Despite global tensions and the Russia-Ukraine war (and global war of words), the S&P Aerospace and Defense Sector ETF (XAR) has mirrored the broad market, falling around 30 percent from last years high.

Some of the bear market rallies have been quite strong which tells me that when the market finally recovers, XAR will do well.

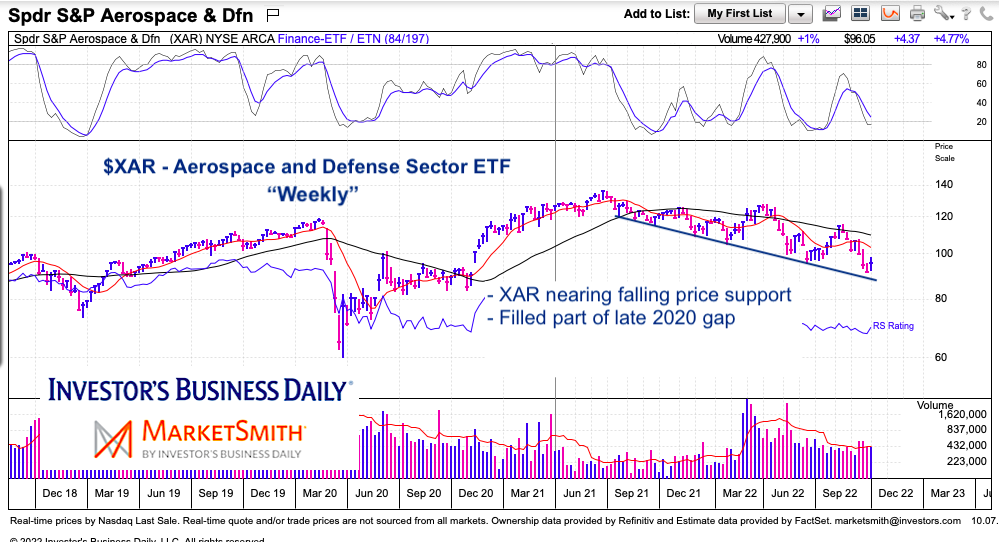

Today we look at a “weekly” chart of the Defense Sector ETF $XAR and highlight how price is entering an important support area.

Note that the following MarketSmith charts are built with Investors Business Daily’s product suite.

I am an Investors Business Daily (IBD) partner and promote the use of their products. The entire platform offers a good mix of analysts, education, and technical and fundamental data.

$XAR Aerospace and Defense ETF “weekly” Chart

Here we can see the ETF is trading just above falling price support. The longer the downtrend goes on, the lower this support goes. That said price has also entered the upper end of a “gap fill” are from the late 2020 gap. Should price fail to stabilize in the low 90’s / upper 80’s, the the low 80’s may be calling, where another open gap resides from early 2020.

In any event, as mentioned earlier tensions are high around the globe. So when the market does recover, Defense stocks should be movers.

Twitter: @andrewnyquist

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.