Apple (AAPL) soared 5% on Wednesday, after posting earnings that beat Wall Street expectations.

CEO Tim Cook pointed to improved services revenue and to Chinese growth prospects.

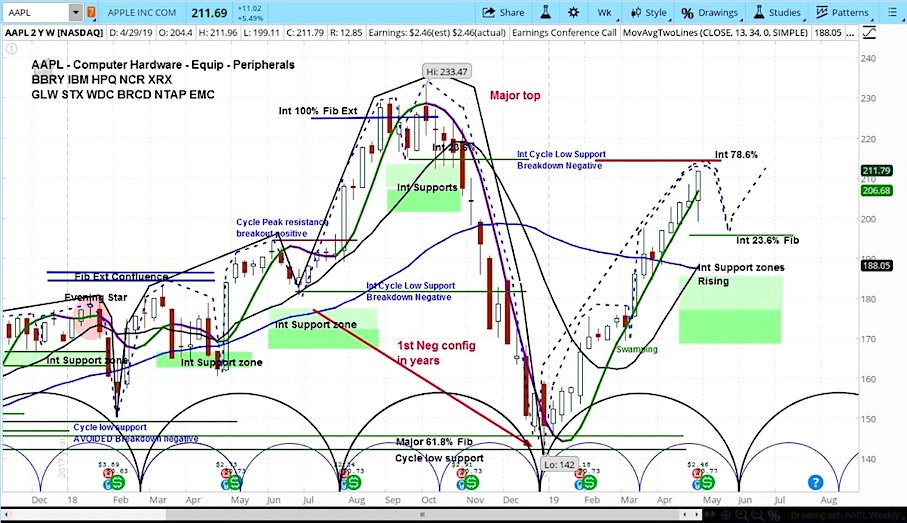

However, the stock is now late it its intermediate cycle and is due for a minor correction.

The company reported earnings per share of $2.46 and total revenue of $58 billion, compared to analyst estimates of $2.37 and $57.6 billion. Management’s guidance for the coming quarter was in the range of $52.5-54.5 billion, above the average estimate of $51.9 billion.

Tim Cook was upbeat about Apple’s prospects in China, “I believe that the tone of the trade relationship is much better today than it was in the November-December time frame. That affects consumer confidence in a positive way,”

In analyzing the market cycles for AAPL, we can see that the stock is still in the rising phase of its current cycle. However, we are now late in this cycle and are likely due for a correction. Our support zone for this dip starts around the $195 area.

Apple (AAPL) Stock Weekly Chart

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.