The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Executive Summary

- That’s a wrap on Q4 earnings season – EPS growth closed at 31.4%

- Next earnings season will begin with the banks the week of April 11, currently EPS growth slated to come in at 4.8%, revenues at 10.4%

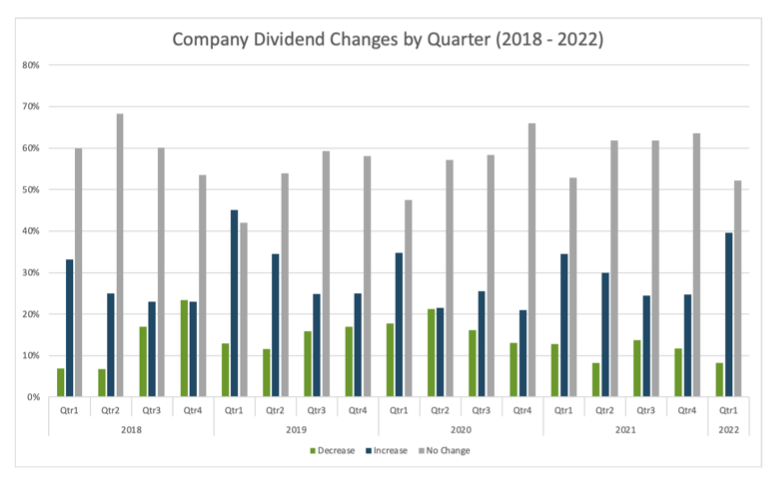

- Percentage of companies increasing dividends at the highest level in 3 years

- Still a few names trickling in this week, specifically retail (TDUP, POSH, SFIX, ULTA, FOSL, EXPR, DKS) and tech (DOCU, SQSP, BMBL, MDB, ORCL)

- Potential surprise next week: Vail Resorts (MTN)

- Q1 2022 reporting kicks off the week of April 11

That’s a Wrap – Q4 Earnings Season

With 99% of S&P 500 companies having reported for Q4 2020, earnings season is more-or-less over. The quarter ends with S&P 500 EPS growth of 31.4% and revenue growth of 16.1%. Profit growth leaders included Energy, Materials and Industrials, while Financials, Consumer Staples and Utilities lagged. (Data from FactSet)

A Look Ahead

After enjoying four consecutive quarters of double digit earnings growth above 30%, investors are grappling with the reality that expectations for the first half of 2022 are in the single digits (4.8% for Q1, 8.6% for CY 2022)*. This partially has to do with difficult comparisons from 2021, with certain quarters posting the highest growth rates in over a decade, but also with headwinds such as higher costs which was the #1 concern mentioned on calls this season. *Data from FactSet

While inflation remained a big concern for corporations in Q4 reports, it didn’t stop many companies from being able to pass those higher costs onto consumers. The outlook for 2022 has remained relatively stable since the beginning of the year, based on the assumption that consumers will continue to absorb higher prices. However, if demand starts to wane, or companies have to handle those higher costs, that outlook could change.

Exacerbating inflation concerns is the Russia-Ukraine crisis which is starting to be mentioned more heavily on quarterly calls, specifically by retailers. When Victoria’s Secret reported last week they warned how an extended conflict could weigh on results in Q1, while others such as American Eagle and Kohl’s have noted that the uncertainty presented by the crisis is something they are taking into consideration when providing 2022 forecasts.

Another looming concern has been interest rates. Just a week ago a 50bp hike in March seemed completely probable, with the CME FedWatch tool showing a 33.7% chance of that happening. Now that probability is down to 0% after Russia’s invasion of Ukraine. Even Federal Chairman Jerome Powell has started to walk back aggressive tightening talk and use language that suggested a quarter-point rate hike might be more reasonable, and that the Fed would move “carefully” on future rate hikes.

Highest Percentage of Companies Increasing Dividends in 3 Years

Despite headwinds such as inflation and supply chain disruptions which were heavily mentioned on Q4 calls, that didn’t stop companies from increasing dividends. Of the 2,737 dividend announcements we tracked in the first quarter, 40% were increases, the highest percentage since Q1 2019 during which 45% were increases. Another 8% were decreases, while 52% remained unchanged. This shows companies were feeling confident in their cash position, and therefore returning value to shareholders.

Source: Wall Street Horizon

Reporting next week:

As Q4 earnings season continues to wind down, there are still a few names, mainly within tech and retail, trickling in this week.

Source: Wall Street HorizonPotential Surprises next Week

Vail Resorts (MTN)

Company Confirmed Report Date: Monday, March 14, AMC

Projected Report Date (based on historical data): Thursday, March 10

Z-Score: 3.17

Since 2007, Vail Resorts has reported fiscal Q2 earnings results in a range from March 6 – 11, with no day of the week trend. As such we set a report date of March 10. On February 22 the company confirmed they would report on March 14, four days later than we had anticipated based on their historical reporting range, suggesting there may be bad news shared on the upcoming call.

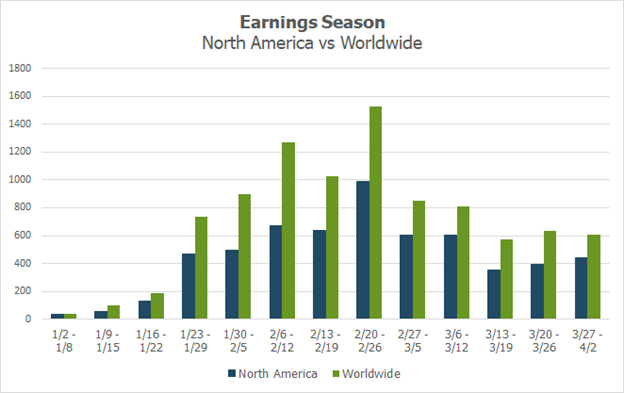

Earnings Season Coming to an End

Over the next few weeks some Q4 stragglers will continue to trickle in, with the Q1 season not scheduled to start until the week of April 11. Peak weeks for Q1 are from April 24 – May 14.

Source: Wall Street Horizon

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort