Given the great expectations preceding it, market reaction to the release of the June 19th FOMC meeting today added up to a distasteful case of anticlimax with the S&P 500 (Symbol: SPX) finishing up a paltry +.02% to close at 1652. The US Dollar (Symbol: DX) ended up well off yesterday’s multi-year high at 84.96 to 84.23, drifting lower overnight and throughout today’s session; but losing only -0.17% following the 2:00 p.m. ET release.

Given the great expectations preceding it, market reaction to the release of the June 19th FOMC meeting today added up to a distasteful case of anticlimax with the S&P 500 (Symbol: SPX) finishing up a paltry +.02% to close at 1652. The US Dollar (Symbol: DX) ended up well off yesterday’s multi-year high at 84.96 to 84.23, drifting lower overnight and throughout today’s session; but losing only -0.17% following the 2:00 p.m. ET release.

Following delivery of an innocuous speech to the NBER entitled “A Century of U.S. Central Banking: Goals, Frameworks, Accountability” (text here), Chairman Ben Bernanke entertained questions; and delivered the rhetorical coup de grace to any last vestige of incipient hawkishness still carelessly whispered about among Fed watchers.

Recall the last three weeks. On the heels of almost 2 months of “taper” talk, the deceptively daring Bernanke spent his now-customary post-FOMC statement press conference treading into uncharted waters. Elaborating in the Q&A well beyond the policy framing suggested in the statement text, Bernanke didn’t quite seem himself – which is to say he left an indelibly hawkish impression on markets. Stocks fell: the S&P slipped up to 91 points in the June 19 and three subsequent sessions. Treasury yields screamed higher: the 30-year US Treasury Bond (Symbol: TYX) yield added +30bps over the same period. Analysts the world over came believe the FOMC would finally begin removing it’s rehabilitative policy training wheels from the US economy at the FOMC meeting during the idyllic period known as “Septaper”.

Between then and now, a coterie of Fed Presidents have gone to work walking back the “misinterpretation” markets assumed in reaction to Bernanke’s comments. Dallas Fed President Richard Fisher – ever one for a clever turn of phrase – even invoked the visceral image of “feral hogs” (finally giving some long-delayed porcine specificity to Keynes’ animal spirits) to describe the initial market response. In the interim, US equities have resumed their climb, the Greenback reached heights not seen since mid-2010 close to 85; USD-denominated commodities largely slid while UST yields stubbornly budged only slightly.

Incredulous by all accounts, traders and investors peered into today’s minutes looking for clarity only to find a FOMC divided. Some members hawkishly advocating for a taper “late in the year”; while some (note these aren’t exclusive camps) wished to see further improvement in labor market conditions before reining in policy accommodation.

Then everybody went home, oblivious to the carnage (or elation, depending on your positioning) to follow:

Bernanke was simple and direct in his summary disavowal of the market’s (apparent) hawkish misconceptions during the NBER Q&A. The questions were predictable, but didn’t obsequiously cut corners the way as those questions posed during Fed press conferences inevitably do. Here are the highlights:

- The current unemployment rate (7.6%) “overstates” the health of labor markets

- “Highly accommodative monetary policy for the foreseeable future is what’s needed in the U.S. economy”

- 6.5% U-3 (not 7% as some have suggested in recent weeks) is the Fed’s quantitative “threshold” – not “trigger”

- The FOMC intends to maintain a high level of accommodation until “well after” 6.5% U-3 is achieved. Only after this level is attained while the FOMC consider altering course.

- The FOMC has seen “some tightening of financial conditions” that are “emerging risks” and that merit accommodation.

- Bernanke indicates he stated on June 19th and “other places” that if this “tightening” were to threaten attainment of the Fed’s “inflation and employment objectives then [the FOMC] would have to push back against that.”

- Bernanke generally cites “transitory factors” that are at work to keep inflation below the Fed’s 2% target. Subdued inflation also allows for accommodation.

Is anything substantively changed from the June 19th FOMC statement or subsequent press conference? Or is Bernanke merely putting forward the dovish side of the same policy coin he flashed three weeks ago, omitting rather than denouncing the unpalatable hawkish-policy-nuanced taper?

Speculation on this point will be pervasive over the coming weeks – I’m of a firm opinion it’s the latter – but the answer doesn’t really matter. What matters is just the thing Bernanke intimated in his first answer of the afternoon: the Fed speaks to guide market perception and prevent gross mis-alignments between the route policy intends and the one markets take. After weeks of parrying a market offense of advancing treasury yields, volatile equity markets, rising mortgage rates and taper estimates pulled aggressively forward, Bernanke delivered a thoroughly convincing dovish riposte.

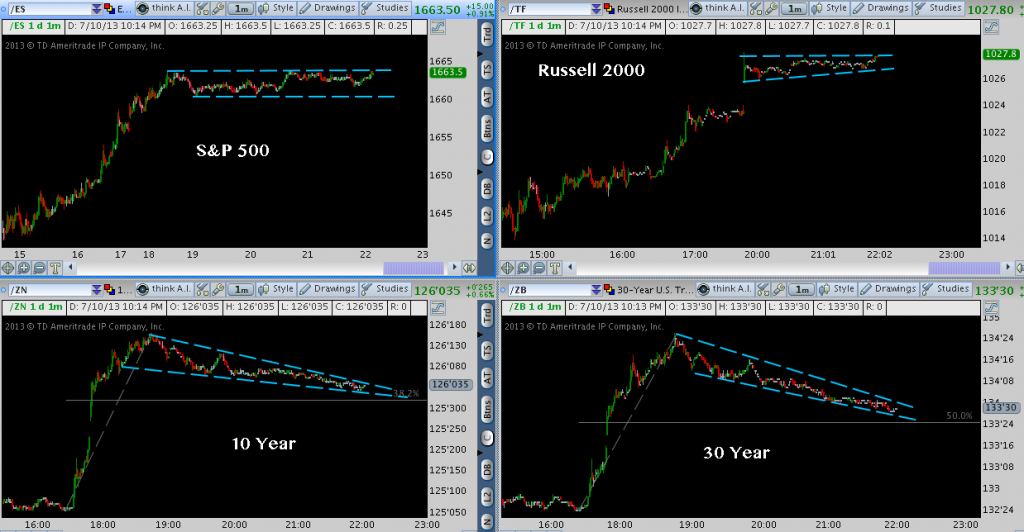

And judging by the market response, convince it did. The US Dollar sank like a stone and every USD-cross bid much higher, though the USD has recover ~40% of its Sydney early AM losses. Inversely, Commodities (Metals more than Energy; Ag mixed) and US Treasuries moved significantly higher (10y up to +0.75%, 30y over +1%) before backing off modestly. No surprise that stocks are comparatively ebulllient: S&P 500 futures (Symbol: ES) are up +0.9% to trade at their overnight highs near 1663. Bernanke, “supportive of asset prices” to the very last.

Stocks & Bonds – 1-Minute (click image to zoom)

Commodities – 1-Minute (click image to zoom)

Currencies (USD Crosses, USD/JPY) – 1-Minute (click image to zoom)

Twitter: @andrewunknown and @seeitmarket

Author holds no position in any securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.