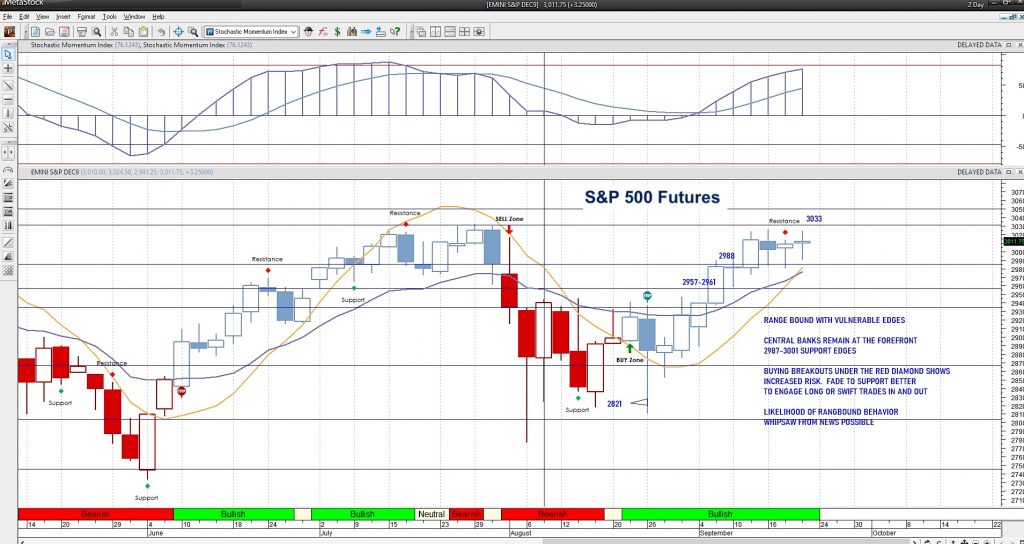

S&P 500 Futures Trading Chart and Price Analysis – September 20

MARKET COMMENTARY

Cautiously long – this is the temperament of S&P 500 futures traders and market participants.

Many old school investors are saying don’t fight the Fed – but the mean, when the Fed is tightening we should not be long the market. And vice versa.

However, markets remain dislocated due to a variety of reasons. In order not to miss out, investors and traders remain long in the fray, but with one foot and both eyes checking the exits. This will increase market volatility intraday -whipsaw remains a problem.

The S&P 500 is expanding into the edges proposed at the first of the week. Repurchasing at the Fed window to keep rates at the levels the Fed proposed is the backdrop of chatter.

WEEKLY PRICE ACTION

Support holds near last week’s levels – 2984 -with 2991 above that- and we tested the low edge of that support before bouncing- again, as expected on Fed day. Undercurrent of bullish action holds. If we look at bigger pictures, all the watched indices are still in breakout formations. Reversal zones at the upper edges near 3017 to 3025. We are cresting to the top this range today but momentum is damp below.

Weekly charts continue to show flattening momentum but we hold above major moving averages. The line in the sand today is 3011.75 – above this zone, buyers will be more brave than beneath 2997- range widens.

COMMODITY & CURRENCY WATCH

Gold prices hold support between 1500-1506 – but continue to run into trouble above in the current negative trend near 1512-1517 as resistance. So far, however, 1493 seems to be strong support. Currency chatter remains in play with the dollar holding its upside above 98. WTI has failed its breakout but is well above the 57 breakout zone. Noisy chatter with Iran keeps prices elevated.

TRADING VIEW & ACTION PLAN

Breakout in progress and holding above 3007- an approximate support region. Pullbacks are still the best places to engage if risk exposure is your primary concern (and this is always my concern). Follow the trend in the shorter time frames and watch the price action. The theme of motion is POSITIVE AS LONG AS WE HOLD ABOVE 3004 today – Do what’s working and watch for weakness of trend. Please log in for the definitive levels of engagement today.

Twitter: @AnneMarieTrades

The author trades stock market futures every day and may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.