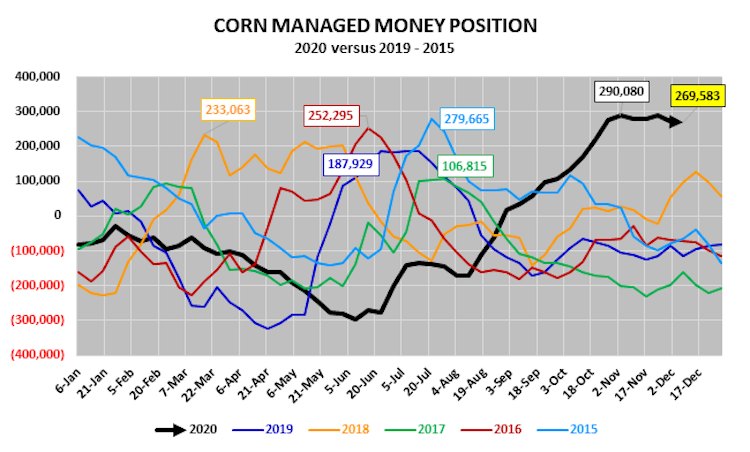

The latest Commitment of Traders Report showed the Managed Money long in corn at +269,585 contracts as of the market closes on December 8th. And although this was down slightly week-on-week, it still exceeded the calendar year Managed Money highs for all but 2015 when comparing it to the 2015 – 2019 timeframe.

Furthermore the current figure remains more than twice as large any net long position Money Managers have held in Corn during November-December since 2015 and is also less than 10,000 contracts below the maximum length held in the “2012 drought year” for that comparative 2-month window (2012/13 was synonymous with 821 million bushel U.S. corn ending stocks and a 7.4% stocks-to-use ratio).

That said, many Corn Bulls still remain unflinching in their current market bias, touting a record 2020/21 U.S. corn export projection of 2.650 billion bushels, record Chinese corn import demand of 16.5 MMT, as well as the possibility of yet another cut to the 2020/21 U.S. corn yield in the upcoming January WASDE report (yield down 6 bpa since August).

In the bulls’ opinion these are all justifiable reasons for March corn futures to continue tracking higher.

However, this begs the all-important question: “Will the Money continue to chase new corn longs with March 2021 corn futures already having challenged the $4.40 price level back on November 30th, 2020 and failed?”

Considering once again the size of their current position, as well as the fact the last time March corn futures traded above $4.40 per bushel this late in the marketing year was December 2013 and January 2014, I remain less than convinced.

Keep in mind, at that time, to generate +$4.40 per bushel the U.S. corn balance sheet offered 2013/14 U.S. corn ending stocks of 1.232 billion bushels and a stocks-to-use ratio of 9.2%. This was and is much tighter than the current view of 1.702 billion bushels and 11.5%. Ultimately, Money Managers will likely need to be fed another wave of “Bullish” news in the January WASDE report to defend adding to their current net corn long of +269,585 contracts. And while that could come in the form of outside influences, i.e. January 2021 soybeans futures finally breaking through strong price resistance at $12.00 per bushel and/or continued weakness in the U.S. Dollar Index (currently trading at its lowest level since April 2018); I don’t currently see it coming solely from the U.S. corn S&D makeup.

I am confident $4.50 March corn will require additional Managed Money participation. It will be the market’s job over the next 4-weeks to define just why they should add to what is already a historically large position.

Twitter: @MarcusLudtke

Author hedges corn futures and may have a position at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.