In our last post on treasury bonds, we looked at the short (NYSEARCA: TBT) and long (NASDAQ: TLT) treasury bonds ETFs.

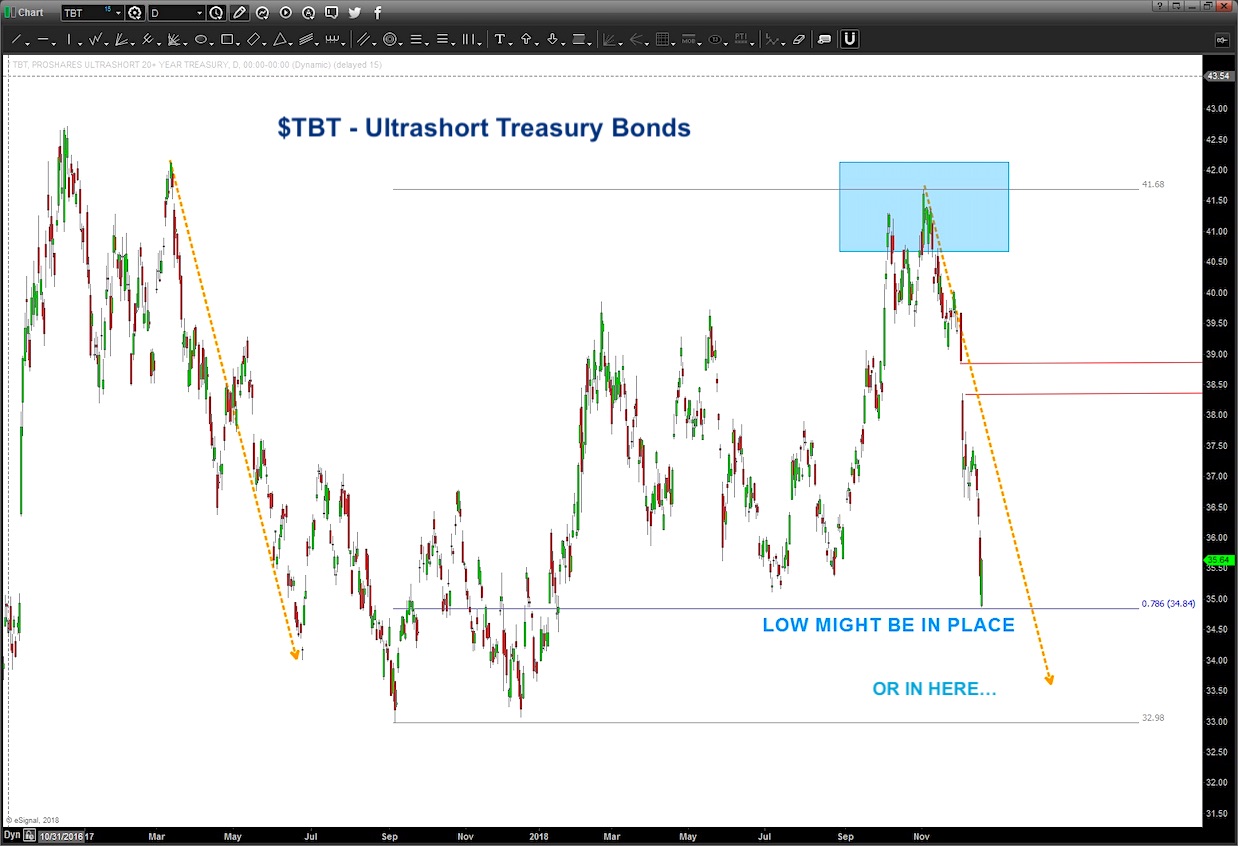

We focused on the ultra short treasury bonds (TBT) and highlighted key resistance targets. Those targets held and we have seen several weeks of decline for the TBT.

On the flip side, we have seen gains in the long treasury bonds ETF (TLT). For additional color on TLT, just comment below or message me on Twitter.

Let’s look at the TBT chart below for an update. Note that the ultra short treasury bonds index is a 2x ETF and is like being long interest rates (traders want the price of bonds to go down, and yields higher). The opposite is happening right now, so traders need to be very careful with timing and sizing (in small increments).

While the 36 area did provide a modicum of support, TBT has moved lower. And, as of the close on 12/20/18, it has held important support.

The 33.50 area is also important support. Over the next couple days/weeks, I’ll be looking to get LONG TBT (long interest rates) with either a “weekly” signal reversal candle (close above the 36-36.50 gap area) or a buy pattern that emerges on a smaller intraday trading time frame. I will be using very small position sizing to start (this is not a market for the faint of heart).

As shown below, we have a formidable gap in and around 38.40-39.00 which if exceeded on a weekly close could propel the TBT to move strongly higher, in my opinion. So a move over 39 could be confirmation.

Thanks for reading and congrats to Andy Nyquist and all the contributors for helping @seeitmarket pass 30,000 followers in Twitter!

Be sure to check out my unique analysis of stocks, commodities, currencies over at Bart’s Charts. Stay tuned and thanks for reading.

Twitter: @BartsCharts

Author does not have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.