Broadcom (NASDAQ: AVGO) rose 10% on Friday morning, after the company posted mixed earnings and revenue guidance that beat Wall Street expectations.

As the stock is still early in its current rising minor cycle, we believe more gains are likely before corrective forces kick in later in the spring.

The company reported earnings per share of $5.55 and revenue of $5.79 billion, compared to analyst estimates of $5.23 and $5.83 billion. Management forecast 2019 revenue at $24.5 billion, above the consensus of $24.4 billion.

CEO Hock Tan explained that, “We were pleased that our broadband business has started to recover and that the semiconductor segment was actually up year-over-year in Q1, if you exclude the expected decline in wireless.”

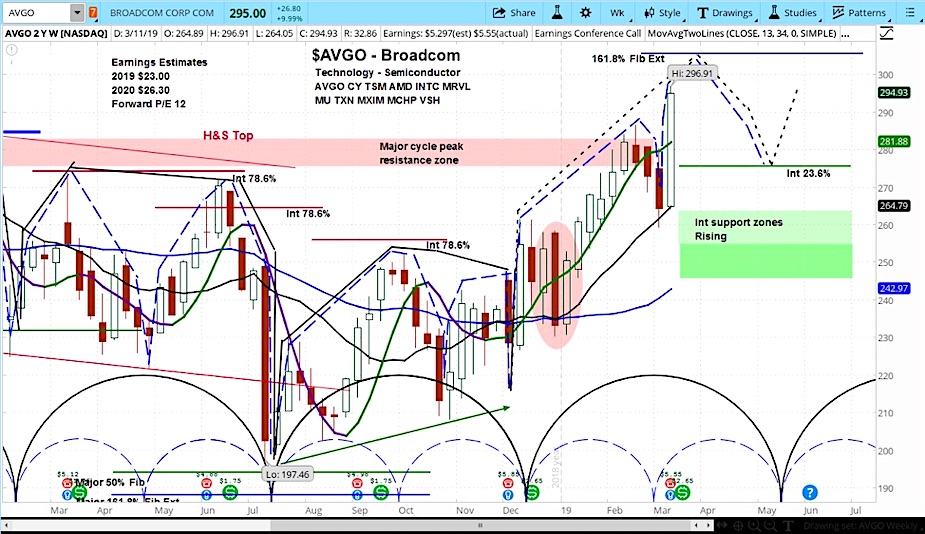

In analyzing the market cycles for AVGO, we can see that the stock has begun a new rising phase for its current minor cycle.

The stock has recovered to a recent high, with likely more gains ahead as it is still early in this cycle. Our target is around $305 before a correction later in the spring.

Broadcom (AVGO) Stock Weekly Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.