The following research was contributed to by Christine Short, VP of Research at Wall Street Horizon.

Fed Chief Jerome Powell did no favors for the beleaguered regional banks last week. A 10th straight rate hike is like an insult to injury for so many small financial institutions. What has been a strong Q1 earnings season is now overshadowed by cascading impacts from steep rises in interest rates and emerging commercial real estate woes.

A sharp risk-off trading environment to kickstart the sometimes-dicey May through October stretch has resulted in quality companies producing the best relative returns. Firms that can increase their dividends and feature decent growth outlooks have, not surprisingly, done just fine on the year.

This week, Wall Street Horizon corporate event data research includes a pair of struggling companies in the Financials sector with off-trend earnings dates, and one blue-chip, dividend-investor favorite that has not been so friendly to shareholders lately that has yet to confirm its Q2 reporting date.

Lincoln Financial: Weak Preliminary Earnings, Shedding Risk Exposure

First up is Lincoln National Corporation (LNC). The Pennsylvania-based Life and Health Insurance industry company within the Financials sector is down a stunning 69% year-on-year. The siren song luring investors is its very high 8.8% dividend yield.

Just last week, LNC issued a dour preliminary earnings report, though. Along with the announcement of a $28 billion reinsurance transaction with Fortitude Re that reduces the company’s exposure to life insurance, and expectations for improved Lincoln’s financial position and future free cash flow, LNC said it expects Q1 adjusted EPS in the range of $1.47 to $1.56, less than the consensus forecast of $1.78.

LNC 5-Year Price History: Shares Down 75% From the 2021 High

Our radar lit up as this is the first time Lincoln will report earnings on a Tuesday. The first-quarter report is also later than usual; LNC has historically issued Q1 results on a Wednesday. So, we would expect May 2 to be the reporting date. Keep Lincoln on your radar for bearish price action following the soft pre-announcement and later-than-average earnings date. Its annual shareholder meeting takes place on Thursday, May 25.

PNC: At the Center of the Regional Banking Maelstrom

Sticking with the Financials sector, PNC was late to confirm its Q2 report due out in mid-July. The Pittsburgh-based super-regional bank is also issuing results on a Tuesday for the first time in our data’s history. Shares fell to their lowest level since late 2021 during industry turmoil last week.

PNC was reported to have been among the bidders for the assets and liabilities of First Republic Bank, but Jamie Dimon’s JPMorgan Chase snatched it up. JPM rallied while PNC fell in the wake of the news. Last month, PNC posted a bottom-line beat, but the good news ended there as its management team slashed the full-year revenue outlook given the tough macro operating environment.

PNC 5-Year Price History: Gives Back Nearly All Its Gains Since March 2020

PNC now trades at just 1.1 times its book value – a more than 20% discount to its 5-year average. But value investors are skittish, to say the least right now. Not even the stock’s 5.1% dividend yield – much higher than its usual 3.0% payout rate – can seem to cushion the selling pressure. Is the bank bracing for more bad news come July? Perhaps it’s too soon to tell, but we’ll be on the lookout for more unusual earnings events.

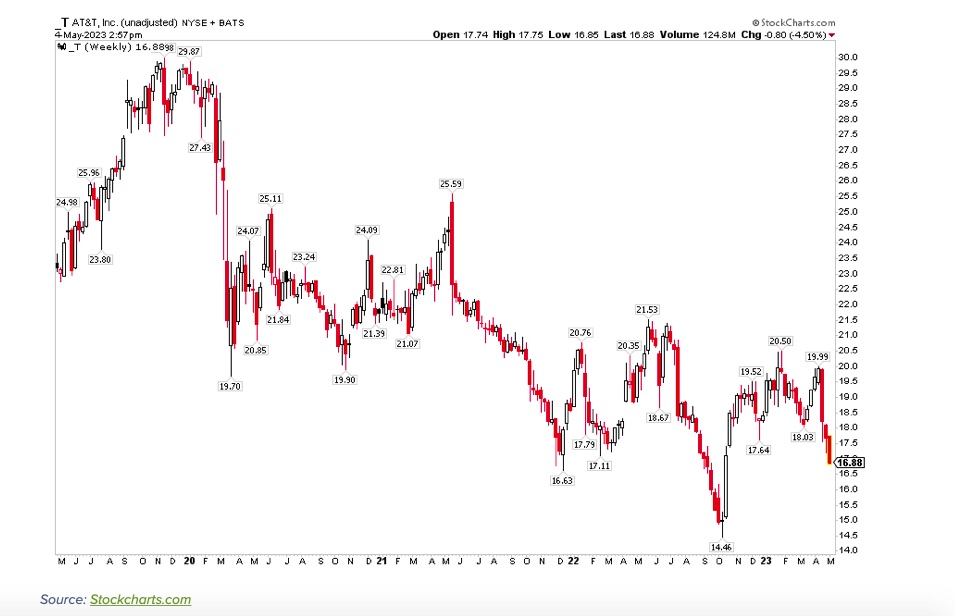

AT&T: A Dividend Dog, Yet to Confirm a Q2 Earnings Date

AT&T (T) has been a frustrating stock for so many investors in recent years. Its high yield, big free cash flow, and low P/E are strong characteristics, but a 2022 dividend cut and much weaker than forecast Q1 2023 free cash flow cast doubts on some of those strong points. The question with T has always been its growth trajectory.

Shares are down more than 12% in the last year, modestly underperforming the broad market and losing out to the Communication Services sector. An earnings beat in April was met with intense selling pressure as a result of slowing subscriber growth. What’s more, market share trends in the industry are viewed by some as leaving AT&T behind. T-Mobile is seen as the leader in the 5G push.

Given the concerning backdrop, AT&T has yet to confirm its Q2 reporting date (as of time of publication on May 9). The company normally confirms the July earnings event around April 24 with a standard deviation of 1.6 days. The result is a high confirmation date Z-score.

Our data team found that T used to confirm 30 days ahead of earnings, then switched to 90 days in 2016, but a new trend could be developing where they confirm just two weeks before reporting. Reading between the lines, it may indicate that the operating environment is less stable. We’ll see if another weak report is issued in July – we show an unconfirmed date of July 20.

The Bottom Line

Earnings uncertainty is running high as the macro picture deteriorates. While the Q1 reporting season has been much better than feared and a respectable number of S&P 500 companies are raising guidance, there are plenty of clues we spot that suggest prudence and tighter risk management could be the right mindsets as the second quarter progresses.

For more information on the data sourced in this report, please email: info@wallstreethorizon.com

Wall Street Horizon provides institutional traders and investors with the most accurate and comprehensive forward-looking event data. Covering 9,000 companies worldwide, we offer more than 40 corporate event types via a range of delivery options from machine-readable files to API solutions to streaming feeds. By keeping clients apprised of critical market-moving events and event revisions, our data empowers financial professionals to take advantage of or avoid the ensuing volatility.

Christine Short, VP of Research at Wall Street Horizon, is focused on publishing research on Wall Street Horizon event data covering 9,000 global equities in the marketplace. Over the past 15 years in the financial data industry, her research has been widely featured in financial news outlets including regular appearances on networks such as CNBC and Fox to talk corporate earnings and the economy.

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.