On Sunday, I wrote the playbook for the Economic Modern Family

- Watch the Retail Sector (XRT)- a failure of those key levels, spells more trouble for IWM IYT KRE. (it did not fail)

- Watch the Semiconductors Sector (SMH)- if it pulls above $260 follow growth stocks. If it holds $240 buy dips, and if it fails $240 prepare for a bigger sell off. (Semis held 260)

- Watch the Biotech Sector (IBB)- the opportunities in this sector appear to be ripe. (IBB was not the sexy play, but will be if it clears key resistance at 131)

I have also written a lot about hard assets-uranium (flying), silver (holding), oil (consolidating) and natural gas (basing).

I also noted that soybeans were starting break out last week.

Now I turn my attention to a key Agricultural ETF (NYSEARCA: DBA), which includes agricultural and soft commodities.

With CPI PPI showing inflation going down, I wish I could say the same for this chart!

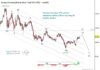

I show 2 charts of this important Agricultural ETF (DBA)- the Daily and the Weekly timeframes.

On the Daily, the phase is bullish as the 50-DMA sits above the 200-DMA and the price is above both MAs. (PHASE)

DBA cleared the January 6-month calendar range. (TODAY)

Time to strike?

While it’s not outperforming SPY, nor has it since late April, we have something to watch for.

And momentum is in a bearish divergence with the moving averages not stacked. Plus, the red dots have t0 to clear the 50-DMA (blue).

On the weekly charts, the price has been consolidating since the April flush.

The phase is bullish and has been since January 2024. That is why I find the bearish calls so out of touch.

While momentum has waned along with leadership-given the current volatility in the markets, the seasonal potential weather disruption and the global conflicts, we are watching.

What we want to see

- DBA outperforms SPY on leadership (Daily).

- Real Motion gain momentum

- DBA’s current price holds Friday low 26.80.

- DBA closes the week at or over 27.40

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.