This post is written as a sequel to my original post from November 24: Bottom Fishing In Oil? Sure It’s Possible, And Here’s How

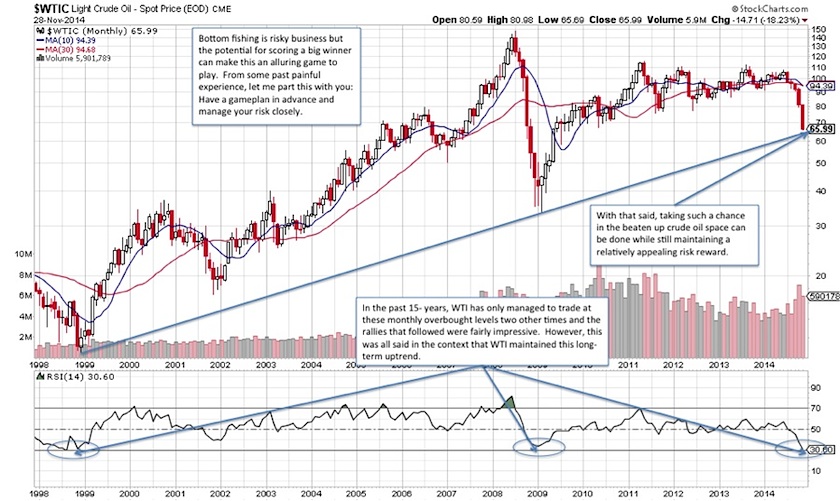

Bottom fishing is risky business but the potential for scoring a big winner can make this an alluring game to play for some. From some past painful experience, let me part this with you: Have a game plan in advance and manage your risk closely. With that said, taking such a chance in the beaten up Crude Oil (WTI – Quote) space can be done while still maintaining a relatively appealing risk reward. Here is one way to play this while minimizing your downside should the trade go sour.

In the past 15- years, WTI Crude Oil has only managed to trade at monthly oversold levels, shown in the chart below two other times, and the rallies that followed were fairly impressive. However, this is all said in the context that WTI maintains this long-term uptrend. Remember that there has been substantial psychological and technical damage done to crude oil of late and it will take time for the damage to heal. For example, note how the 10/30-month moving averages are now trending down and the 10-month ma has quietly dipped below the 30-month ma, resulting in a long-term death cross sell signal. Also, as a reminder from my prior post on the subject that longer-term bearish projections still have not yet been met.

Lastly as seen on the United States Oil Fund ETF (USO) the massive selling last week left a large downside gap on the chart that has likely left ample resistance along the way. The top of this gap (27.85) is now going to play a crucial role on any rallies and will therefore be a key level in your risk/reward calculations. As there was not gap on the WTI crude oil chart, a comparable level will be more likely in the $73.25 range.

WTI Monthly Chart: Discipline is the key to picking a bottom in oil.

United States Oil Fund Daily Chart (USO): A closer look at the damaging gap

The bottom line here is that bottom fishing in oil can work, but you have some technical headwinds against you, so you will not only have to watch your downside risk levels, but your reward potential may have to get taken a notch or two down for the time being.

Follow Jonathan on Twitter: @jbeckinvest

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.