The featured chart today draws inspiration from some of the charts and themes I shared in last week’s S&P 500 ChartStorm.

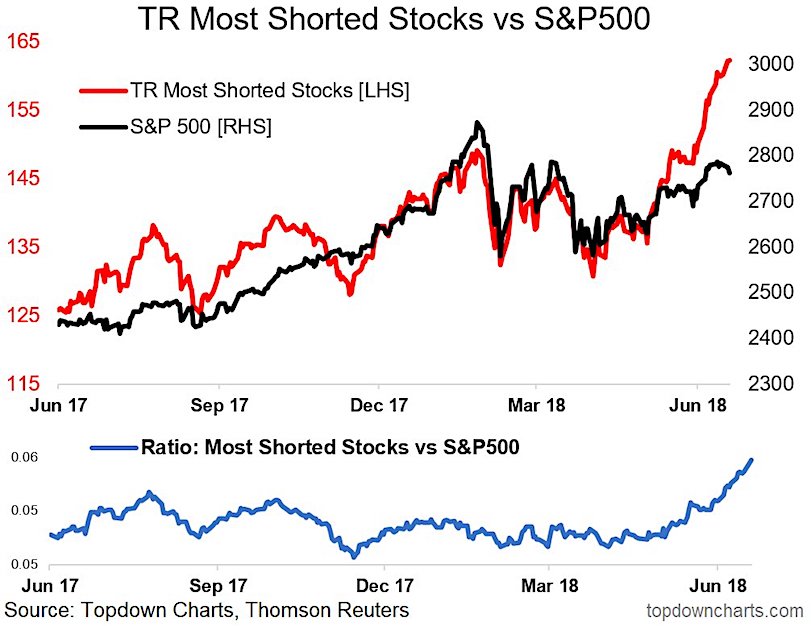

It shows the Thomson Reuters “Most Shorted Stocks” index vs the S&P 500 (as well as the performance ratio between the two).

When you see the “most shorted stocks index” materially outperforming vs the broader index you can draw one key conclusion: shorts are getting squeezed.

Basically what happens in a short squeeze is you get a rush to cover short positions as bears get caught wrong-footed.

So you can basically say that much of the recent rally was driven by short-covering.

However, as I’ve noted elsewhere there are a few macro undercurrents that are preventing the S&P500 itself from heading unrestrainedly higher, and this is creating a series of winners (e.g. US small caps) and losers (e.g. emerging markets).

Twitter: @Callum_Thomas

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.