In previous posts on Apple, Inc (NASDAQ:AAPL) I’ve focused on the weekly chart and the use of the 40 week moving average (MA), which I believe, to be a very good tool for trend following.

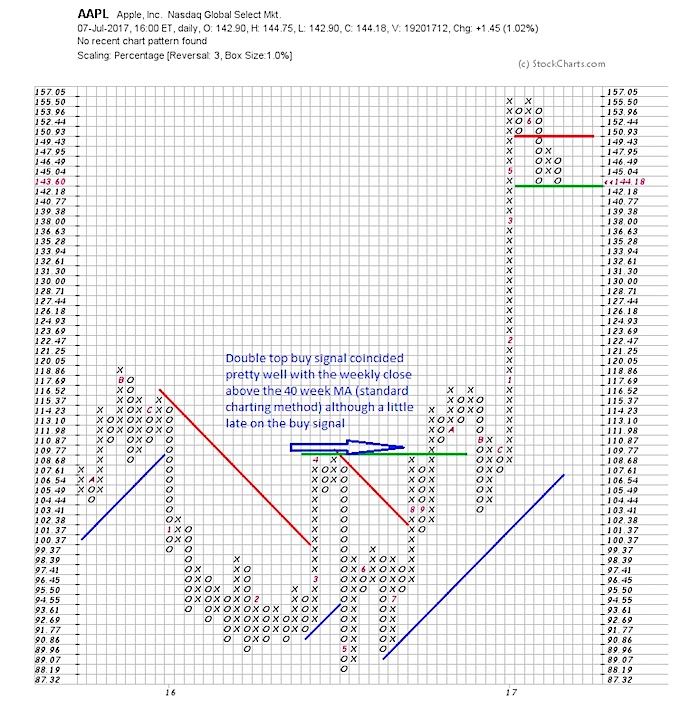

As many of you know, I also have a deep appreciation for point and figure charts. So as Apple’s stock price has been above its 40 week MA for almost one year, I thought checking in on an AAPL point and figure chart would be interesting for active investors.

You should be able to follow along with some brief notes on the chart itself.

Apple, Inc. (AAPL): What’s Point & Figure Saying?

First a brief recap…

What I find interesting is the double top buy signal generated in September of 2016. Yes, it came later than the close above the 40 week MA in July of last year, but you can notice it came at an important resistance level and after building a solid bottoming pattern. We can see the first Point & Figure sell signal came in October that same year, however after signaling several double top buy signals and also above the trend line. The point being: AAPL was still in an uptrend.

More recently, we see AAPL has generated a double bottom sell signal (highlighted with red horizontal) this past June, although after a strong move higher that can be seen by the single column of X’s proceeding that signal. That area where the sell signal was generated will act as resistance with any move higher. As of the writing of this post, AAPL is sitting at support and a 142.18 print will generate a double bottom sell signal.

Big picture: AAPL is still in an uptrend. However, another sell signal here before moving higher, could offer foresight that shares of Apple are losing steam and the trend may be nearing to an end.

Thanks for reading.

Twitter: @Snyder_Karl

The author may have a position in related securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.