In the past several weeks, investors and consumers have weighed in on the prospects of inflation.

Today we’ll do the same, but focus on commodities. Rising commodities often spurs inflation. But we’ll do so with an investment wrinkle, using the Invesco Agriculture Commodities ETF (DBA).

Whether it be rising Corn, Wheat, Soybeans, Sugar, these inputs effect consumer prices (not to mention rising energy prices). But due to futures buying and hedging, sometimes these don’t show up for weeks to months.

But I think people will go from worrying about inflation to actually seeing in the months ahead. Today’s chart is simple and just highlights the major change in trend for agricultural commodities that took place last year… and the pullback that is currently underway.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of technical and fundamental data and education.

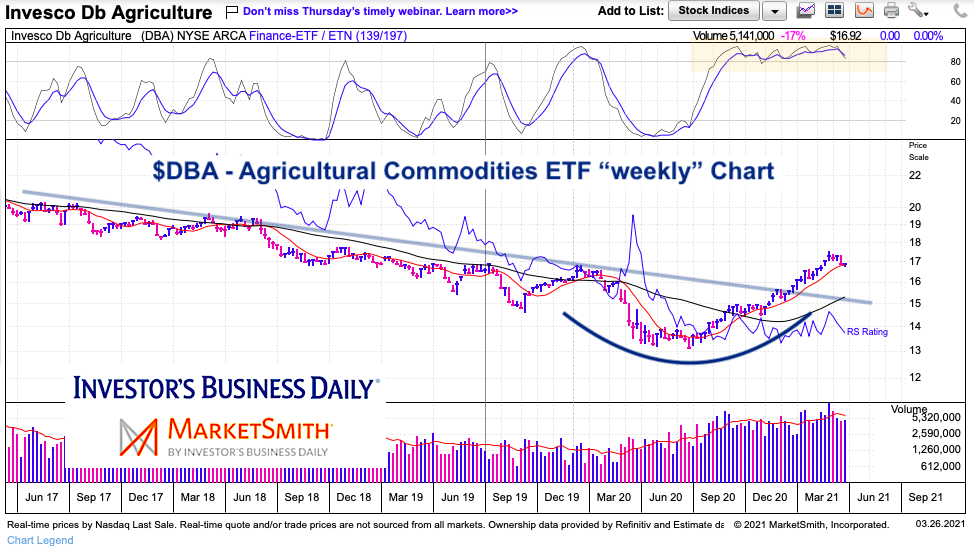

$DBA – Invesco Agriculture Commodities ETF “weekly” Chart

Here we can see the down-trend that was broken toward the end of last year.

This is a big change in structure. Also note the wide, one-year rounded bottom formation. Definitely bullish intermediate term.

That said, the Agriculture ETF is overbought and momentum is waning. Also note that price has turned lower. DBA is currently testing its 10-week moving average. A move below that could see the 40-week moving average. But any move lower will likely find buyers for another wave higher. I’ll be watching for opportunities to arise on this pullback.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.