Cross-asset class trading remains on the thin side. After the S&P 500 (SPX) and Russell 2000 (RUT) attained closing all-time highs yesterday, equities are giving a bit back as traders square their positions and prepare for the volatility this afternoon’s FOMC decision is sure to stir up in its wake. Here’s a quick glance at how some of the more broadly-followed and interest-rate sensitive instruments are setting up.

Cross-asset class trading remains on the thin side. After the S&P 500 (SPX) and Russell 2000 (RUT) attained closing all-time highs yesterday, equities are giving a bit back as traders square their positions and prepare for the volatility this afternoon’s FOMC decision is sure to stir up in its wake. Here’s a quick glance at how some of the more broadly-followed and interest-rate sensitive instruments are setting up.

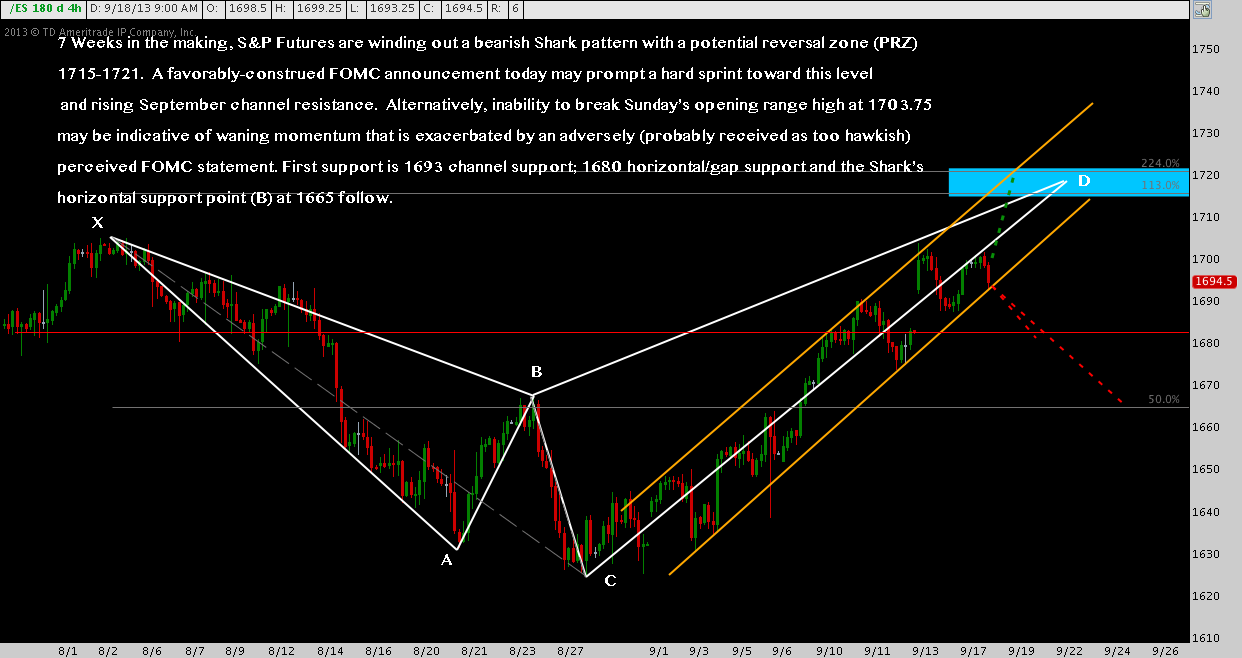

S&P 500 Futures (ES) – 4-Hour: Ahead of the FOMC

The S&P is testing September’s rising channel (yellow) support near 1695, after pushing above 1700 again into yesterday’s closing all-time highs.

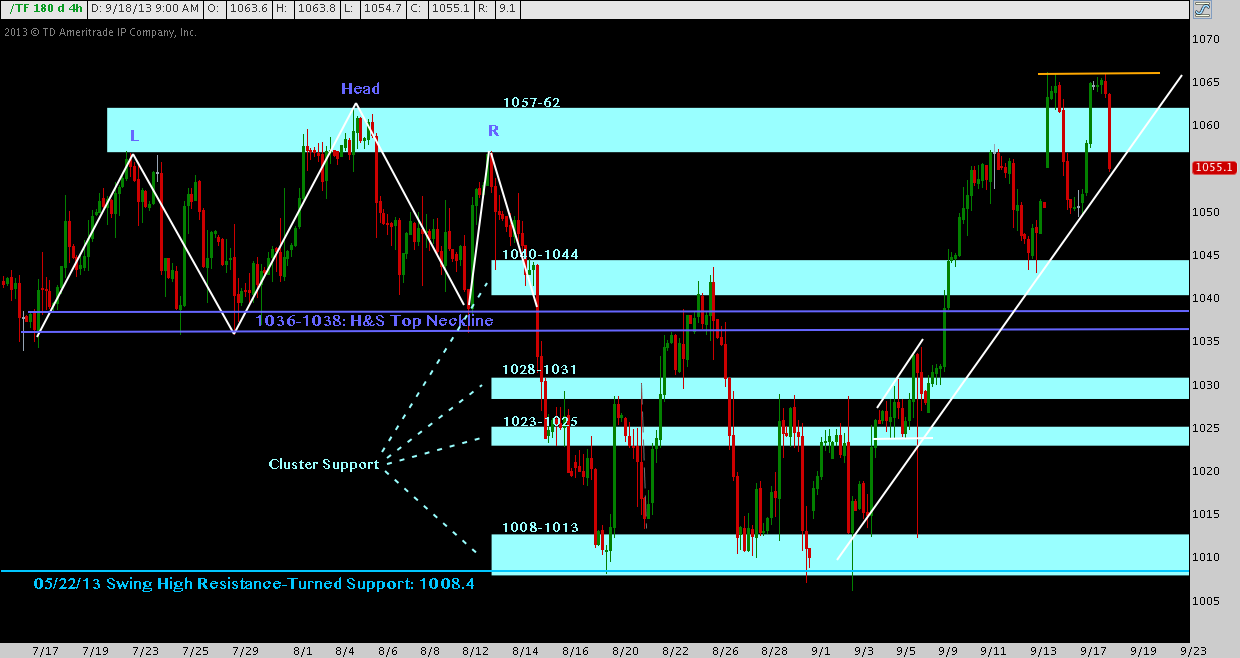

Russell 2000 Futures (TF) – 4-Hour: Ahead of the FOMC

Similarly the Russell 2000: after climbing as high as 1066.2, R2k (TF here) is trading approximately -1% of its all-time highs, still struggling with the mid-July to mid-August topping range at 1057-1062 and at rising September trend line support.

NASDAQ 100 Futures (TF) – 4-Hour: Ahead of the FOMC

The NQ is faring comparatively well leading into this afternoon’s FOMC statement: below the highs put in following Sunday night’s gap-up at the Globex open; but suffering some relatively muted giveback in today’s session.

US Dollar Futures (DX) – Weekly: Ahead of the FOMC

The Weekly context remains highly important for the Greenback: DX has returned again to rising wedge support after testing into closing trend line resistance (dashed red line) earlier int he summer. Will its inability to breach these cyclical downsloping trajectory come into play following the FOMC decision?

Another look at the DX wedge: support is clearly demarcated at 80.75-81 as the Dollar sits at a confluence of wedge support and the 61.8% fibonacci retracement of the 2013 range.

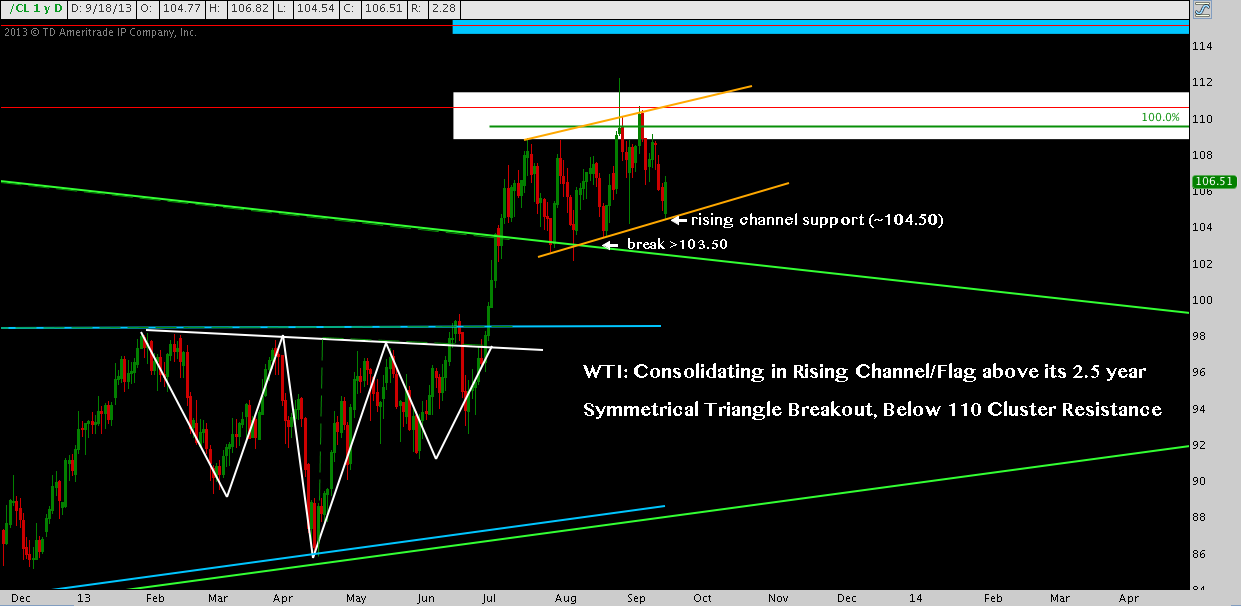

Light Sweet Crude Futures (CL) – Daily: Ahead of the FOMC

Oil seems to care more about relief at the tentative Syria disarmament and today’s lower-than-expected inventory print than the FOMC. Immediate support remains at rising channel (yellow) support near 104.50; followed by the downsloping symmetrical triangle trend line at 102. Resistance is also very familiar by now at oft-visited 108-111 cluster resistance.

Gold Futures (GC) – Daily: Ahead of the FOMC

Gold has stalled just above 1300 and major near-term 1270-1280 cluster support.

EUR/USD – 4-Hour: Ahead of the FOMC

Predictably the opposite of DX, EUR/USD appears poised to break higher from 3-month-long Cup-with-Handle resistance at 1.34, though cluster noise between 1.3350-1.34 may be enough to hem it in (which would coincide closely with wedge support holding for DX near 81).

USD/JPY – 4-Hour: Ahead of the FOMC

The Dollar/Yen – which also figures into DX, though with a far smaller weighting v. the Euro – continues its ambiguous sideways amble, above its Summer symmetrical triangle, but with flagging USD-positive momentum exemplified by September’s potential Head & Shoulders Top.

Best of luck this afternoon.

Twitter: @andrewunknown and @seeitmarket

Author holds no positions in instruments mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.