Ticker: ASUR

Sector/Industry: Tech – Business Software

Asure Software (NASDAQ:ASUR), an Attractive Small Player in a Booming HCM Market

Asure Software (ASUR) is a $195M cloud-based provider of time and labor management, and workspace management solutions to businesses to control costs. ASUR was founded back in 1985, but reinvented itself in 2016 to adapt to the changing Tech trends. It has 330 employees and over 8,000 clients.

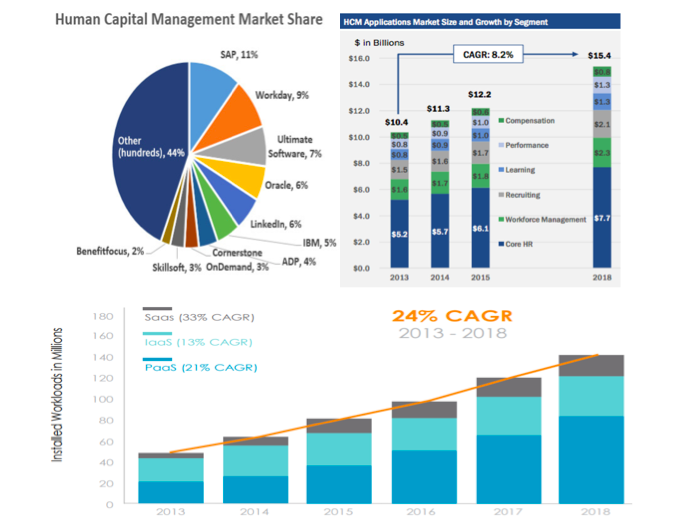

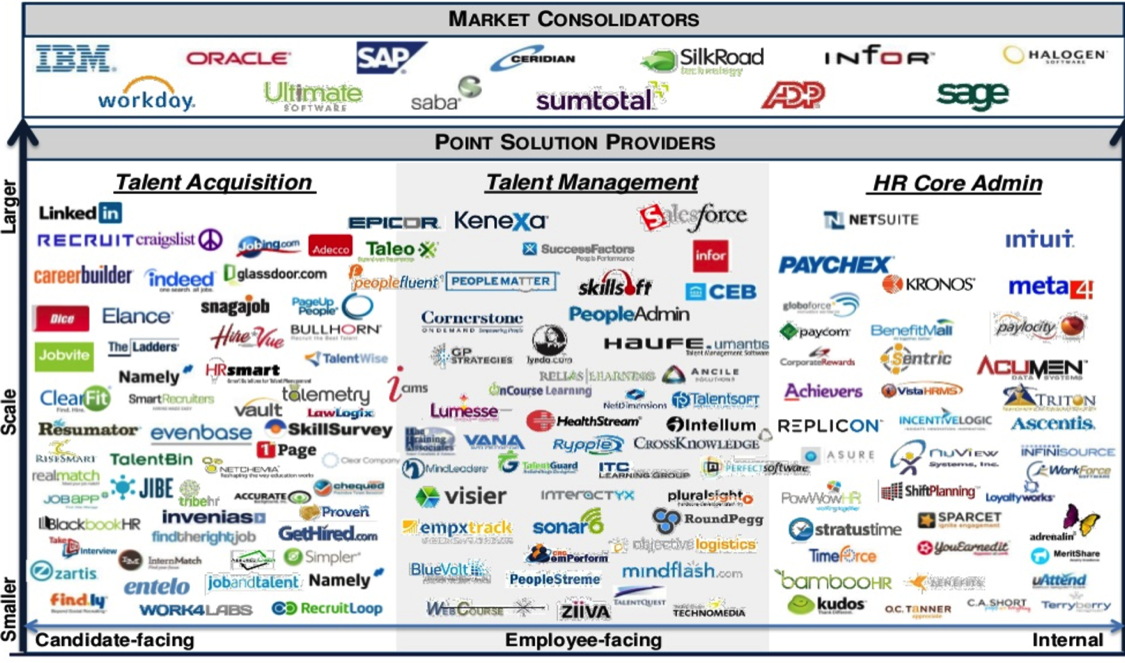

The Human Capital Management (HCM) industry has seen a number of large software players take aim due to the strong growth outlook, and ASUR is a smaller player that created a new category linking traditional HCM with workspace solutions. There are large cap companies like Oracle (NYSE:ORCL), Automatic Data (NASDAQ:ADP), Linked-In (NYSE:LNKD), SAP AG, Workday, IBM, Ultimate Software and Cornerstone On-Demand, but around 52% of the total market remains in the “other” category, highly fragmented leaving significant potential for consolidation.

The Human Capital Management market is expected to grow to $22.5B by 2022 from $14.5B in 2017. Talent management remains a priority for companies and human resources is increasing in complexity due to collaboration, social media and mobility. It is estimated that 22% of the HCM market is seeking new functionality.

Chart Sources: Asure Investor Relations & Jeff Monk / Falvey Partners

The HCM market also is highly predictable with recurring revenues, long-term customer relationships, low economic sensitivity, and the ability to cross-sell products. Asure Software (ASUR) acquired Mangrove Software to give it a full HCM solution and SaaS based products now account for 73% of revenues as its transition is nearly complete. It recently saw 69% Q/Q cloud bookings growth, a 202% Q/Q jump in its sales pipeline, and 46% Q/Q growth in cross-sell opportunities. ASUR wants to capitalize on changing trends in the workplace with being able to work from anywhere, its software helping organizations manage people and space for a mobile, digital, multi-generational and global organization.

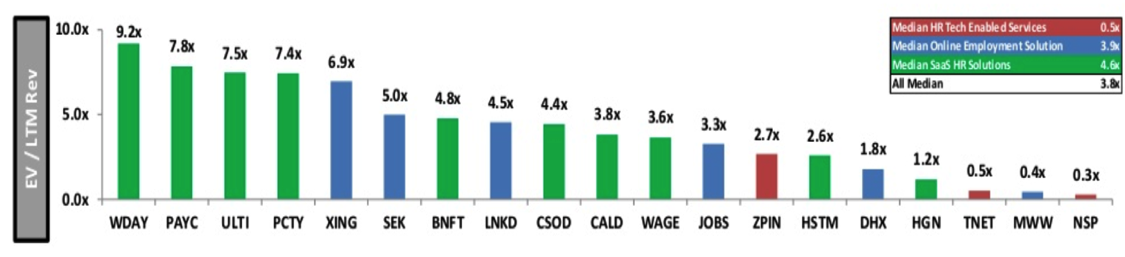

ASUR has just 12.1M outstanding shares and the CEO owns 7.99% while the Chairman of the Board owns 5.48%. ASUR trades 17.45X Earnings and 3.3X FY18 EV/Sales, which makes valuation attractive to peers considering its 50% revenue growth target in 2017 and another 25% next year. Gross Margins at 77.3% in Q1 rose from 74.3% the year prior, and EBITDA rose 300% Y/Y. Recurring revenues as a % of total increased to 85% vs. 73% in the prior quarter. ASUR has expanded its sales infrastructure, now with 40 reps, and in Q1 won business from P&G, Merck, and Pfizer.

In closing, Asure Software is a transforming company that is growing its metrics rapidly while being a small player in a large and growing industry, but still able to win deals from top tier customers. Shares feel around 30% undervalued at current levels, and the longer term opportunity is even greater, while the potential for consolidation makes it an intriguing acquisition target as well.

Chart Source: Asure Investor Relations & Jeff Monk / Falvey Partners

Check out more of my investing research and options trading ideas over at OptionsHawk. Thanks for reading.

Twitter: @OptionsHawk

The author does not have a position in the mentioned security at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.