There are a few bank stocks that have risk-reward trading setups that I like here on the pullback.

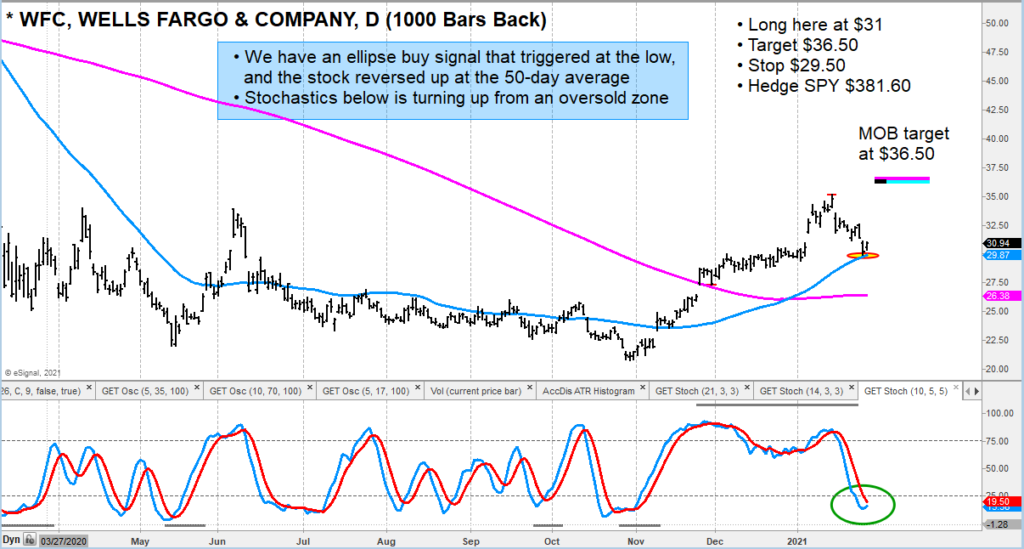

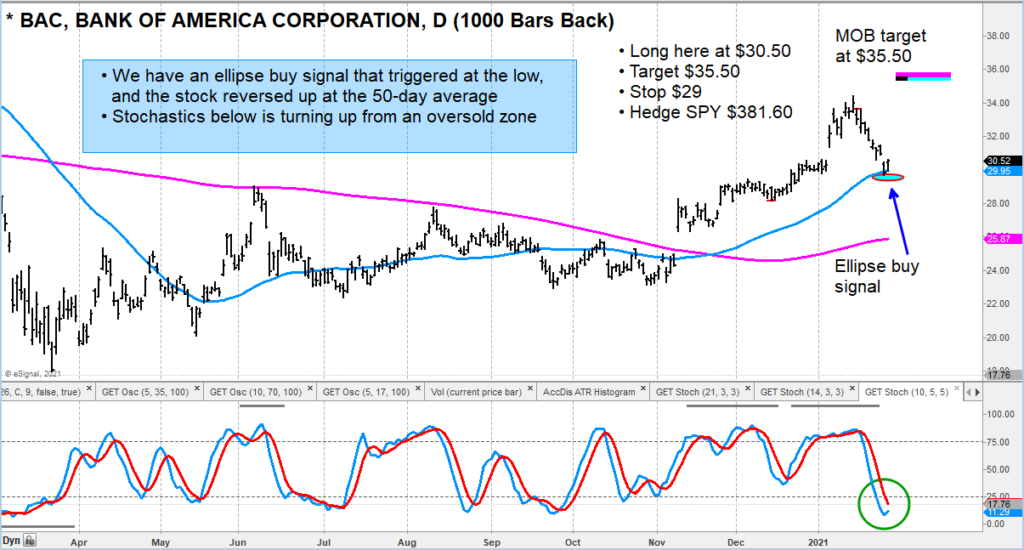

I added starter rating positions in three bank stocks that triggered ellipse reversal buy signals: JP Morgan (JPM), Wells Fargo (WFC), and Bank of Americat (BAC). Note that these are short-term trading signals that allow for a smaller entry with good risk-reward. And in the current environment, these trades will either be stopped out very quickly, or begin to work.

If they are stopped out, I will have to patiently wait for another reversal ellipse buy signal.

As you can see in my notes to myself on the charts, the risk/reward off the recent reversal looks pretty good. Hedgers can use SPY or XLF to balance risk. My stop out (i.e. sell stop) price levels are on charts. These are important as they limit downside in volatile markets.

JP Morgan Stock (JPM) Chart

Wells Fargo Stock (WFC) Chart

Bank of America (BAC) Chart

The author has a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.