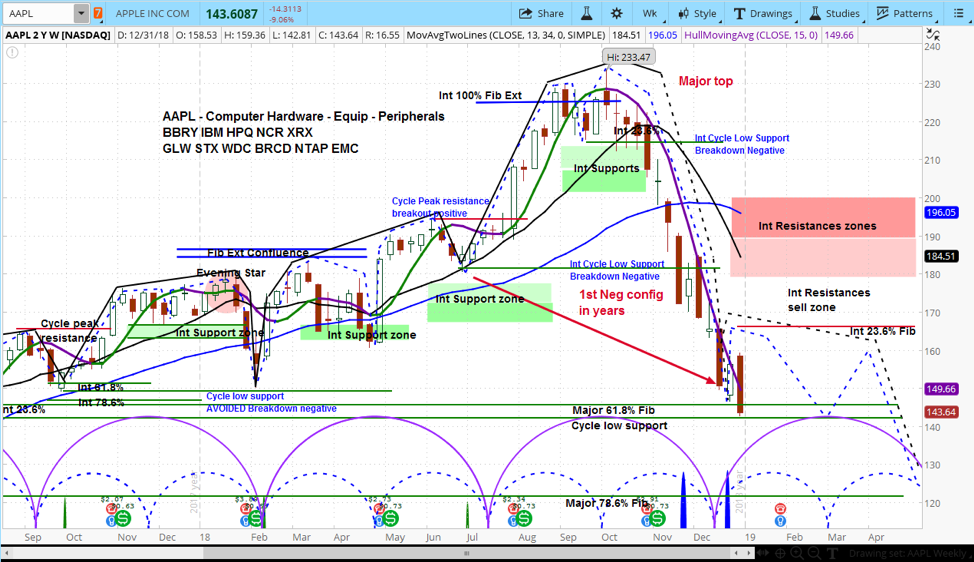

$AAPL – Apple Stock Weekly Chart

Apple’s stock price tanked on Friday morning, as AAPL traded 9% lower, after revising sales estimates for the holiday quarter.

Based on its market cycles, we see support at the current levels. However, Apple stock is facing downside risk in the intermediate term – see chart above.

The company cut its revenue forecast for the quarter just ended to $84 billion from its range of $89-$93 billion. This makes revenue lower than the $88 billion of the quarter one year ago. CEO Tim Cook pointed to weak demand in emerging markets, as well as the trade war with China.

Cook further explained that, “We’re not going to sit around waiting for the (macroeconomic conditions) to change. We’re going to focus on the things that we can control.” For example, he pointed to encouraging customers to upgrade through better marketing of their trade-in program.

In analyzing the market cycles for Apple stock (AAPL), we believe it had been trying to find an intermediate bottom. The weakness from this news suggests rebound attempts will be short-lived as this declining phase extended in time and price.

Apple stock could hold support around $142, temporarily, on high-volume capitulation. However, we see the intermediate downside risk to around $120 in May.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.