, we would rather be sellers than buyers in this space.

All charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.