The equity markets roared back from the Brexit scare last week finishing the period with the best weekly gain of the year. Bond yields plunged in nearly every corner of the globe including the U.S. where the yield on the 10-year Treasury note yield (INDEXCBOE:TNX) declined to an all-time record low.

This action resulted in a rush to equities where more than 60% of the issues within the S&P 500 Index (INDEXSP:.INX) have a dividend yield greater than Treasury instruments. Given the stock market has virtually no competition from the bond market, the demand for stocks is anticipated to remain strong. Especially as bond yields plunge.

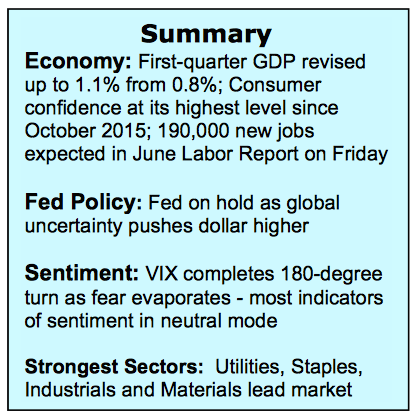

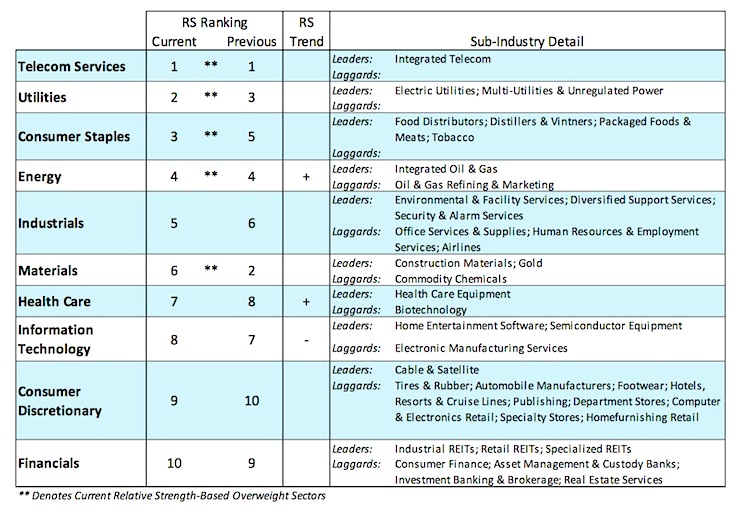

Despite 16 straight weeks of outflows from U.S. equity mutual funds, the popular stock market averages are sitting less than 2.0% from the record highs recorded in 2015. We expect that before the current stock market rally runs its course, the outflows that anchored the market in the first half of the year will reverse and become a significant tailwind in the third quarter. Although sector leadership will likely move to more aggressive areas of the market, the ultra-low interest rate environment will continue to attract investors seeking income. The strongest sectors are utilities, consumer staples, energy, materials and industrials.

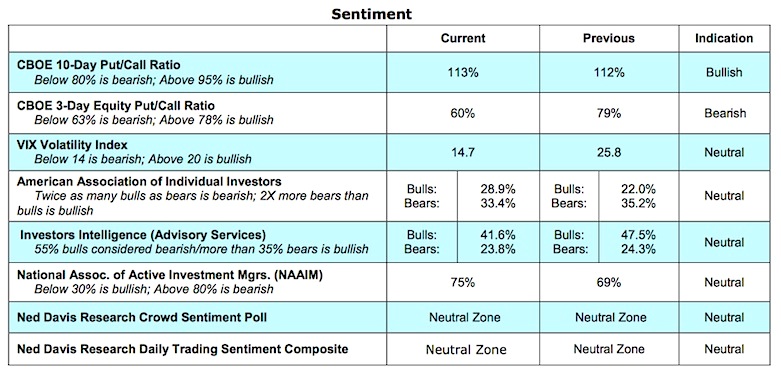

The technical condition of the stock market improved into the rally. The most significant difference between 2016 and 2015 from a technical perspective has been the strong support from the broad market. Not only has this not faded in the wake of the Brexit vote, but breadth has actually improved. Advance/decline lines have hit new highs and we have seen back-to-back days of 9 to 1 upside/downside volume on the NYSE. Investor sentiment, as seen through the prism of the CBOE Volatility Index (VIX), has already reversed from the fear levels seen following the UK vote. The dramatic plunge in the VIX last week indicates that fear has left the building but the latest surveys from the American Association of Individual Investors and data from Investors Intelligence show no sign that optimism is excessive. Using contrary opinion, we would anticipate that it will likely require new all-term record highs by the popular averages before sentiment becomes problematic. The Presidential election cycle historically makes its presence felt in the September/October timeframe. That is the period when the stock market could become the most vulnerable.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.