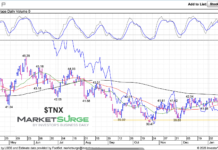

The stock market has rallied right into resistance along with Bitcoin teetering at its 39k price level.

However, the market is holding its current trading area and though we are at a pivotal point, Wednesday could have another push higher if key levels are cleared.

With that said, which price levels should we watch to clear in the Nasdaq 100 (QQQ), Russell 2000 (IWM), and Bitcoin if the market is going to continue upwards.

Looking at the above chart, the Nasdaq 100 is sitting just under its 200-DMA at $366.

On the other hand, IWM is sitting near the high of 1/26 at $203.55.

We are watching these two indices as the QQQ represents the big-cap tech area while the Russell shows the small-cap index.

With interest rate hikes looming and increasing inflation, watching each to clear key resistance levels can be used as a short-term buying indicator.

Therefore, watch for both indices to clear nearby resistance areas before looking for the next quick upwards.

Along with the recent market correction, Bitcoin has pulled back and has been working its way back towards the 39k price area.

With that said, if Bitcoin can clear the 40k area, watch for reversal trades within the crypto space.

Amplify Transformed (BLOK) and Hut 8 Mining (HUT) are two interesting companies we have been watching that are poised to move higher if Bitcoin can clear 40k.

Watch Michele’s latest appearance on Fox Business and Bloomberg!

Stock Market ETFs Trading Analysis & Summary:

S&P 500 (SPY) Back in a cautionary phase with the second close over the 200-DMA at 452.95.

Russell 2000 (IWM) 203.55 to clear.

Dow Jones Industrials (DIA) 355.29 to clear next.

Nasdaq (QQQ) 366 to clear.

KRE (Regional Banks) Needs another close over 72.29

SMH (Semiconductors) Needs to stay over 270

IYT (Transportation) Large move from positive UPS earnings.

IBB (Biotechnology) Watch to hold over the 10-DMA at 129.26

XRT (Retail) 82.29 to hold over.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.