With the recent equity market turmoil, many traders and investors are looking for signposts. Is the sell-off contained to equities and VIX-related ETPs or is there a larger market shift underway?

One place to look for clues is in the bond market (roughly twice the size of the global equities market). And more specifically, bond yield spreads.

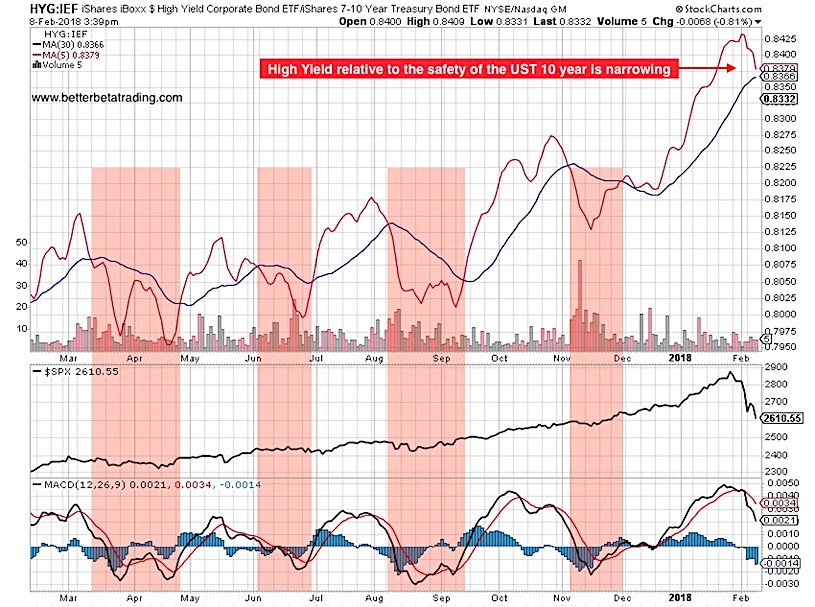

When risk appetites are on, investors seek out the higher yield of riskier corporate debt and ignore the safer but lower yielding Treasuries. When risk is rising, the trend reverses as high yield prices relative to Treasuries drop and traders seek safe havens.

Bond yield spreads as illustrated in the chart below show risk is rising.

We often look at the ratio of HYG (iShares iBoxx $ High Yieid Corp Bond ETF) to IEF (iShares 7-10 Year Treasury Bond ETF) and use a set of moving averages to smooth the trend. As the ratio drops and credit spreads widen, the bond market is signaling that equities may be entering a period of underperformance.

This a ratio to watch as the equities market searches for a durable low…

HYG:IEF – High Yield Corporate Bonds : 7-10 Year Treasury Bonds

Thanks for reading!

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.