Investing is NOT gambling; done right, it involves thoughtful portfolio construction – incorporating objectives with capital market assumptions influenced by the current environment and expectations going forward. But sometimes gambling is afoot in the markets.

For example, Bed Bath & Beyond does not have a new must-have bathroom accessory product that would justify the share price jumping from $5 to $25 over the past week, with the subsequent drop back down to $11. Yes, the Reddit/options traders are at it again, but the biggest gamble may be the recent rally in the markets.

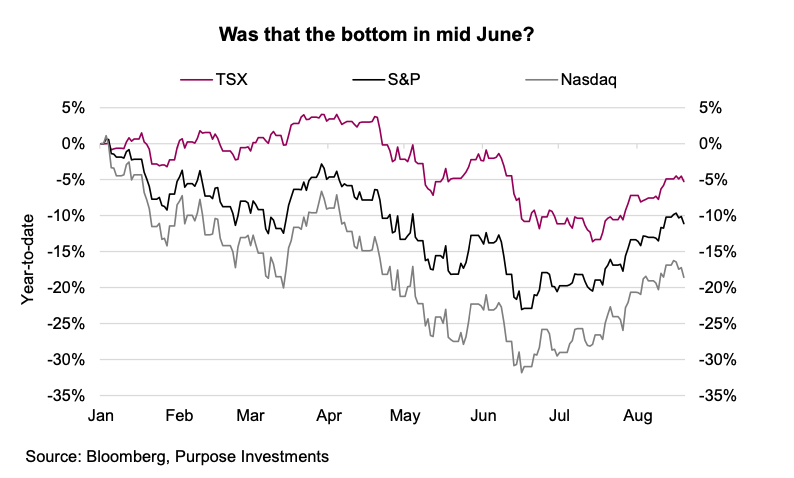

A f ew days ago, the S&P 500 reached a level in which it was down less than 10% compared to its all-time high. It’s been a little weaker since then, but still an incredible rally from the lows of mid-June. The S&P has risen +17%, Nasdaq +22% and TSX +11%.

In the history of bear market bottoms, the recovery is ALWAYS questioned for months with tons of well-founded convincing naysayers. Over time, the pessimists concede it’s over, and markets return to their normal upward trajectory. Could this be that? Maybe. But count us in the ‘naysayers’ camp after this market rally. We turned much more positive at the beginning of July in Richardson Wealth’s outlook for the 2nd half (HERE). This was predicated on a few things, including the degree of the drawdown, the view that inflation would begin to soften, and that recession fears were a bit overblown. But this advance does appear too far and too fast.

Short covering combined with some softening inflation data and improved economic data, which allayed recession fears during the less liquid summer months, drove this rally. And now, the market is gambling on a perfect future. Think about it. The S&P is down 11% from a high that was a bit of a speculative peak to round out the +28% appreciation in 2021. Down only 11% with inflation softening but still a risk. Down only 11% with earnings revisions turning negative, the Fed is still on hiking autopilot and, despite a few recent economic data points, recession risk is still real.

Future uncertainty

This market appears to be sitting on an open-ended straight, hoping for a good river card. Maybe inflation will come down fast enough, allowing the Fed to stop raising rates. Maybe yields will stabilize, the economy will have a soft landing and earnings growth won’t slow materially. Or maybe this market rally just keeps going higher on short covering of bearish bets. It could happen, but the probability does not look great.

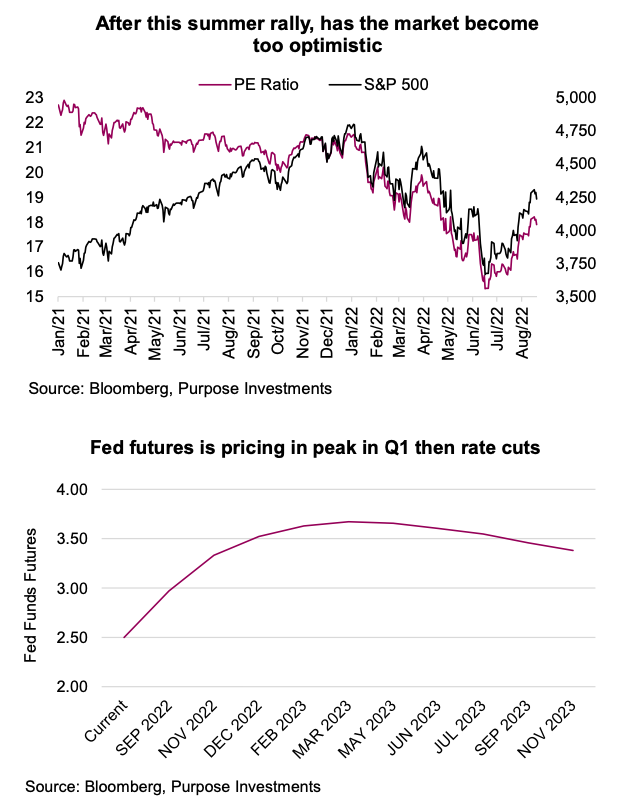

This has been the summer bounce rally. Market Ethos June 20th: “Our base case remains that as the economic data softens, the inflation fears will too, leading to a market bounce. But we could also fast forward to recession fears as earnings/margins come under pressure. Valuations are increasingly providing some margin of safety, but this will continue to be a challenging year.” That valuation safely margin has certainly been reduced. In early July, the S&P 500 was back down to its long-term average of 16x forward estimates. Now it is back up to 18x, not expensive, but if you are less confident about the sustainability of the ‘E,’ certainly less safe.

The Fed influence

And then there is the all-important Fed. The world knows, given inflation, that the Fed will likely

continue to be aggressive on hikes this year. Notably, the market is pricing overnight rates to peak in Q1 at just over 3.5%. After that, the market is expecting the Fed to start cutting rates. Of course, this is a moving target, and this curve moves with data and likely Fed talk. But try to imagine why the Fed would be cutting in mid-2023. Maybe inflation is all the way back down to the target rate of 2%? This seems unlikely given the various nuances of inflation and stickiness (very slow to react). Or it is because the economy has slowed so much that stimulus is required. If that is the case, that is not good news for the markets or earnings.

Impact on portfolios

Don’t get us wrong, we are not bouncing from having a positive outlook for the 2nd half to being bearish. However, if you had added some U.S. market exposure when it was hardest to do so in those tough months of May and June, dialing back, given this rally, seems prudent. We are approaching two months that have historically been a bit unkind for investors. And betting big on the river card often does not end well.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.