Since the spring of 2011, Silver prices have been mired in a persistent decline. Every rally has been sold and subsequent selloffs have been painful … let’s just say that it’s been a rough time for silver investors.

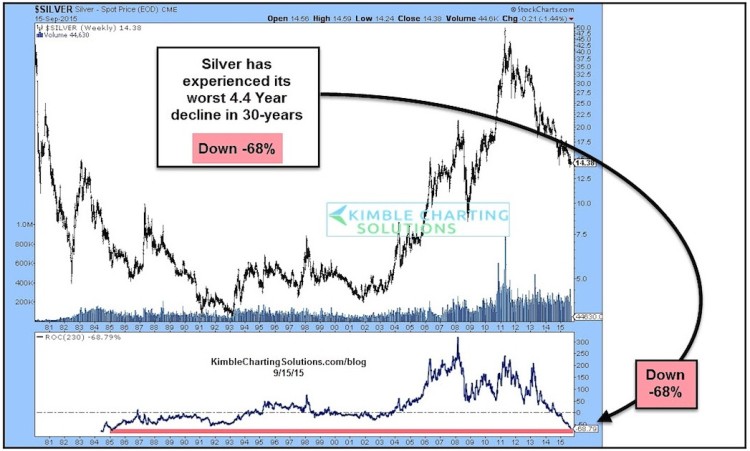

As you can see in the chart below, Silver hasn’t seen this large of a 4 year decline in the past 30 years!

From top to bottom (thus far), Silver prices have fallen over 65 percent (see the chart below). Yikes!

BUT – we should also ask: Could this provide a risk-managed opportunity?

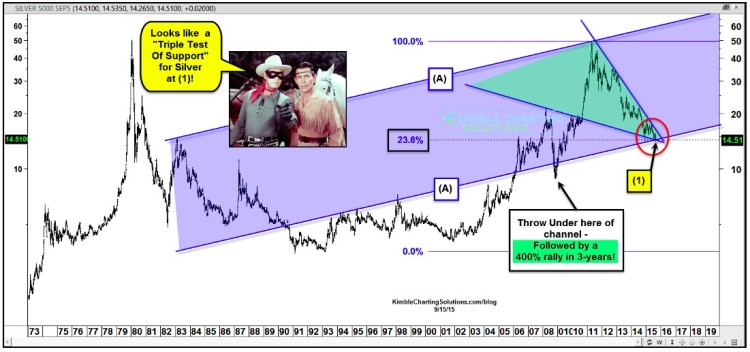

Silver Prices – 1973-2015 Chart

Now let’s look at a similar view of silver but let’s add some price pattern analysis and see if opportunity is knocking.

As you can see in the chart below, silver prices hit the top of the rising channel in May of 2011 (point A). This channel served as resistance and stopped Silver on a dime after a vertical “blowoff”rally.

The nearly 70 percent decline over the past 4-years has seen Silver prices fall from the top of the price channel to the bottom.

Now Silver is testing triple support: the bottom of rising channel support (A), along with two other support lines at point (1).

Note as well that the bottom of channel (A) has been in play for the past 30 years, so this is not a routine test of support!

What Silver does at this price support line will be very important (whether it be from a “trading” or “investing” standpoint). Another indicator to watch is the Swiss Franc and how it handles its 15-year support line. The last major precious metals move came in 2011 when the Franc said Gold would be flat to down for years to come (when it peaked).

Humbly speaking, this appears to be a time of opportunity in the Silver space. BUT, investors should follow these support lines, as they should tell investors where Silver will be a few months from now. Thanks for reading.

Twitter: @KimbleCharting

Author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.