The volatility in the biotech space over the last two years has been quite a sight to behold.

I’m not strictly speaking of volatility in terms of downside either. There has been money to be made on both sides of the market for those that have been nimble in their trades.

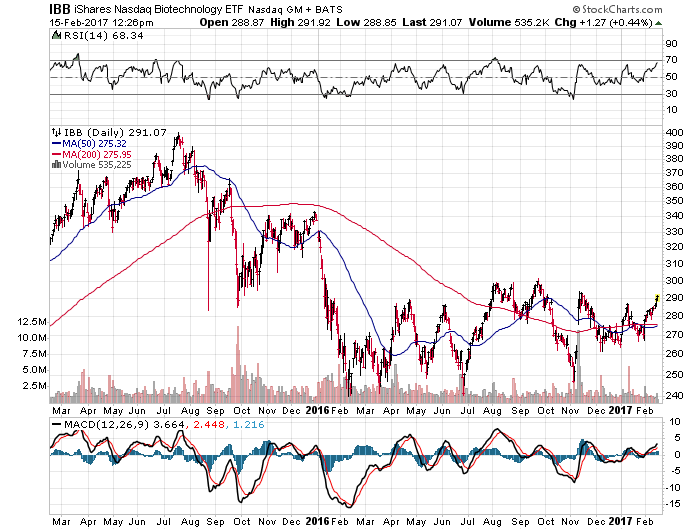

Most ETF investors are probably familiar with trading the iShares NASDAQ Biotechnology ETF (IBB). This market-cap weighted giant has $8.2 billion dedicated to a basket of 164 stocks in the biotech research and medical services fields. As you can see on the chart below, this index has been on a rollercoaster ride of whipsaws in both directions over the last year.

If you have been quick to jump on the dips or sell any rallies, there has been opportunity in this type of environment. However, in my opinion, a healthier looking chart has developed in a different ETF that takes a more level approach.

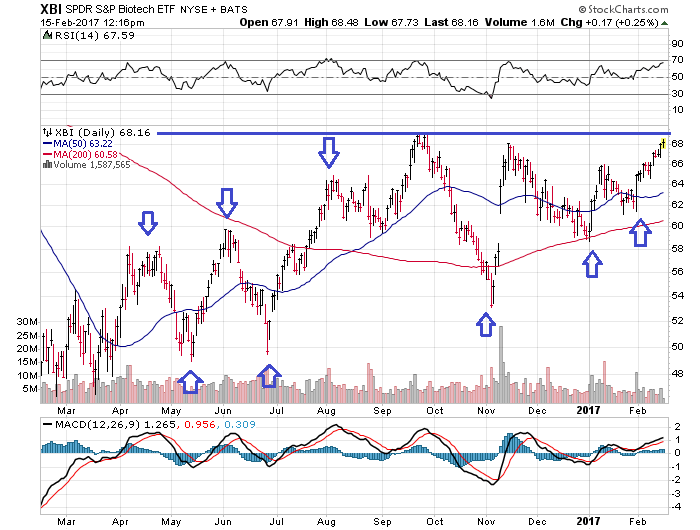

The SPDR S&P Biotech ETF (XBI) tracks 90 U.S. biotech stocks using an equal-weighted methodology. This effectively gives smaller companies a more meaningful contribution to the overall return of the fund. Over the last year, this ETF has experienced a similar series of peaks and valleys. However, it has also developed a more definitive pattern or higher highs and higher lows.

XBI is now nearing its prior 2016 highs which will be a pivotal area to watch. If XBI breaches that resistance level near $69, it would confirm a strong trend is in place with the potential for further highs through the first half of 2017. The previous all-time high in XBI occurred in mid-2015 at the $90 level, so this fund still has quite some ways to go to recapture its former glory.

From a larger standpoint, biotech stocks have been one of the weaker health care industries for some time now. Any additional strength in this area may also help broader sector funds such as the Vanguard Health Care ETF (VHT). This ETF has nearly one quarter of its portfolio dedicated to the biotech group.

Those investors who favor trend following or looking for breakout contenders may be intrigued by the pattern developing in these indexes. It’s certainly worth keeping an eye on if the market decides to undergo another round of sector rotation that favors health care as a catch-up opportunity.

Keep in mind that the potential for prior highs to act as resistance is a very real possibility. Thus, implementing a trailing stop loss or other risk management plan can help mitigate the effects of an ill-timed reversal.

Thanks for reading.

Twitter: @fabiancapital

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.