The equity market ended one of the most volatile weeks in history last week with the Dow Industrials losing 10% and the S&P 500 Index losing nearly 9%.

All three major indexes entered bear market territory after the World Health Organization deemed the coronavirus a pandemic and oil prices saw their biggest one-day decline since 1991.

The losses would have been significantly larger were it not for a sensational 10% rally in the final hour of trading on Friday, triggered by remarks from the President declaring a national emergency which, among other things, freed up another $50 billion in financial assistance to state and local governments to address the health crisis and the most vulnerable segments of the economy.

Additionally, a partnership was formed between the Federal Government and the private sector in an effort to take bold measures to get ahead of the economic disruptions caused by this virus.

The Federal Reserve and other central banks have pledged widespread stimulus efforts.

The Federal Reserve on Sunday cut rates by 125 basis points to a target range of 0-.25% and launched a massive $700 billion quantitative easing to offset the negative impact of the coronavirus. It also slashed the rate of emergency lending at the discount window for banks by 125 basis points to .25% and lengthened the term of loans to 90 days.

Next week we will hear from Congress on additional funding measures as well as from the European Union on a coordinated global stimulus package. The question remains can central banks and governments place a floor under the economy and the stock market.

How slow will the economy become?

We don’t yet have hard evidence of the overall influence of the coronavirus on the economy. There remain many unknowns, including how many people have contracted the virus, so it is difficult to predict economic outcomes.

History teaches us that epidemics tend to have temporary effects on economies and markets. Nevertheless, temporary shocks can lead to bankruptcies, rising unemployment and other adverse effects on the economy before it bounces back. We could have a first- and second-quarter drop in GDP with pent-up demand coming back to produce a solid second half or we could see more economic challenges ahead.

When to turn bullish?

The key to a recovery in the markets depends in large part on the duration of this virus which, at this point, we do not know. If the pandemic is brought under control, pent-up demand combined with low interest rates will likely put the economy back on track. Brian Skorney, Biotechnology analyst at Baird states, “If you think we can bottom when we reach peak U.S. deaths, I would say that is at least a month away, more likely in May though.” If we find out that the virus rate is higher and the duration drags on, we can expect more short-term volatility.

Wait for the technical indicators to offer the all-clear signal.

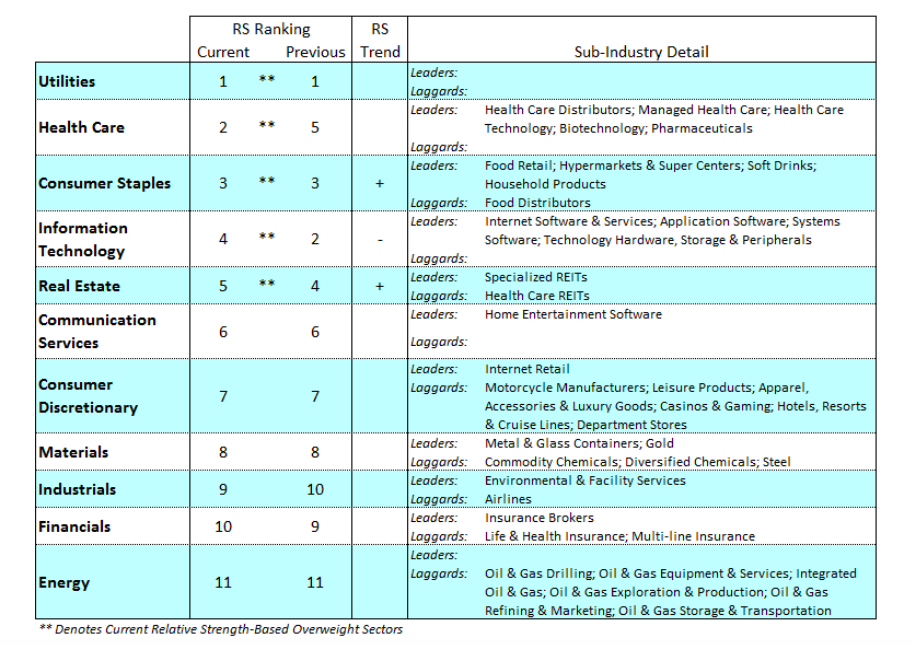

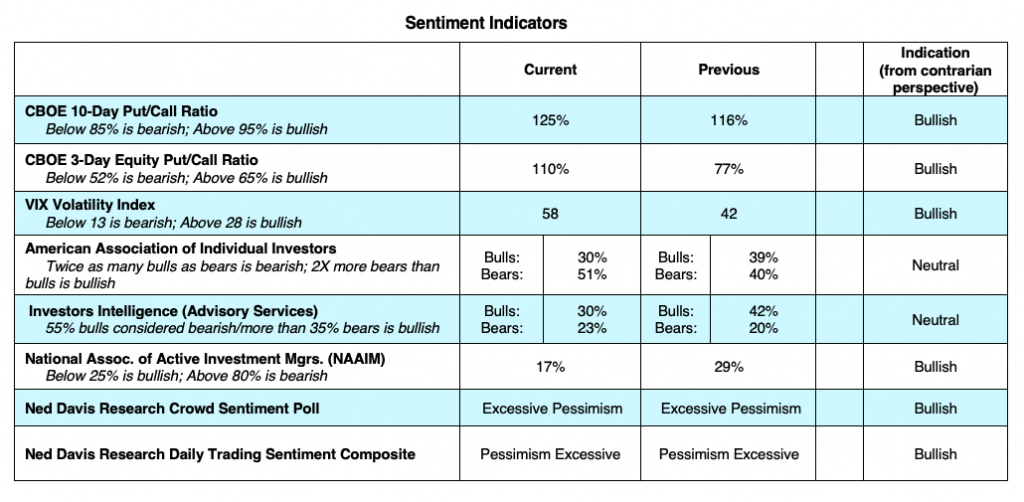

Last week’s stock market offered the first indication that the bottoming process could be underway. There were signs of a selling climax when the S&P 500 dipped below 2500 with sentiment indicators pointing to extreme pessimism, which from a contrarian perspective, is a bullish element. For the bottoming process to unfold, look for a retest of the lows with overall volume contracting and fewer stocks making new 52-week lows followed by a broad-based rally with upside volume overwhelming downside volume suggesting momentum has reverted back to the upside.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.