Tuesday is off and running and market participants are in a read and react mode. The bounce is still in motion but there’s plenty of time to see how this plays out. And plenty of variables to watch.

The latest economic data: Empire Manufacturing is showing a large beat at 25 vs 10 expected. Retail sales also coming in positive: 0.6% vs 0.3%; Ex Autos 0.5% vs 0.3%.

Today’s Market Movers: US Dollar, Yields, and Crude Oil

The S&P 500 (INDEXSP:.INX) is attempting its 3rd day of gains, while most of the safe havens continue to be sold. We’re seeing meaningful moves in Treasuries and the US Dollar Index (CURRENCY:USD) with yields moving back up to 2.25 and the dollar breaking above a short-term trend line.

This action has seen Crude Oil and Gold (NYSEARCA:GLD) weakening (and commodities overall). Crude dipping under 47 looks like a technical breakdown of the one-month trend (but much will depend on the close).

The trend in equities at this point has improved a bit, but still not safe to think new highs are imminent. There’s some evidence of an hourly negative divergence using RSI for S&P 500 futures. Financials will be important given the breakdown late last week… and despite the snapback in the S&P 500, financials remain under pressure. The S&P 500 area to sell today for traders lies near 2472-3, then 2480-2, while on downside the pivots are at 2457, then 2447.

Three charts I’m watching:

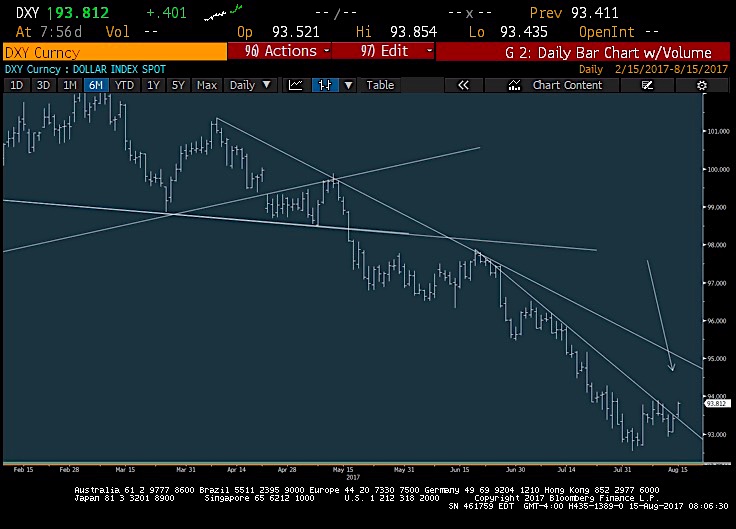

US Dollar Index – We’re seeing a decent pop in the US Dollar index with commodities turning back lower and safe havens weakening. A move back to 95.50 looks possible.

10-Year US Treasury Yield – Treasury yields are also starting to lift… key resistance on the 10-year lies just above at 2.28. For now, the downtrend is still intact.

CCI Commodity Index – Commodities are starting to roll over with the US Dollar Index and 10-Year yield advancing. Crude oil is slipping under trendline support. Commodities in the short run still looking a bit lower.

Thanks for reading and good luck out there.

If you are an institutional investor and have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.