I’ll start today with my thoughts on the Retail Sector ETF (XRT) as we ended last week:

“For Granny Retail XRT we first want to see her hold the 200-WMA at around 71.00. But until she makes her way back over 74.50 area, we are cautious on equities.”

Even after a decent retail sales number first thing Monday morning, XRT still struggled to stay green.

Perhaps that was the peak of spending.

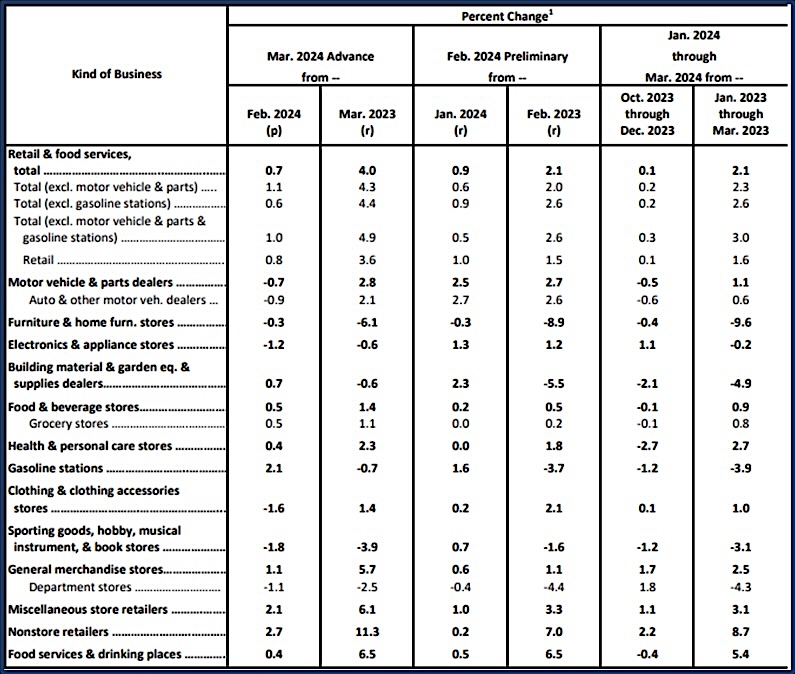

Plus, if you look carefully, the spending was limited to only a few areas of the economy.

Spending for motor vehicles, furniture, electronics, clothing, and sporting goods all declined.

Gasoline stations surged 2.1% and grocery stores +0.5%.

Health and personal care stores-the whole Vanity trade theory rose.

Nonetheless, with the 200-week moving average looming at around 71.00-has the consumer finally had it?

The weekly chart shows the support at the 200-week moving average or around 71.00.

What happens if that level of support breaks?

The next likely target is around 67.00 or right where the 50-week moving average (WMA) now sits.

That area also matches the January low.

Interestingly, with the 200-WMA above the 50-WMA, the Retail Sector (XRT) never went out of an accumulation phase into a bullish phase.

In other words, the consumer has been ok, but not nearly as robust to say BULLISH!

At this point, headlines on geopolitics are taking center stage as far as price movements go.

What we hope for is that XRT can hold current levels and we can go back to watching for buys in companies related to our vanity trade:

Drug companies like Novo-Nordisk

Personal skin care companies like AbbVie

Makeup companies like ELF

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.