Amazon (NASDAQ:AMZN) reported Q3 earnings after the bell by missing EPS estimates and posting in-line revenue figures. Here’s a quick look at how I break down the Amazon third quarter earnings miss.

Removing valaution from the equation, this was actually another spectacular quarter for this massive commerce company.

Below are my key my takeaway’s from Amazon Third Quarter Earnings release:

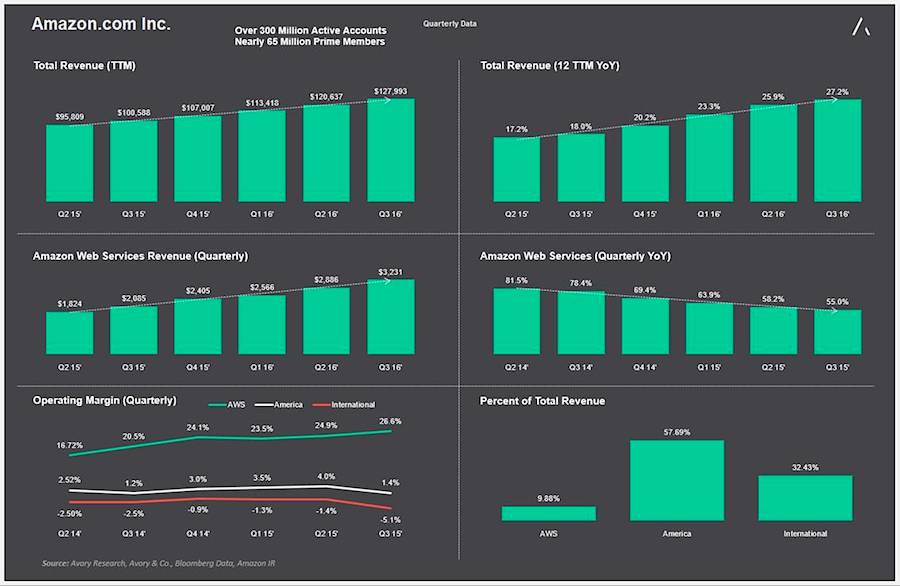

- 12 month revenue now sits at $127B. This is larger than 494 S&P 500 companies.

- 12 month revenue is growing at 27.2% year over year. This is faster than any of the 11 companies referenced in point 1 generating revenue higher than $127B.

- Amazon Web Services generated $3.2B this quarter and growing revenues 55% year over year. Some may view the downward growth trend in revenues as a negative but here is a stat for you. Within the S&P 500 there are only 7 companies generating $3.2B or more in revenues while growing this revenue by over 55% year over year. (Facebook is a notable name on the list).

- Operating margins are weak across the board. International operating margins declined to -5.1% from -1.4% last quarter.

- Amazon Web Services is highly profitable at 26.6% and accelerating higher.

- International as a percent of revenue now makes up 32%, while AWS makes up only 9.88%.

- They have over 300 million active accounts and over 65 million prime members.

This quarter once again highlighted that Amazon is a massive company that has developed a strong network of all types of goods and services. Amazon third quarter earnings also showed that total accounts and paid prime members continue to grow which helps develop a stickiness around the business.

That said, they continue to invest in hundreds of different areas while sacrificing margins. Overall this is great for revenue, but at some point they need to show that there is leverage in the business. If you are long this name, hopefully they do it before it is too late.

You can catch more of my market insights on my site, The Market Meter. Thanks for reading.

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.