The following article is a part of my Gone Fishing Newsletter that I provide to fishing club members each week to identify macro inflection points and actionable micro trade set-ups.

I recently wrote an article for See It Market – There’s A Lot Not Priced In – with key macro themes I believe are not priced into the market. Here’s an update on that theme with focus on key economic leading indicators that show more evidence of slowdown.

Recent Data Disappoints

Recent data failed to boost spirits following last week’s barrage of tariff-related developments. Case-Shiller Home Price growth continues to decelerate, Durable Goods Orders dropped, and New Home Sales disappointed (though they did so on the back of robust upward revisions). Complementing this dour mood is the continued inversion of the 10yr – 3month yield curve, which pessimists point out is the San Francisco Fed’s “most reliable [recession] predictor”. Include today’s Dallas Fed Survey, which missed by a whopping 185%, and it’s no surprise to some, the sky appears to be falling. – Macro Intelligence 2 Partners

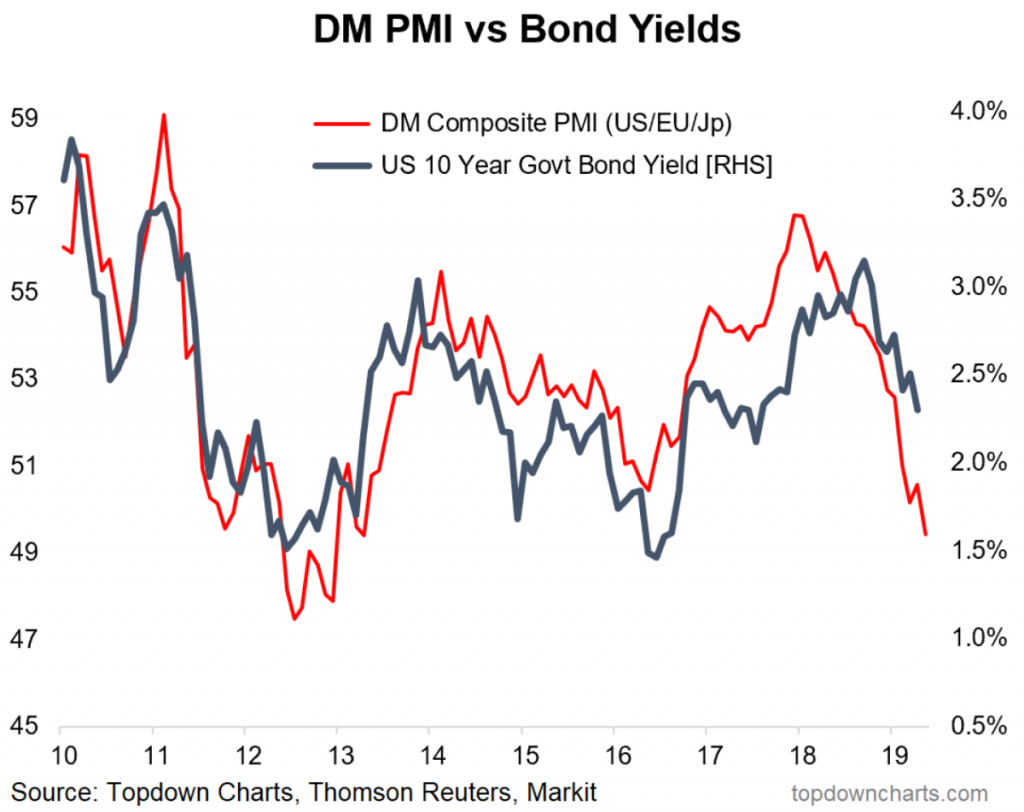

And this was before the Flash May Markit PMI report wherein Services fell to a 39 month low and Manufacturing to a 116 month low – all the way back to September 2009.

Here are a few other alarming Slowdown Trends (sources marked on charts):

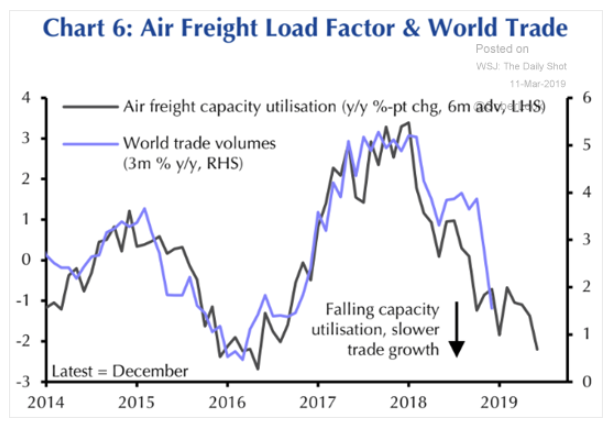

Air Freight Slowdown / World Trade Volume Slowdown

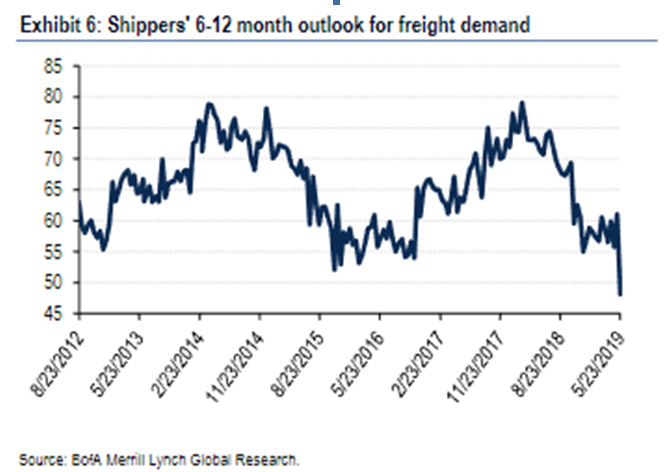

Trucking Slowdown

Global (Developed Market) PMI Slowdown

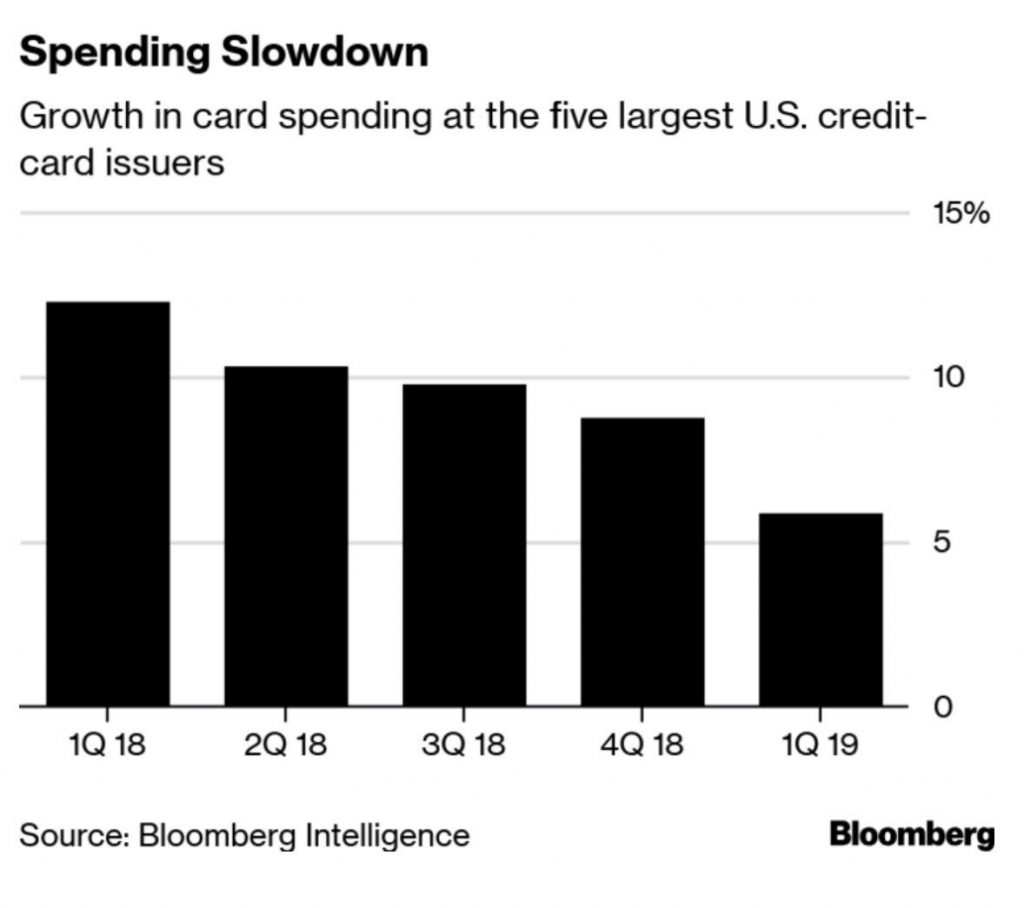

Spending Slowdown

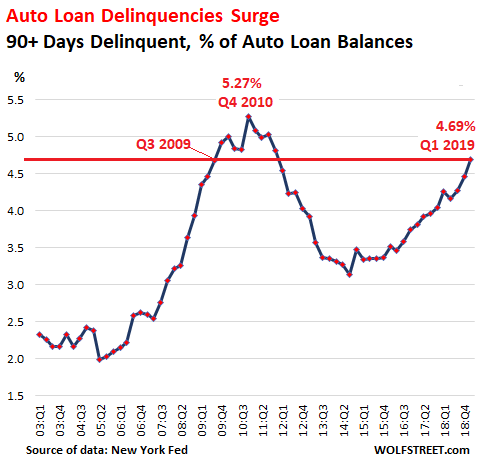

Auto Loan Delinquencies Surge

Auto industry weakness is manifest in three areas of great (recession concern):

- Surging loan delinquencies of 4.7% (see chart above) similar to 2009 and yet occurring against a low rate employment backdrop.

- Alarmingly Auto Loans is the 2nd biggest consumer debt category – $1.28T up 58% from Q1 2008.

- Layoffs in Auto industry are up 207% over last year.

As much as the Trade War can be attributed to slowdown in a number of key areas – World Trade Volumes that impact Freight and Manufacturing Slowdowns; Tariffs that can decrease Consumer Spending and contract Company Profits/Revenues – the Auto Industry weakness as detailed in this RealVision Interview existed before the Trump Tariffs. That points to structural weakness in the US Economy and will compound the growth slowdown that these other indicators are demonstrating, even if the stock market doesn’t know it yet.

Thanks for reading and please consider joining me in the LaDucTrading LIVE Trading Room where I take macro and market-moving news, give it context, and recommend trade ideas from it. For additional education, I provide my LIVE Trade Alerts from Interactive Broker to clients interested in my Value and Momentum stock and option plays.

Twitter: @SamanthaLaDuc @LaDucTrading

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.