Investing Outlook Highlights:

- Fed Strikes a Dovish Tone for Now

- Animal Spirits at Risk of Evaporating

- Earnings Beat Rates Turning Lower

- Optimism Emerging After Evidence of Panic

- Seasonal Strength Being Challenged

- Breadth Thrusts Not Being Followed by Better Trends

When stocks are declining, large prices moves are discussed in terms of seeing “increased volatility” but when prices rebound by a similar degree such language is usually discarded. In reality, it is two sides of the same coin.

In the current case, the sharp rebound in stock prices in January (the S&P 500 rallied nearly 8%) was largely a function of the even larger decline seen in December (when the S&P 500 fell 9%).

Longer-term trends can provide context at a time when day-to-day price moves can appear dizzying. The S&P 500 spent all of January inside of the bounds established in December (a so-called “inside month”).

As welcome and impressive as the January gains were, it would be premature to conclude that the longer-term trend has shifted. Rather, stocks appear to have enjoyed a sentiment-fueled bounce rather than rallying on evidence of fundamental improvement.

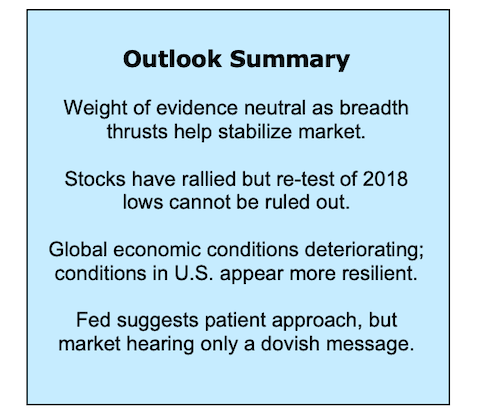

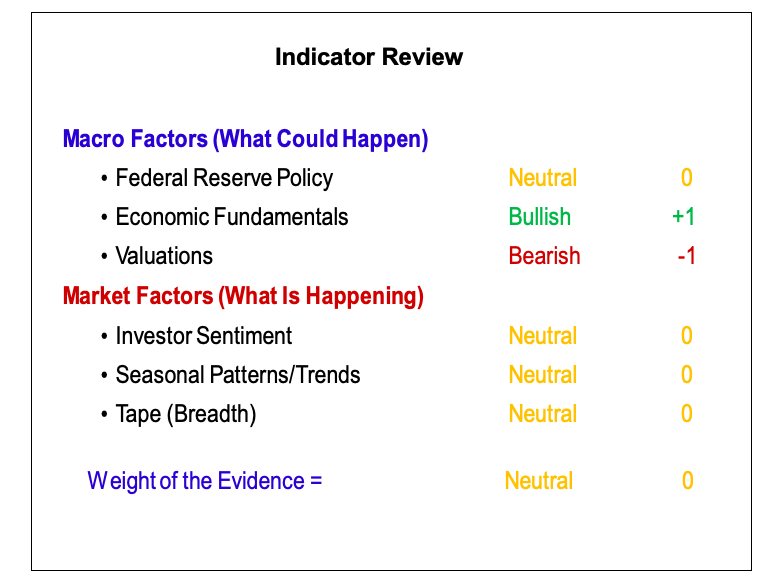

The weight of the evidence moved to neutral in early January after finishing 2018 with a message of caution. While the weight of the evidence has improved, the evidence in hand does not allow us to conclude that the cyclical bear market has run its course.In the wake of the nearly straight line move off of the December lows, more time and testing will be needed to determine whether the rally has been a prelude to a meaningful re-test or the first leg higher in a new cyclical bull market.

The weekly chart for the S&P 500 puts some of the recent price moves in context. The January price rally has brought the index back into a support/resistance range that had been intact prior to the December weakness. Price swings within this range can likely be discounted as noise, while moves outside of the range (above 2800 or below 2600) could provide more meaningful evidence of the underlying trend. Importantly, the trends from both a momentum and overbought/oversold perspective remain consistent with an ongoing cyclical bear market. The divergences that emerged over the course of 2018 have not been resolved.

The lack of positive divergences from a momentum and breadth perspective at the December lows suggest it is more likely than not that the S&P 500 could re-test its December lows.

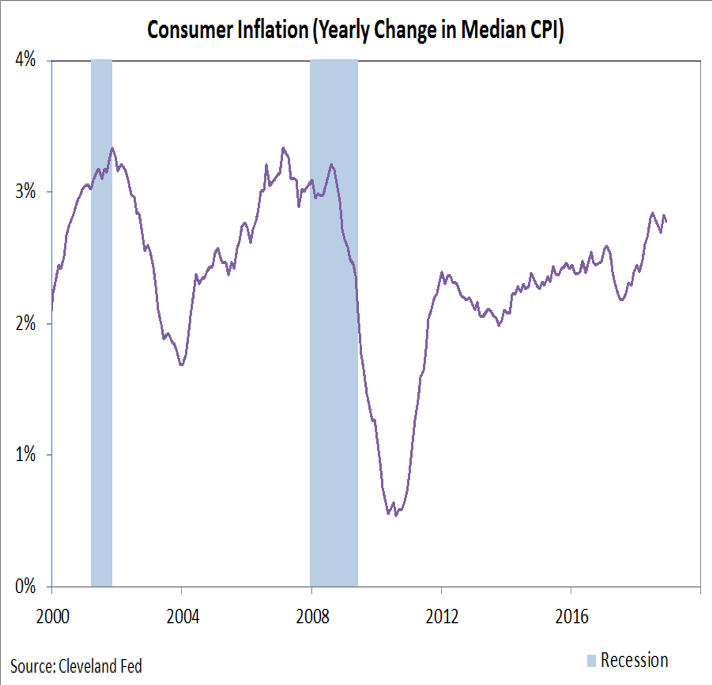

Federal Reserve Policy is neutral. In addition to dealing with the official Federal Reserve mandate of balancing economic growth and price stability, Fed Chairman Jay Powell is finding himself having to navigate public comments from his predecessor at the Fed (Janet Yellen) and President Trump as well as stock market volatility. After raising rates four times in 2018, the Fed’s latest summary of economic projections (released after the December 2018 FOMC meeting) suggested that the Fed Funds rate remained shy of neutral and that another two rate hikes were likely in 2019. In the wake of the first FOMC meeting of 2019, Powell appeared to dramatically shift course.

The message to the market now seems to be that the rate normalization process is substantially complete, the pace of balance sheet drawdowns could be tweaked and it is uncertain whether the next move in rates will be higher or lower.

The absence of updated economic projections from the Fed makes it difficult to determine whether perceived shift toward a more dovish stance is a messaging effect or if expectations for the economy and interest rates underwent a meaningful shift in the six weeks between the December and January FOMC meetings.

Continue reading on the next page –>