Uncertainty is mounting as the new omicron covid variant adds to economic concerns like inflation.

This week, I shared an article looking at potential topping formations on the Transportation Sector (IYT) and small cap Russell 2000 Index (IWM).

Here we revisit these charts and topping formation, while introducing another potential warning sign.

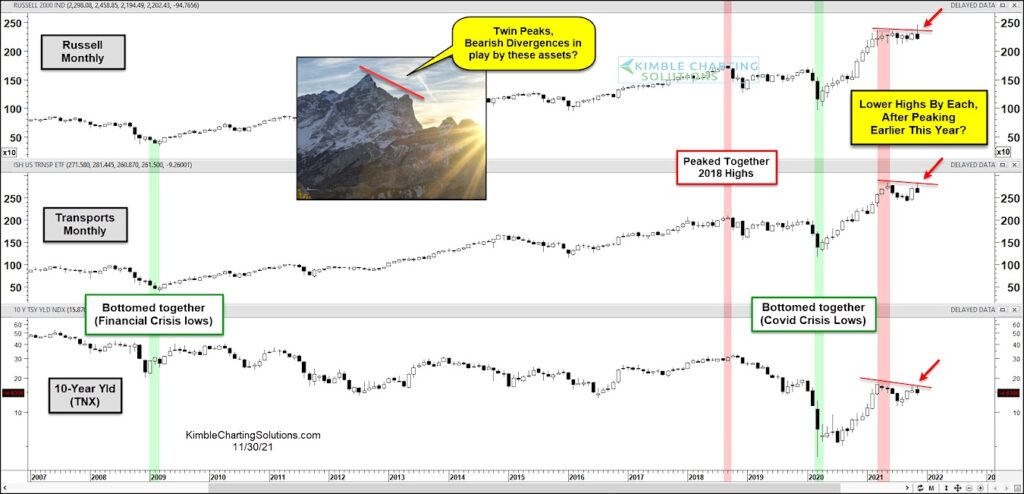

As you can see in today’s chart 3-pack, we added the 10-Year US Treasury Yield to the mix. In 2018, yields, transports, and small caps peaked at the same time. Then in 2020 they bottomed together during the covid crisis.

Twin Peaks once again?

Could this trio be topping again in 2021? Bearish divergences (lower highs) have emerged and offer the potential for more downside. In my humble opinion, bulls better step up and turn this situation around… and soon! Stay tuned!

Note that KimbleCharting is offering a 2 week Free trial to See It Market readers. Just send me an email to services@kimblechartingsolutions.com for details to get set up.

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.